-

Congress should consider giving direct authority over nonbank mortgage servicers to the Federal Housing Finance Agency, according to a report released Monday by the Government Accountability Office. The report said there should be "parity" among financial regulators in the oversight of regulated entities and third parties they do business with.

April 11 -

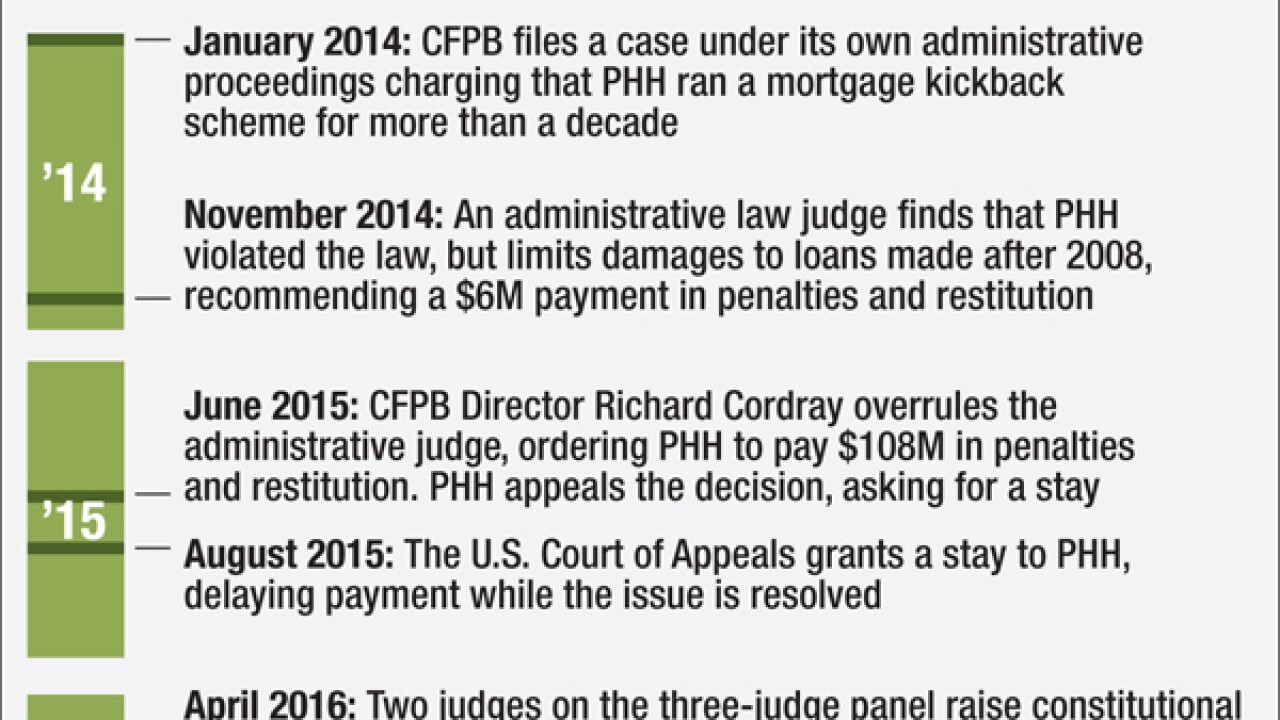

A federal appeals court has set the stage for yet another legal showdown over the Consumer Financial Protection Bureau's structure in a major test of the bureaus authority.

April 11 -

The U.S. Court of Appeals for the D.C. Circuit will hear oral arguments Tuesday about the Consumer Financial Protection Bureau's structure, in a case that has national implications. Even though a ruling isn't expected until the end of the year, legal experts say there are four major legal issues involved.

April 10 -

In a panel featuring the four living chairs of the Federal Reserve Board, Janet Yellen said that she does not share Minneapolis Fed President Neel Kashkari's view that the biggest banks need to be broken up but respects his opinion and the role of regional banks in the Fed system.

April 8 -

If merchants in the U.S. took a cue from their counterparts in Australia and began making consumers pay a surcharge for credit card transactions, it would attract more backlash than revenue.

April 8 -

Speaking before the Senate Banking Committee, CFPB Director Richard Cordray said fintech companies should be held to the same standards as depository institutions. At the hearing, Cordray fielded questions on payday loans, indirect auto lending and regulation by enforcement rather than rule-making.

April 7 -

Democratic presidential hopeful Hillary Clinton has made reining in the shadow banking system a focal point of her campaign platform, but there are fears that doing so could come with a high price tag for the U.S. economy.

April 7 -

The housing market has been improving but mortgage credit remains "stubbornly" tight on loans bought by the government-sponsored enterprises, according to a chief housing adviser at the White House.

April 7 -

The National Credit Union Administration is hosting a free Webinar on Wednesday, April 27 that will review the latest requirements for compliance with the Bank Secrecy Act and other federal regulations.

April 7 -

Regulators and lawmakers must exercise healthy caution before granting fintech firms preemptive powers via national bank charters or otherwise.

April 7 Alvarez & Marsal

Alvarez & Marsal