-

The Rakuten application has opened another front in the battle over nonfinancial companies' ownership of banks.

October 24 -

FCUs are regaining their appeal given the resources NCUA has put into helping de novos and the potential for expanded fields of membership.

October 23 -

The application for Riverside Bank of Dublin comes just six months after another group opened a bank in a nearby market.

October 16 -

OUR Community Bank would focus on small-business loans with an emphasis on underserved Hispanic and Latino communities in South Florida.

October 10 -

Maine Harvest Federal Credit Union, which will serve farmers and the food industry, opened this week and aims to make $12 million in loans over the next six years.

October 9 -

Even with the FDIC actively encouraging groups to start banks, challenges like raising capital and low interest rates make it tough.

October 9 CCG Catalyst

CCG Catalyst -

Frustrated after being overlooked by mainstream financial institutions, organizers of the proposed Pagan Federal Credit Union are hoping to be chartered by the end of the year.

October 4 -

Sound Bank is now Dogwood State Bank after its sale to an investor group. The buyers also moved Dogwoods State's corporate offices from eastern North Carolina to the state's capital.

October 2 -

Gulf Capital Bank has received conditional approval from state and federal officials and could be up and running late this year or early next year, its organizers say.

September 30 -

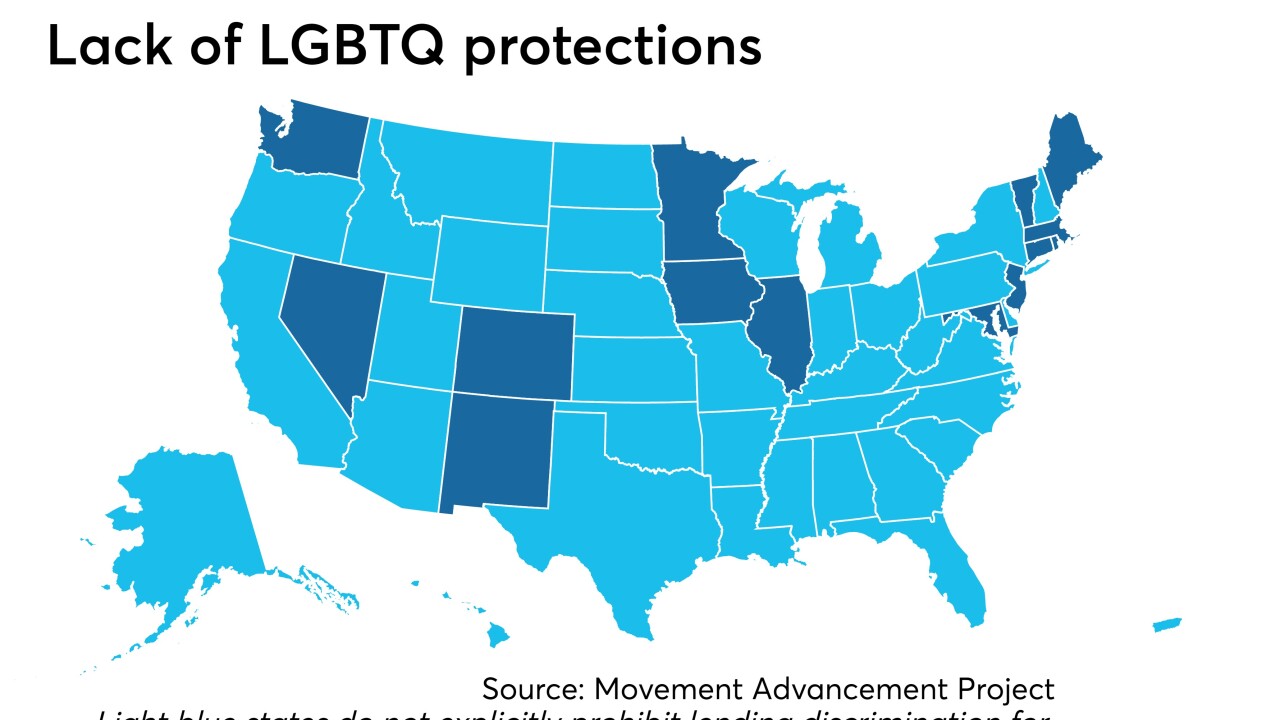

With credit discrimination still legal in many states, the Michigan-based institution aims to help this marginalized group.

September 30