Community banking

Community banking

-

Native American leaders are cheering the proposal, which would give banks Community Reinvestment Act credit for making loans on reservations, even if the lands sit far outside their assessment areas.

January 7 -

The company, which has agreed to buy Marquis Bancorp, could use some of the proceeds to fund growth and pay off a line of credit.

January 7 -

Sidhu, who co-founded the digital-only unit of Customers Bancorp, replaces her father, Jay, who will remain executive chairman. The bank is also rolling out a new service that allows direct-deposit to customers to access their paychecks two days before they are paid.

January 7 -

Some banks and fintechs have already introduced pet-friendly policies in the office. Here are five reasons why it works.

January 7 -

Here's one way community banks are trying to win over commercial clients and wealthy households: by sharing internal research with them and positioning themselves as experts on everything from business sentiment to demographics.

January 6 -

Quontic Bank is offering high-interest, digital-only savings like others, but it says its secret sauce is homegrown technology that optimizes deposit prices. Financial bloggers have taken notice.

January 6 -

The company will pay $29 million for a bank located northwest of Grand Rapids.

January 6 -

Though there were several high-profile mergers of equals among bigger banks, deal activity rose only slightly, and the vast majority of transactions involved the smallest of institutions. Here's an overview of those trends and others that stood out in bank dealmaking last year.

January 5 -

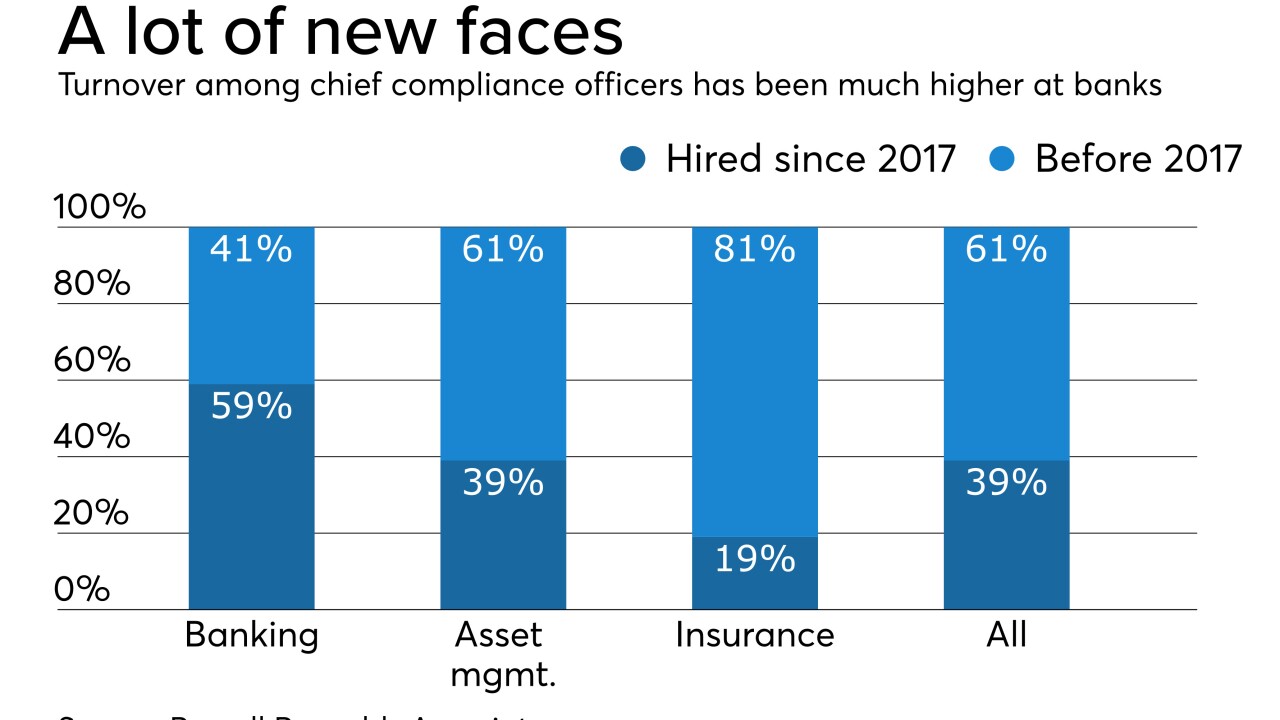

Banks had the highest turnover of chief compliance officers among the 100 largest financial services firms in the world, according to a recent study. Recruiters say that’s a function of changing job demands, high pressure and poaching by fintechs — plus old-fashioned demographics.

January 3 -

Organizers of TYME Bank aim to take advantage of consolidation taking place around Texas.

January 3 -

Michael Troutman will serve as chief revenue officer at Bay Banks of Virginia, where he will advise management and the board on growth opportunities.

January 3 -

Steuben Trust received two bites from potential MOE partners, but the New York bank’s lightly traded stock and many other challenges forced a sale to a much larger rival instead.

January 2 -

Franklin Financial CEO J. Myers Jones is trying to reduce his company's exposure to shared national credits and health care loans, which have enjoyed solid yields but come with a downside.

January 1 -

The three federal agencies announced slight adjustments in the cutoffs for "small" and "intermediate small" institutions for the purposes of Community Reinvestment Act exams.

December 31 -

Political uncertainty, sector-specific concerns as well as interest rate and labor trends may continue to depress commercial and industrial lending in the coming months.

December 31 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

December 30 -

Organizers of Bank of St. George still need to raise $18 million before opening.

December 30 -

Wells Fargo's continued leadership shake-up led to more executive shuffling in the final two months of 2019.

December 29 -

Tom Lopp abruptly suspended a program that accounted for 83% of Sterling Bancorp's mortgage production this year. An ongoing audit of the program and pressure to diversify beyond mortgages are reasons to watch Lopp and Sterling in 2020.

December 27 -

Low rates and spotty loan demand mean banks are having to “dig deeper” to improve efficiency and maintain profit margins.

December 26