-

Waiting for the SBA to sign off on PPP loan forgiveness; banks criticized for requiring balloon payments on loans in forbearance; how backlash over Scharf remarks affects Wells Fargo’s diversity push; and more from this week’s most-read stories.

September 25 -

The central bank's proposal to overhaul the Community Reinvestment Act differs markedly from the OCC's regulation in testing, data collection and other areas.

September 21 -

The future of Fannie Mae and Freddie Mac, the Fed’s supervisory regime for the biggest financial institutions, reform of the Community Reinvestment Act and a host of other industry-related issues are on the ballot this November.

September 17 -

The Federal Reserve Board will discuss an advance notice of proposed rulemaking on the Community Reinvestment Act at an open meeting. The central bank had previously declined to support an OCC rule overhauling the 1977 law.

September 17 -

The four-year plan submitted as part of its acquisition of E-Trade includes grants to community development organizations and support for uniform vendor diversity standards.

September 11 -

Bank of America announced how it plans to spend a third of its $1 billion commitment to address racial and economic inequities and the effects of the coronavirus pandemic in communities of color.

September 8 -

A three-stage plan combining data analysis, public disclosure and market-based regulatory intervention would better align financial services with what consumers really need.

September 2

-

The Dallas regional is placing deposits in several minority depository institutions, providing each with low-cost funds that can be redeployed in underserved communities.

August 19 -

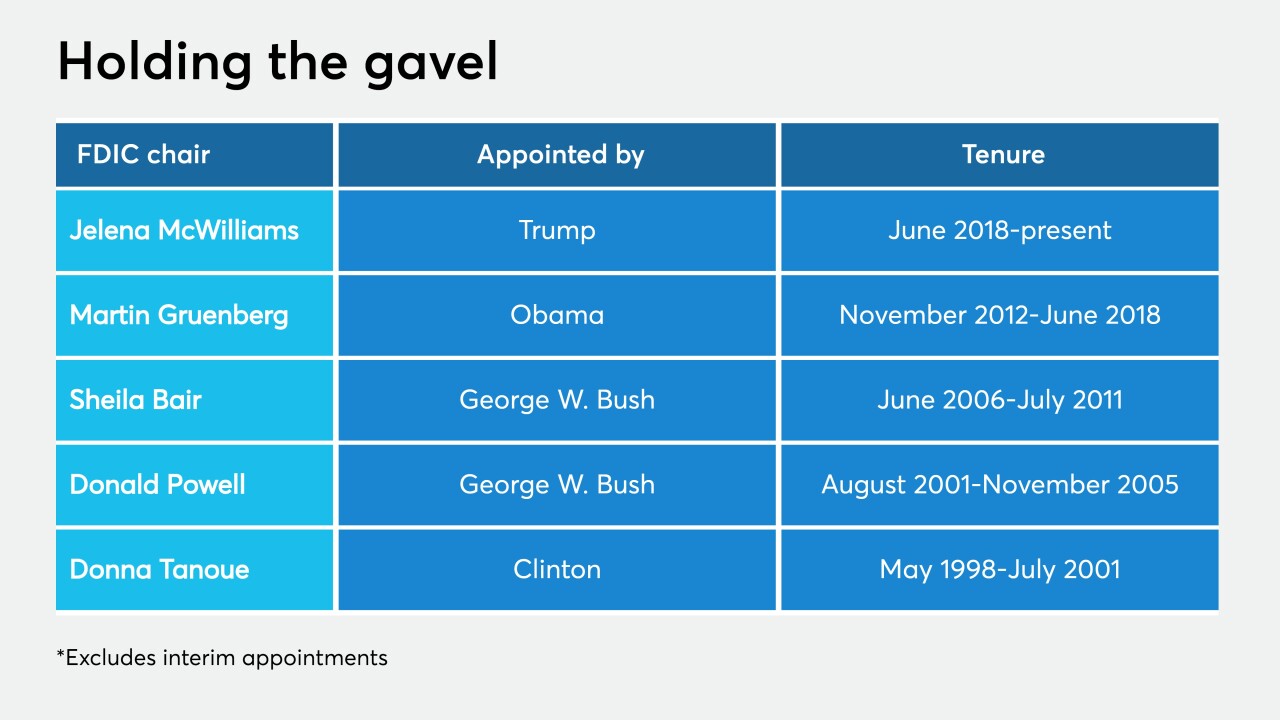

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 12 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 11 -

Acting Comptroller of the Currency Brian Brooks said the agency plans to issue new assessment procedures within weeks as a follow-up to recent Community Reinvestment Act reforms. He also touched on the “true lender” issue and why the agency is considering a narrow-purpose payments charter.

July 30 -

While the resolution sends a message of disapproval of the OCC’s reform of the anti-redlining law, the Republican-controlled Senate is not expected to consider the measure.

June 30 -

Former Comptroller of the Currency Gene Ludwig says making online lenders, credit unions and other nonbanks comply with the Community Reinvestment Act would be a powerful tool in addressing racial and economic injustices.

June 22 -

A blueprint that includes more CRA and tax credits for lower-income African Americans would help a demographic disproportionately harmed by the coronavirus pandemic.

June 19 Operation HOPE Inc.

Operation HOPE Inc. -

From hiring to health care, Vice Chair Anne Finucane shares details about Bank of America’s pledge to address vital needs in minority communities.

June 18 -

As governments explore whether to compensate African Americans for centuries of racism, financial institutions need to do their part to redress victims of persistent redlining.

June 16 Polyient Labs

Polyient Labs -

The lawmakers are attempting to block the regulation reforming the anti-redlining law under review powers granted to Congress, but the move is largely symbolic with the Senate and White House controlled by the GOP.

June 11 -

A blueprint that includes more CRA and tax credits for lower-income African Americans would help a demographic disproportionately harmed by the coronavirus pandemic.

June 10 Operation HOPE Inc.

Operation HOPE Inc. -

Acting Comptroller of the Currency Brian Brooks says financial institutions are needed more than ever to “sustain existing businesses” and help entrepreneurs rebuild. Meanwhile, reforming the Community Reinvestment Act, he says, can “unblock opportunities” in minority neighborhoods.

June 7