-

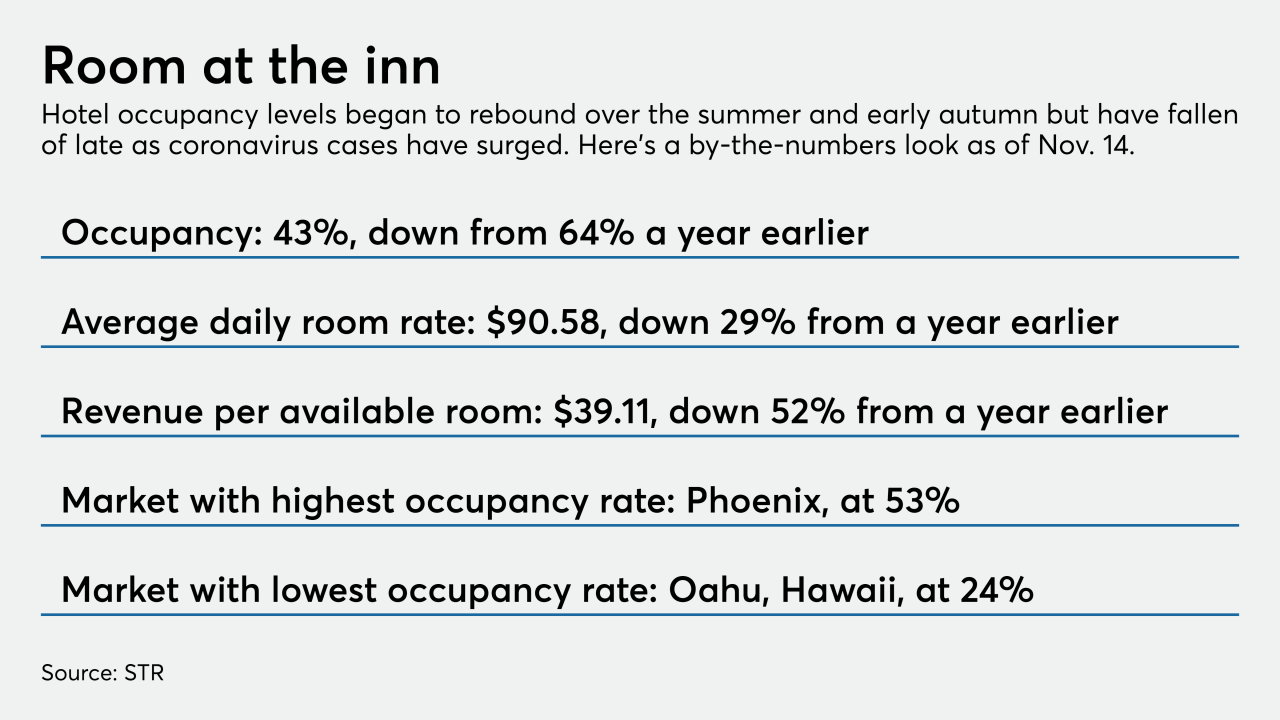

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

The Ohio company will benefit after settling unpaid judgments tied to nonperforming loans at a bank it bought before the last financial crisis.

November 19 -

Lending opportunities have become scarce, especially with commercial borrowers, and banks are resisting the temptation to relax standards to boost volume.

November 12 -

The region now leads the nation in virus cases, and with winter lurking the fear is that the outbreak will only get worse.

November 5 -

A prosperous decade leading up to the pandemic had left lenders in good shape, but they're worried the economic shock to the state's most vital industry could linger into 2022.

November 2 -

The New Jersey company reported a quarterly loss after becoming one of the first lenders to liquidate loans harmed by the coronavirus pandemic.

October 30 -

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

October 29 -

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

October 28 -

The company's Silicon Valley Bank unit reduced its loan-loss cushion by $52 million. Private-equity and VC clients have warmed to the practice of doing deals virtually, which increases lending opportunities, SVB executives said.

October 23 -

The Cincinnati company, one of just a handful of lenders to reduce its cushion against bad credits in the third quarter, was grilled by analysts who suggested it was being too optimistic about the long-term effects of the pandemic recession.

October 22