-

While the banking industry is divided on the use of conversational technology, the San Francisco company believes chatbots can make it easier for customers to discuss their finances.

April 3 -

The agency would be subject to congressional and White House oversight; American customers will be able to send money to 200 countries.

April 3 -

The state’s banking regulator said that the online consumer lender made over 46,000 small loans to Bay State consumers without a license. The company surrendered its license to the state regulator as part of a 2011 consent order.

April 3 -

The latest salvo by the acting director of the Consumer Financial Protection Bureau — proposing in the agency's semiannual report that all CFPB rules be subject to congressional approval — left many observers stumped if not outraged.

April 2 -

The Atlanta company partners with banks and merchants to offer consumer installment loans. It could seek to raise as $1 billion as early as this summer, according to a published report.

April 2 -

-

Acting Consumer Financial Protection Bureau Director Mick Mulvaney proposed dramatic curbs to his agency's power in a report Monday, including a recommendation that all CFPB rules must be approved by Congress.

April 2 -

A BankThink argues that Treasury's GSE cash infusions are just the return of stolen money; MUFG wants its Union Bank to be one of the nation's 10 largest; fintech promises a 30-minute mortgage; and more.

March 29 -

A majority of midsize and large banks complain that red tape is mounting and that they are passing on higher regulatory costs to customers and have less flexibility in designing products, according to a new survey by the RMA.

March 28 -

The Canadian bank becomes the largest institution to implement the fintech firm’s Bank Operating System technology.

March 28 -

Some investors fear BBVA is taking a big risk by getting into unsecured personal lending long after online lenders have established themselves, but bank officials argue the bank’s cost of funds and in-depth knowledge of its customers will help it to outdo the competition.

March 28 -

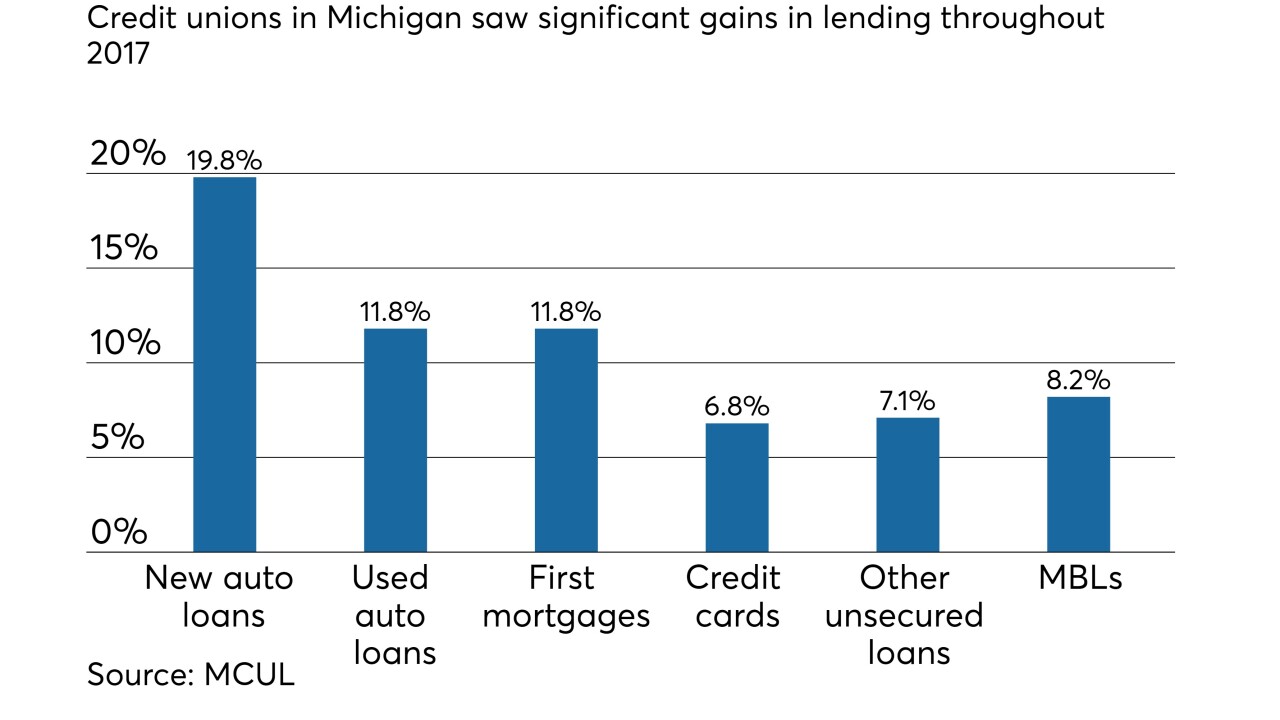

Credit unions in Michigan saw significant gains in Q4 2017, as CUs there ended the year with significant boosts to membership and lending.

March 28 -

Even as many venture capitalists retreat from the online lending industry, Upstart Network is hoping to find investors still willing to bet on the business.

March 27 -

The latest Credit Union Trends Report from CUNA Mutual Group predicts robust membership growth in the year ahead and sustained lending growth due to positive economic factors.

March 26 -

The San Francisco-based online lender reported a net loss of $115 million for 2017, more than half of which was connected to warrants issued in a deal that stabilized the struggling firm.

March 26 -

Only North Dakota has its own state-owned bank, but policymakers in other states say more public banks are necessary to fully meet society's needs. Among those who proponents say would benefit the most: small-business owners and legal marijuana suppliers and distributors.

March 25 -

SunTrust's new IT chief preaches collaboration; will CRE securitizations return to haunt?; Amazon here, there and everywhere; and more.

March 23 -

The congressional resolution to overturn the payday regulation comes as acting CFPB Director Mick Mulvaney has already said the agency will reconsider the rule internally.

March 23 -

Readers react to the Senate regulatory relief bill, weigh in on the Consumer Financial Protection Bureau’s innovation initiative, chime in on whether banks need to provide more value in a digital age and more.

March 22 -

While some key indicators dropped in the year ending Dec. 31, 2017, credit unions in many states continue to thrive, with several new states jumping to the head of the pack for various growth measurements.

March 22