-

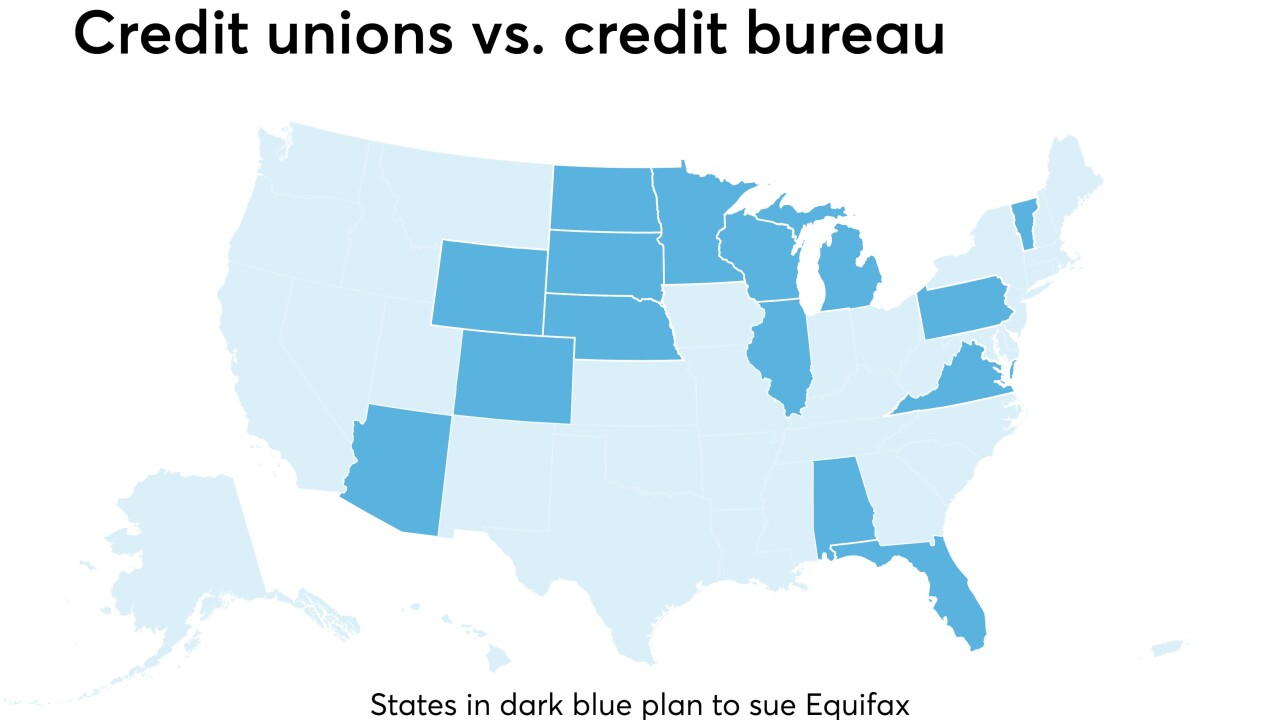

Credit unions, trade associations and others wishing to join the Credit Union National Association's class action suit against Equifax have until the end of January to do so.

January 16 -

With less than three months before the PCI DSS Requirement 8.3 takes effect, all involved in the handling of cardholder data must take definitive steps to review, implement and upgrade their multifactor authentication strategies and implementation to assure compliance, writes Dirk Denayer, business solutions manager at VASCO Data Security.

January 15 VASCO Data Security

VASCO Data Security -

Readers react to the Federal Housing Finance Agency considering changing its credit scoring policy, slam the possibility of enforcing mandatory penalties for data breaches at credit reporting agencies, weigh the possible nomination of a credit union regulator to the CFPB, and more.

January 11 -

The two senators are set to introduce a bill that would force such firms to pay $100 per customer whose personal information was compromised.

January 10 -

Account takeover's harder to quantify than payment fraud because it has so many elements and downstream impacts, writes Kevin Lee, trust and safety architect at Sift Science.

January 9 Sift

Sift -

Twenty-two trade groups, including seven financial trade groups, sent a letter to House lawmakers calling for new data security standards that would preempt state law.

January 5 -

The credit bureau enraged many with its response to a massive data breach this fall, but closing the company down would ultimately harm consumers.

December 28 Consumers' Research

Consumers' Research -

Interactive Brokers says it will allow customers to bet against the cybercurrency; aides to Alabama senator drafted for key regulatory positions to ease banking rules.

December 13 -

In a rare show of public support for a security technology, the banks are leading a $40 million funding round for Menlo Security, provider of browser technology that keeps malware at bay — and they’re using it, too.

December 11 -

Recent data breach events in September 2017 in the U.S., involving the stock value drop of Sonic as well as Equifax, are evidence of the negative impact of data breaches on the economic value of businesses. Clearly, they have become incidents of board-level importance, writes Justhy Deva Prasad, chief data partner at Claritysquare.

December 7 Claritysquare

Claritysquare -

Debit and credit both have their downsides, but both of those downsides disappear if you stay up to date with the latest fraud prevention and chargeback management practices, writes Suresh Dakshina, president of Chargeback Gurus.

December 6 Chargeback Gurus

Chargeback Gurus -

An ex-regulator’s stern warning about the risks of sharing consumer information with fintechs has prompted debate over common security standards for banks and nonbanks, better data tracking and new liability insurance products.

December 5 -

Empow's security platform, integrated into a company's network through APIs or by routing data to empow, breaks down the individual components of a security tool to create an "abstracted new layer" that talks to a set of artificial intelligence algorithms.

December 5 -

PayPal wants to integrate TIO's bill payment customers into PayPal's network, but a data breach has that goal on hold.

December 4 -

Hackers stole the personal data of 57 million customers and drivers from Uber Technologies, a massive breach that the company concealed for more than a year.

November 21 -

The advent of blockchain technology may prove to be disruptive to traditional credit reporting agencies by decentralizing data aggregation and allowing consumers to take ownership of their data through a personalized wallet they could share with prospective lenders, writes Alexander Koles, CEO, founder and managing director of Evolve Capital Partners.

November 16 Evolve Capital Partners

Evolve Capital Partners -

It is important to have the right layers of security in place, ideally those that evaluate passive and behavioral biometrics, as they are proving to be the most reliable, writes Robert Capps, authentication strategist and vice president of NuData Security.

November 13 NuData Security

NuData Security -

Company’s first earnings report since the data breach also discloses lots of suits and investigations; Senate bill also calls for one-year delay in corporate tax rate cut to 20%.

November 10 -

Barros has no answer for Senate committee on encryption; a bitcoin network split won’t happen … for now.

November 9 -

More than a dozen state leagues and credit unions have signaled their intent to sue Equifax, but to what end?

November 8