-

More than 20 banks have been sold to credit unions. A prominent banking lawyer made the case at this year's ICBA convention that banks can become more aggressive acquirers.

March 19 -

CULedger and the computing giant will work to develop blockchain technologies, create new products and improve existing ones.

March 15 -

A partnership between TDECU and a Texas-based fintech will help provide payment plans for consumers struggling to pay legal fees.

March 15 -

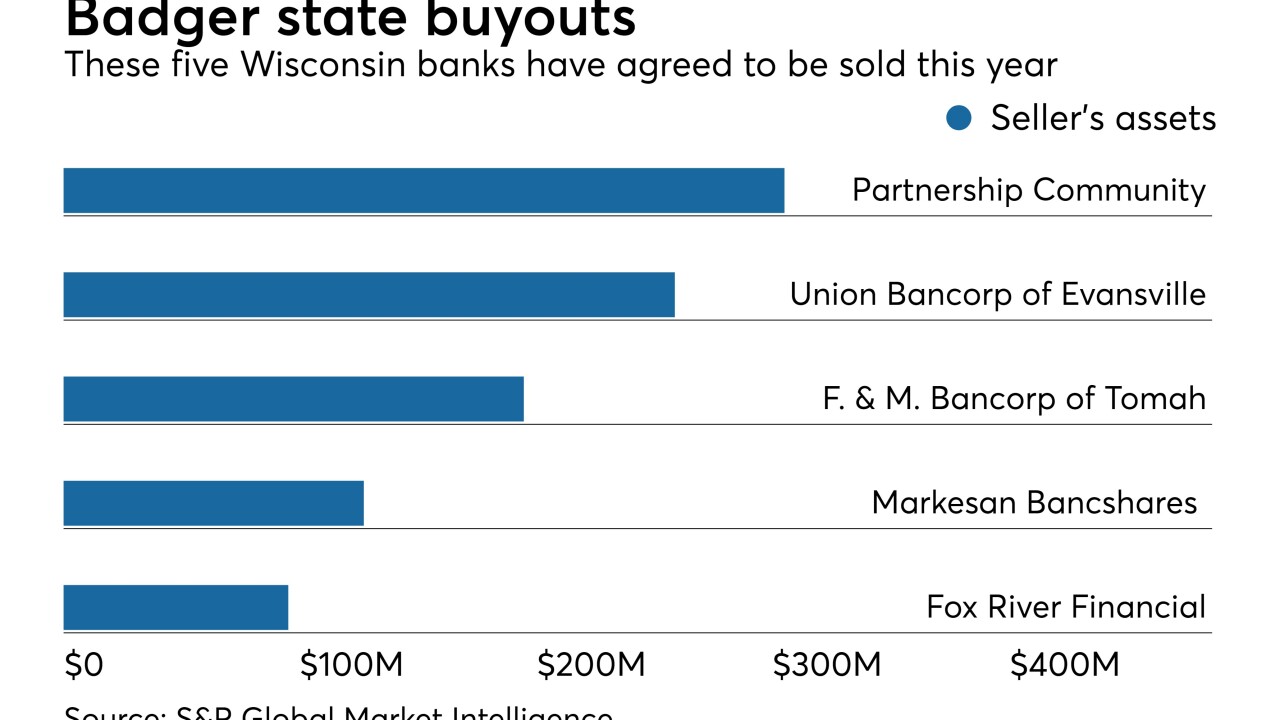

The small Wisconsin city features a vibrant economy, low employment and a growing population, but banks that want to buy their way into the market have their work cut out.

March 14 -

The 2020 presidential hopeful removed the contentious provision from a previous version of the bill that had won praise from bankers but sparked fierce opposition from credit unions.

March 13 -

The CUSO and tech giant have joined forces to help expand blockchian services to credit unions.

March 11 -

The CUSO will work with AffirmX, which provides compliance and risk management offerings, on product development.

March 7 -

Several megabanks have sued the National Credit Union Administration claiming breach of settlement in a previous case related to mortgage-backed securities, but trends may favor the agency.

March 6 -

The Arizona-based CUSO returned $6.2 million in cash rewards to its credit union members for 2018.

March 1 -

Community banks and credit unions fear a Senate plan and other legislative ideas will nullify steps taken by Fannie Mae and Freddie Mac that have made it easier for smaller institutions to compete.

February 28