-

Financial Services Committee approves bill requiring financial regulators to tailor rules to ensure they are appropriate for small FIs.

March 2 -

The pace of new regulations appears to be slowing slightly in 2016, but that does not mean the regulatory burden on credit unions is lessening.

March 2 -

The Consumer Financial Protection Bureau on Wednesday ordered online payment processor Dwolla Inc. to pay a $100,000 fine for deceiving customers about its security practices the first action it has taken related to data security.

March 2 -

NCUA Board Member McWatters nomination to Export-Import Bank must go through Senate Banking Committee, which the senator chairs.

March 2 -

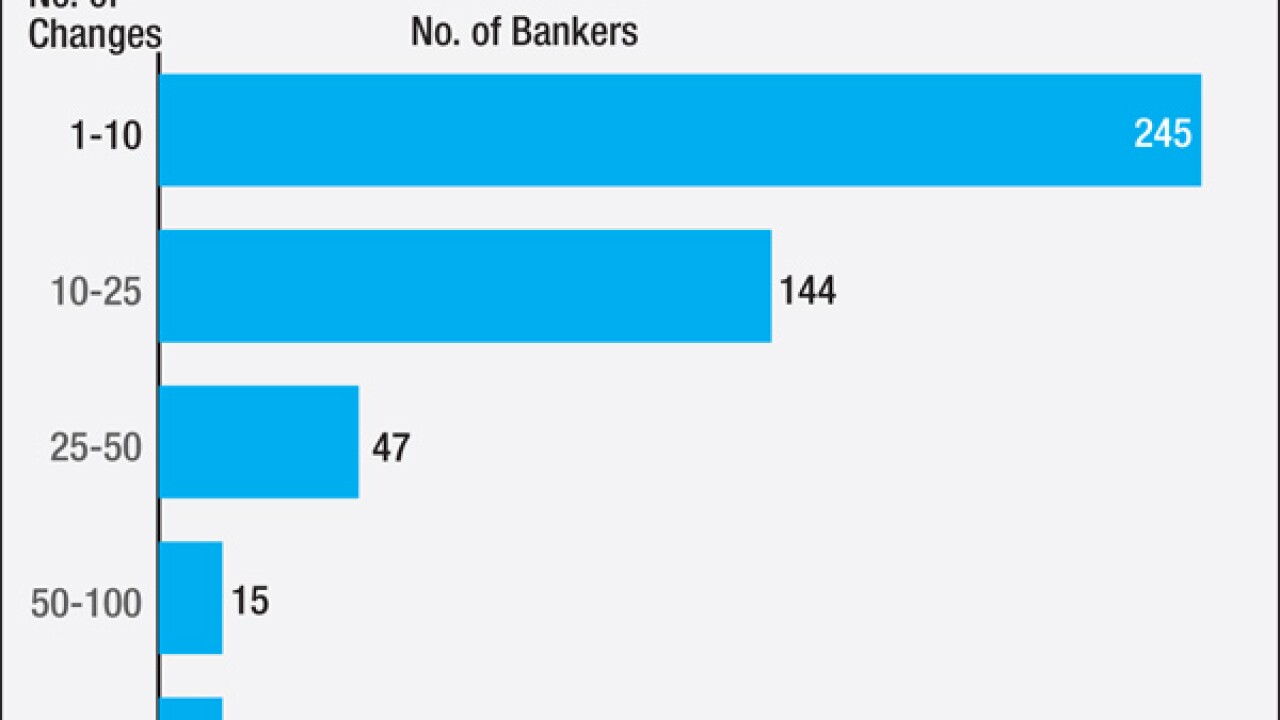

Bankers are still grappling with vendor software problems, longer processing times and delays in mortgage closings as a result of new disclosures that went into effect four months ago, according to a new survey by the American Bankers Association.

March 1 -

WASHINGTON The House Financial Services Committee will hold a vote Wednesday on a credit union-backed bill that would provide regulatory relief for financial institutions that are not considered systemically important.

March 1 -

The mortgage servicer said it has received letters from the Securities and Exchange Commission regarding separate probes into its collection practices and fees.

March 1 -

National Credit Union Administration announces the Temporary Corporate Credit Union Stabilization Fund received its seventh consecutive "clean" audit opinion.

March 1 -

NCUA issued its prohibition orders for the month of February, prohibiting four people from employment and activity in the affairs of any federally insured financial institution.

February 29 -

Western Union has promoted Jacqueline Molnar to chief compliance officer.

February 29