-

American Express will give employees two weeks’ notice before it starts bringing a larger number of staffers back to its offices. The credit card giant had previously said it intended to start bringing back employees on Jan. 24.

January 4 -

Wall Street’s push to refill office towers across the country has been derailed again. This time it’s the highly transmissible omicron variant of the COVID-19 virus that’s forced executives to rethink their plans.

January 3 -

Goldman Sachs Group, one of Wall Street’s staunchest advocates of returning employees to offices, will make COVID-19 vaccination booster shots compulsory as the firm stands by its workplace philosophy through surging infection rates in New York.

December 27 -

Average per-loan charges last year were little changed despite the addition of a new temporary fee for refinancing. Those for loan-to-value ratios above 80%, home-purchase financing and adjustable-rate mortgages only rose slightly.

December 27 -

President Biden extended the pause on federal student loan repayments by another three months as the U.S. faces a fresh wave of COVID-19 cases from the omicron variant, removing a near-term threat to millions of Americans’ finances.

December 22 -

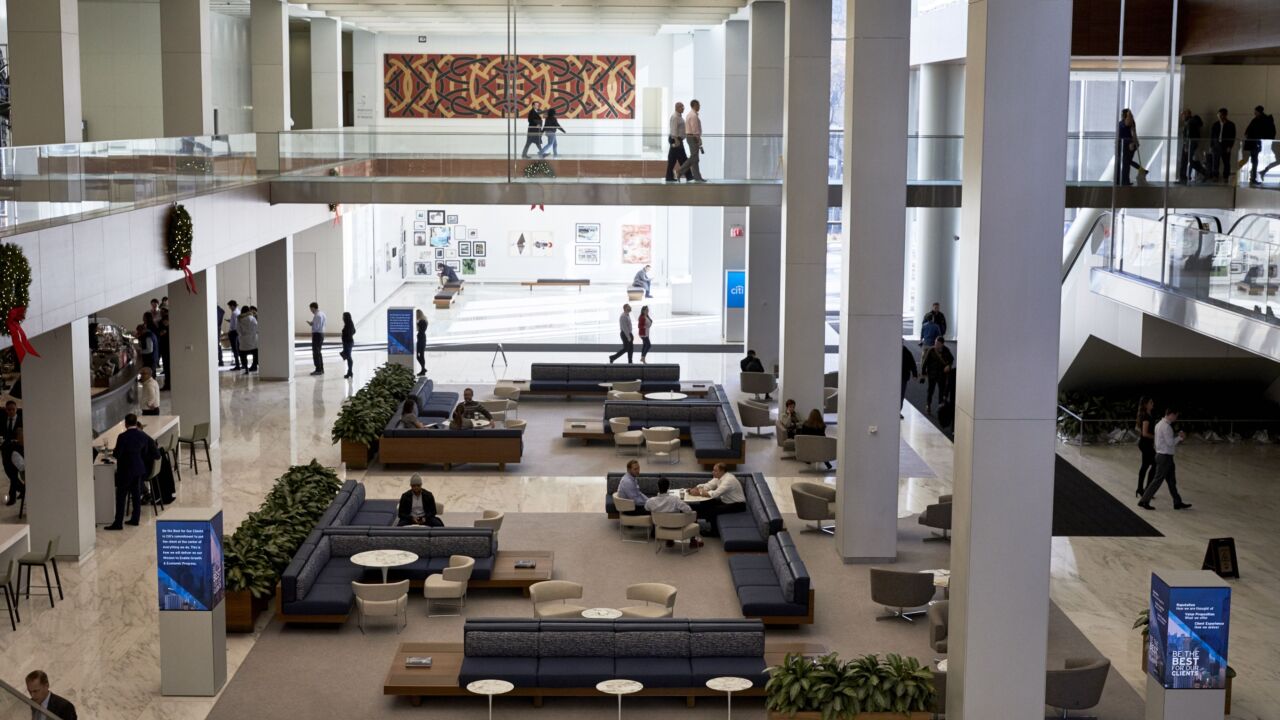

Citigroup told staffers in the New York City metropolitan area to work from home again through the holidays if they are able, citing the recent rise in COVID-19 cases in the region.

December 16 -

The decision comes after New York state instituted a mask mandate for businesses that don’t require proof of vaccination.

December 14 -

The new omicron strain is prompting more financial institutions to extend mask mandates in the workplace and remote work schedules.

December 2 -

The home buying process has undergone significant changes. The pandemic has profoundly altered the mortgage lending market. The continuation of remote work, relocation out of key urban areas, a growing preference for online possibilities, and the deployment of artificial intelligence applications are only a few trends that are shaping the industry. Join Heidi Patalano, Editor-in-Chief of National Mortgage News and Beth O'Brien, Founder and CEO of CoreVest Finance as they discuss how lenders can stay competitive and meet the needs of home buyers in the fast evolving mortgage business.

-

The expectation that people will want social distancing and ever-expanding digital banking options well after the pandemic passes is informing branch architecture at banks and credit unions.

November 12 -

Since the pandemic began, many members of small credit unions have defected to banks that offer better digital products and services. The credit unions are focusing on in-person banking or catering to small businesses and other niches to rebuild their customer base.

November 1 -

Citigroup will require all U.S. employees be vaccinated against COVID-19 as a condition of their employment, citing new orders from President Biden.

October 28 -

Toronto-Dominion Bank is thanking employees for their pandemic-era resilience with a new reward: a piece of the company.

October 28 -

Lending momentum is building and tourists have come back, but the coronavirus is a lingering concern for a state that relies heavily on vacationers.

October 27 -

American Express will allow employees to work from wherever they want at least four weeks a year as part of the company’s push to offer greater flexibility even after the pandemic subsides.

October 18 -

Capital One Financial delayed reopening its offices until sometime next year as the delta variant continues to upend banks’ plans to fully repopulate workplaces across the U.S.

October 7 -

Bank of America is offering $200 awards to Merrill Lynch Wealth Management branch employees who return to the workplace and confirm they’re fully vaccinated against COVID-19.

October 6 -

The company will now begin bringing back staffers who have been working remotely on Oct. 18, rather than Oct. 4, according to an internal memo Wednesday from Chief Operating Officer Scott Powell.

September 1 -

Some banks and credit unions, once hopeful of a swift end to the pandemic, are beginning to toughen credit underwriting and rethink growth strategies as if the coronavirus will influence the economy for years to come.

August 26 -

The more stringent safety measures, announced to staff on Tuesday, signal escalating caution at Goldman, which greeted the return of employees in June with live music and food trucks.

August 24