Community banking

Community banking

-

Kelly King, the North Carolina company's chief executive, also noted that BB&T is busy integrating a number of recent acquisitions. It is leaning toward buying back stock, though management could be coaxed into making a deal if the right bank became available.

February 10 -

The Bancorp in Wilmington, Del., named Sepideh Behram to the role of chief compliance officer. Her hiring comes as the $4.8 billion-asset company works to shore up its risk and compliance management.

February 10 -

Banks are coming up short in trying to keep pace with other more advanced app providers, but emulating these five steps taken by nonbanks can help drive mobile engagement.

February 10 -

Several big banks have promised their customers cardless ATMs this year, but customers of the $1.2 billion-asset Avidia have been able to get cash without taking out their cards since last summer.

February 9 -

Orrstown Bank launched several innovative Web initiatives in 2015, including a SMS two-way texting platform and a Zillow-like feature that displays housing listings on its Web presence.

February 9 - California

Lighthouse Bank in Santa Cruz, Calif., has brought back one of its co-founders to become its president. The $176 million-asset bank said in a press release that Jon Sisk had become its president on Monday.

February 9 -

Broadway Financial in Los Angeles has been released from an enforcement action administered by the Federal Reserve.

February 9 -

Bankers, irate with the NCUA's plan to expand field-of-membership for certain credit unions, are flooding the agency with comment letters. The NCUA has received 10,500 total letters, or more than triple the previous record for such responses.

February 9 -

Overhauling the S&L crisis-era method for intervening in struggling banks, which did not live up to expectations during the 2008 meltdown, should be a higher priority.

February 9 -

The Federal Home Loan Bank System was designed to provide liquidity to community lenders and traditional insurers, not to unregulated lenders that circumvent the membership rules.

February 9 -

Activist investor Lawrence Seidman has reversed course and will support the lone Malvern Bancorp director standing for re-election.

February 9 -

Eastern Bank turned to YouTube videos as a way to connect with customers it picked up in a recent acquisition in New Hampshire. It even got a little help from Rob Gronkowski of the New England Patriots.

February 8 -

Asset growth drove the Pennsylvania bank to create software that helps it vet and monitor vendors, with automated tracking of contracts and deadlines and storage of supporting documents.

February 8 -

Heartland Financial USA in Dubuque, Iowa, has completed its acquisition of CIC Bancshares in Denver and made related executive moves.

February 8 - Texas

Dick Evans, chairman and CEO at Cullen/Frost Bankers in San Antonio, discusses the decline in oil prices, and what it means for energy lending at the $28.6 billion-asset company.

February 8 -

Sunshine Financial in Tallahassee, Fla., has agreed to name a new board member in exchange for a truce with an activist investor.

February 8 -

Pioneer Bank in Dripping Springs, Texas, has promoted Elizabeth Blose to chief financial officer as it works to finalize a merger deal and relocate its headquarters.

February 8 -

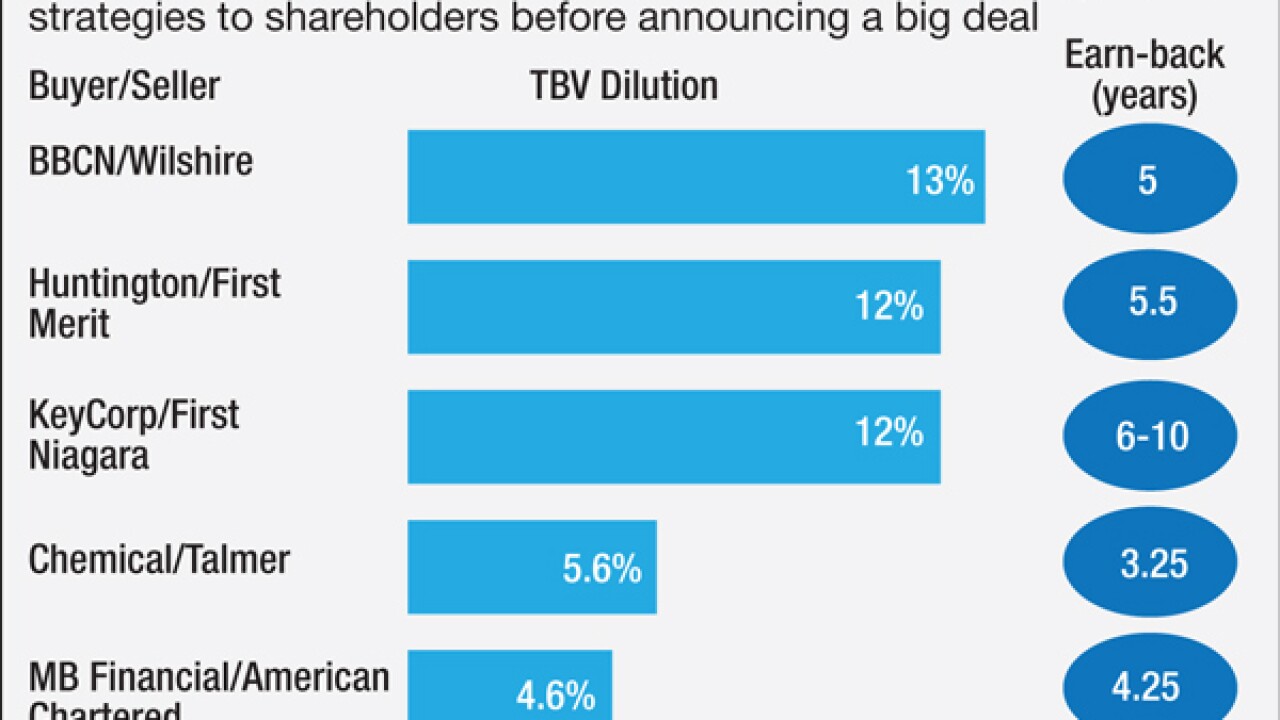

Bankers need to let investors know in advance what types of deals they are willing to pursue, along with the financial parameters. Doing so is a critical step in managing shareholder expectations at a time when consolidation is heating up.

February 8 -

Chesapeake Bank & Trust in Chestertown, Md., has named former community bank chief executive Ray Tarrach to its board. Tarrach had been president and CEO of Chestertown Bank, which was renamed Mercantile Eastern Shore Bank in 2004.

February 8 -

CenterState Banks in Davenport, Fla., will record a first-quarter $17.5 million net loss on the early termination of its loss-share agreements associated with seven failed banks.

February 8