-

The upstate New York company unloaded three loans, joining a short list of lenders that have purged problematic credits during the pandemic.

January 22 -

The bank's nonaccrual loans have been soaring as the pandemic continues to roil the hospitality sector. M&T executives said they've been working with borrowers to keep them out of foreclosure.

January 21 -

Payments activity “snapped back” in the fourth quarter and should lift revenue the next few quarters, CEO Brian Moynihan said.

January 19 -

The Dallas bank says reserves could return to pre-pandemic levels by the end of 2021— a year earlier than analysts were predicting — if vaccines prove effective at slowing the spread of the coronavirus.

January 19 -

Federal relief efforts have minimized loan losses so far, but risks remain in credit card, auto and business lending. Many borrowers will need another lifeline to stay afloat until the economy rebounds, CEO Jamie Dimon says.

January 15 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

One engineered a big M&A deal, another struggled with his bank's credit issues and another abruptly resigned. Here are their stories and more.

December 23 -

While banks are reporting steady declines in deferrals, hard-hit borrowers such as airlines, commercial real estate developers and hotel operators will almost certainly struggle to regain their footing.

December 17 -

The emergence of vaccines has boosted travel forecasts — and crude prices. The expected bump at the pump could help oil and gas companies get back on track with loan payments.

December 10 -

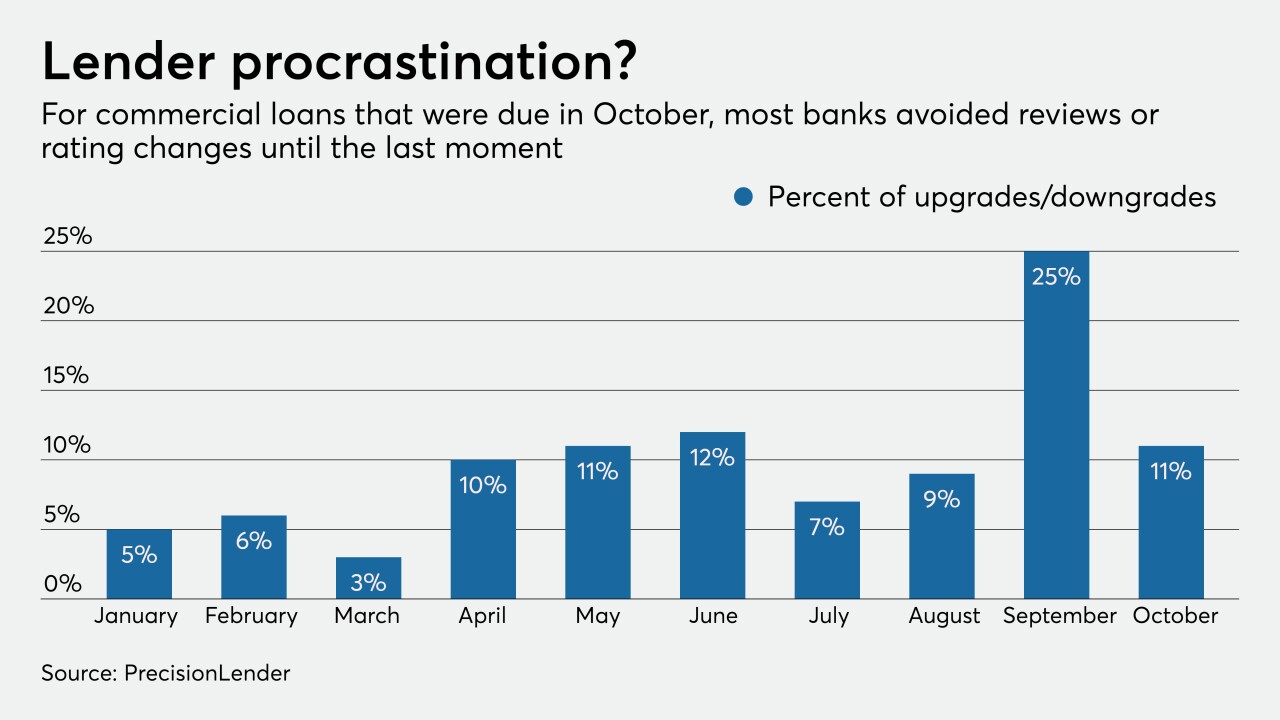

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8