-

Wells Fargos reputation as a consumer-friendly bank suffered a significant blow Thursday after it agreed to pay $190 million to settle charges that thousands of employees created unauthorized bank and credit card accounts for customers in order to collect bonuses for themselves.

September 8 -

CU trade groups have generally praised Jeb Hensarling's Financial Choice Act, though some analysts say it has little chance of becoming law.

September 8 -

The National Credit Union Administration announced a series meant to educate credit union board members on the fundamental concepts of strategic planning.

September 8 -

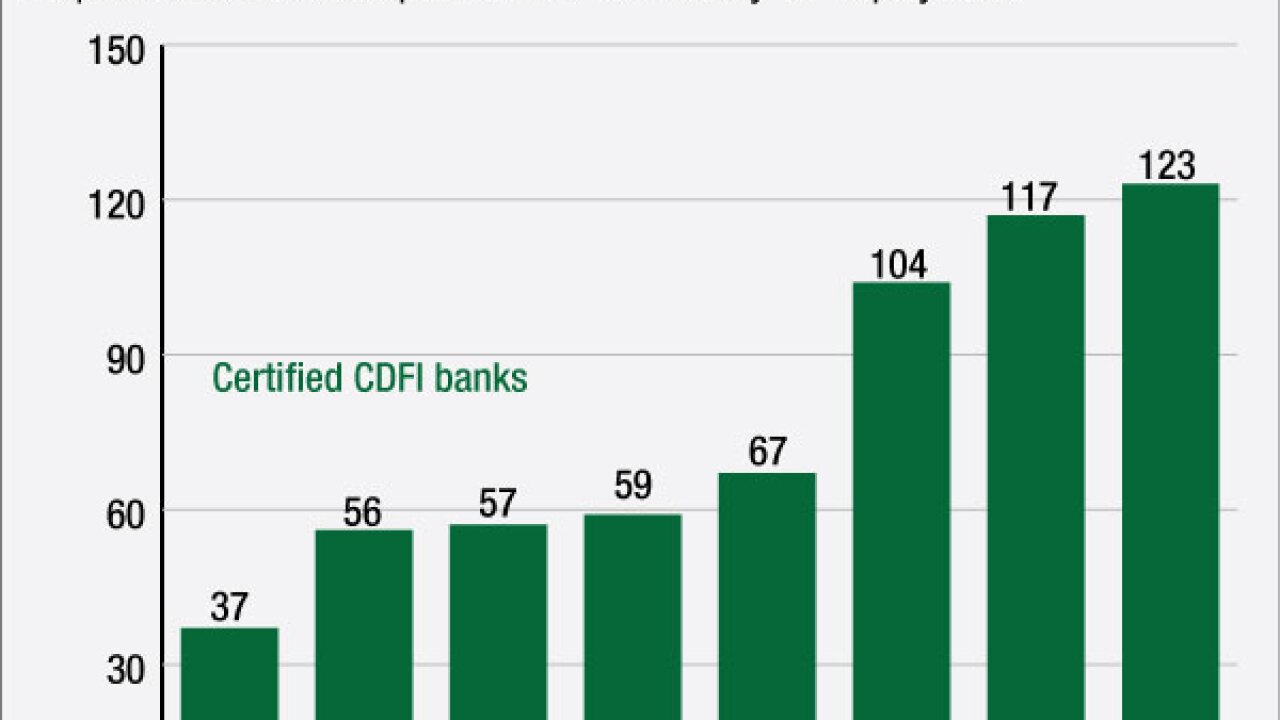

A rising number of banks are looking to become community development financial institutions, emboldened by low-cost capital and an exemption from the ability-to-repay rule.

September 8 -

Wells Fargo has agreed to pay $187.5 million to settle claims by federal regulators that the megabank wrongfully opened unauthorized bank and credit card accounts for more than 2 million customers.

September 8 -

Wells Fargo has agreed to pay $187.5 million to settle claims by federal regulators that the megabank wrongfully opened unauthorized bank and credit card accounts for more than 2 million customers.

September 8 -

Trade groups cheered NCUAs long-awaited announcement of public budget hearings.

September 7 -

The trade group challenged the NCUA's member business lending rules enacted in February, but also hinted that it is prepared to file another lawsuit should the agency move forward with a separate regulation that would expand credit unions' field of membership.

September 7 -

The Federal Reserves structure and makeup and even geographical locations drew criticism from members of Congress and the public as favoring the wealthy and ignoring the conditions of ordinary Americans

September 7 -

Making good on threats it had made previously, the Independent Community Bankers of America filed suit Wednesday against the National Credit Union Administration, claiming the agency's recent overhaul of its member business lending rules violate two different laws.

September 7