-

As they continue to protest credit union mergers, banks are set to reap the benefits from a deal that will create an institution one-third the size of the entire CU industry.

February 8 America's Credit Unions

America's Credit Unions -

BB&T is buying SunTrust Banks, creating a $442 billion-asset institution. Credit unions are hopeful the mega merger will present an opening to pick up new business.

February 8 -

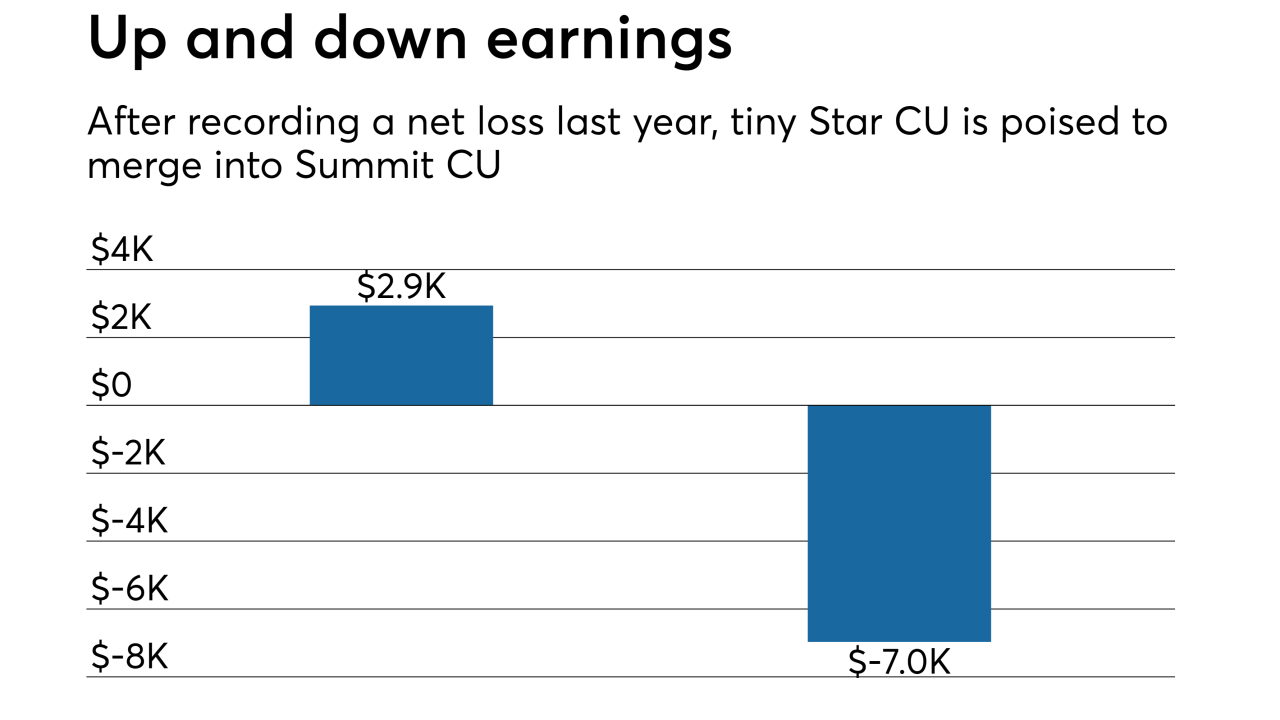

Members at Star Credit Union, which has just $32,000 in assets, have approved the proposed merger into Summit.

February 7 -

In 2017, the National Credit Union Administration board approved provisions to make mergers more transparent. But one of those changes has become a casualty of the government closure.

January 25 -

The Lake Mary, Fla., credit union has agreed to buy Fidelity Bank of Florida, which the SBA designated as a certified lender in 2017.

January 24 -

The $1.9 billion-asset Schools Financial Credit Union has plans to merge into SchoolsFirst, which is already the largest credit union in California.

January 23 -

"I don't and I never would discount the European banks," Citigroup Chief Executive Officer Michael Corbat said in an interview at the World Economic Forum in Davos. "Don't overestimate the U.S. banks' position, and don't underestimate the European banks' position."

January 22 -

Bank of America Chief Executive Officer Brian Moynihan predicted another round of consolidation in the U.S. that could lead to the emergence of a new competitor.

January 22 -

Coast-Tel Federal Credit Union is merging into Bay Federal Credit Union on Feb. 1 with the integration expected to be completed by midyear.

January 18 -

A number of healthy credit unions have undertaken “mergers of equals” to bolster long-term prospects. But those institutions are opening themselves up to unique risks and challenges as a result.

January 17 -

The deal for Citizens State Bank is part of VyStar's plan to expand throughout Florida and Georgia.

January 15 -

Santander taps JPMorgan Chase exec Colleen Canny to lead retail network; can Trump actually fire Fed's Powell?; will 2019 bring long-awaited reform of Fannie Mae, Freddie Mac?; and more from the past two week's most-read stories.

January 4 -

Chartway Federal Credit Union now has roughly $2.2 billion in assets and more than 190,000 members.

January 2 -

Regulators have approved the proposed merger of Big Sky Federal Credit Union into Billings Federal Credit Union.

December 20 -

Old Dominion University Credit Union, which had two branches and about 3,000 members, has merged with Langley.

December 20 -

Hampton Roads Catholic Federal Credit Union had $5.3 million in assets and about 1,000 members before it merged with ABNB earlier this month.

December 14 -

A consolidation of Germany's fragmented banking market is very much in the cards, following months of speculation.

December 13 -

Community 1st Credit Union now has roughly $150 million in assets and more than 12,000 members after absorbing Generations Credit Union.

December 10 -

At $3.3 billion in assets, the combined organization would be the second-largest CU in Washington state.

December 6 -

Delmar Owens Corning Fiberglass Federal Credit Union had less than $1 million in assets and about 130 members when it merged into Sunmark.

December 5