-

Growers Edge is adapting retail financial technology to compete with traditional banks in ag lending and crop insurance.

August 8 -

A fintech called NCS Analytics wants to analyze power-use data at cannabis businesses for banks that finance them. It says the information can help expose illegitimate activity.

August 2 -

The brokerage expects customers will use conversational tech to check accounts and perform other financial transactions while stuck in traffic.

July 24 -

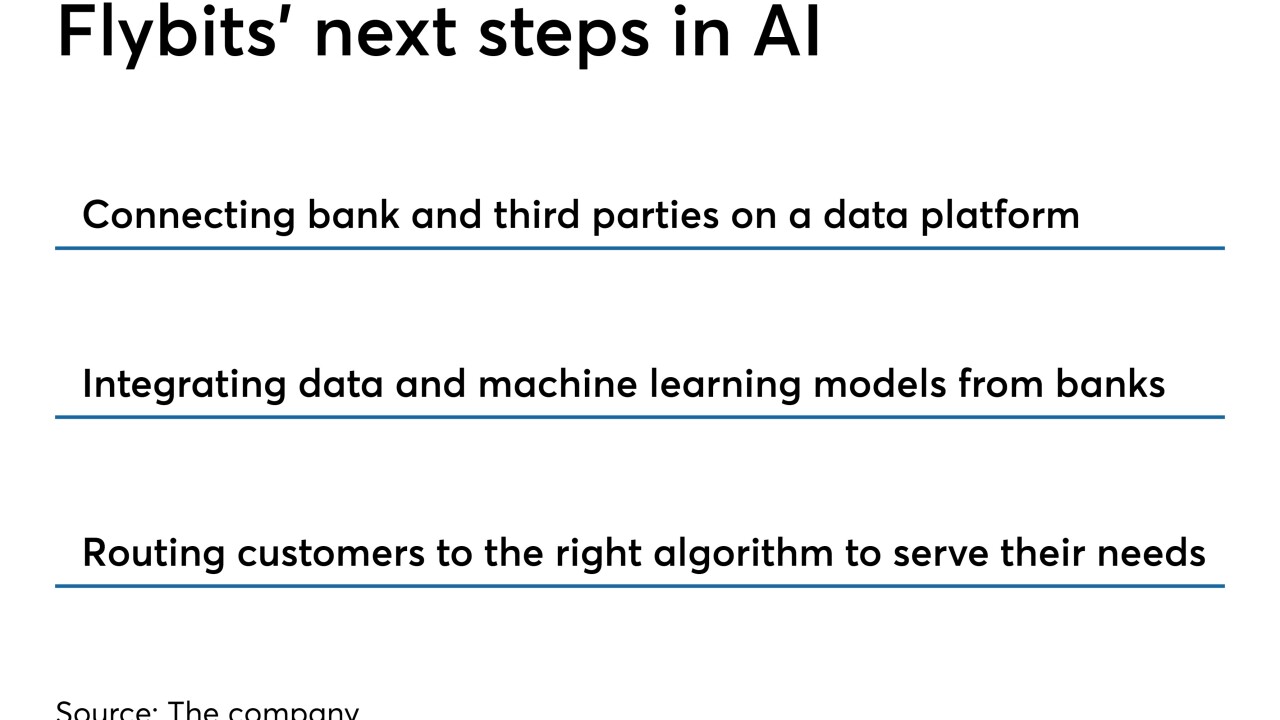

Flybits is building a marketplace to connect banks with third parties that might want to share data across channels.

July 18 -

The fintech is moving ahead with a loan service after regulatory concerns stymied its deal for an ailing bank.

July 12 -

In a downturn, some fintechs, such as independent lenders, will be more vulnerable to economic forces than those working to service banks' regulatory needs.

June 28 -

Brad Goedken wants agreements for HarborOne Bancorp to include better protections, such as cost reductions if a service fails.

June 25 -

Synapse is working to refine its application programming interfaces to meet know-your-customer and other complex requirements, but it's a tall order, the head of the back-office-services platform says.

June 14 -

The head of the venture capital firm Nyca Partners recommends that banks find firms that are big players in narrow markets and wouldn't strain tangible common equity.

June 13 -

The digital bank is a whole new line of business for Goldman, meaning there's no risk that it is cannibalizing from the main institution, said Omer Ismail, the head of the bank's U.S. consumer business.

June 10 -

Boston-based Trio is openly offering its cash management account as capital at risk, offering big incentives if consumers agree to sign up for an uninsured account.

June 6 -

Subhankar Sinha, the bank’s new head of blockchain, says its partnership with Bakkt is part of a larger effort to figure out what it would look like to be a custodian for digital assets.

June 3 -

The London firm lags the three largest U.S. vendors but bets its new open banking platform can win it more business.

May 30 -

Steve Hagerman, who was responsible for the first mortgage platform at JPMorgan Chase, will be head of consumer lending technology at Wells. It also named Gary Owen, a veteran of WarneMedia, Promontory Financial and Citi, its chief information security officer.

May 28 -

Charges against Stephen Calk indicate he lied to regulators about what he knew when he approved loans to Paul Manafort, as well as his interest in landing a job in the Trump administration.

By Kevin WackMay 23 -

Avidia Bank joins the network even as other community banks call on the Fed to create its own real-time payment service to compete.

May 22 -

Biz2Credit is offering its Biz2X platform to all banks after gaining HSBC and Popular Bank as clients.

May 21 -

Azlo will offer customers the ability to apply for a Kabbage loan through a new program called Mission Street Capital.

May 16 -

Although the euphoria over blockchain has dissipated recently, many still see it as vital to the future of banks and the economy at large. Following are key issues being hashed out.

May 15 -

Most financial institutions can’t compete on pay, but there are other advantages they can offer, including agile development.

May 10