With many forms of financial discrimination against LGBTQ consumers still not explicitly prohibited, sources say the time is right for a credit union chartered specifically to serve that community.

Enter Superbia CU, which was

According to Myles Meyers, founder of Superbia Services, which raised more than $1 million to get the credit union off the ground, queer and transgender consumers still face “subtle and direct” intolerance and discrimination. As evidence, he pointed to an Iowa State University study that found same sex couples were

“The experience I encounter as an individual customer of a financial institution today is quite different than when I am accompanied by my husband,” Meyers said, insisting Superbia will provide an experience that “affirms” the millions of LGBTQ individuals. “We will be looking, engaging and speaking to our members as part of the community. It will not be a niche market experience that begins and ends with the presentation of a billboard or brochure.”

While the credit union will be based in Michigan, it aims to have a national reach thanks to a partnership with CLEAR (the Center for LGBTQ Economic Advancement and Research). Myers said the two groups worked together to identify gaps for this community that traditional financial services providers have not addressed.

Superbia has not yet been approved for federal deposit insurance, nor specified exactly what products it plans to offer. The group’s website includes a page where consumers can sign up to receive more information, as well as

Online services from the credit union are expected to begin sometime next year.

Superbia’s organizers spent more than a year raising funds to get the initiative off the ground. The group ultimately pulled together $100,000, including garnering help from the public via an Indiegogo crowd-funding campaign.

It remains unclear why the new institution was chartered in Michigan when Superbia Services is based in New York. A spokesperson for the Michigan Department of Insurance and Financial Services said via email that

"Superbia Credit Union met that criteria and applied to be a Michigan-based credit union with a corporate office in Michigan," she said.

Lucy Ito, president and CEO of the National Association of State Credit Union Supervisors, said Superbia was granted an association charter, permitting it "to serve individuals in the association in Michigan as well as other states," though organizers will also have to navigate state-specific laws if they intend to serve members in multiple states.

Superbia’s Meyers said Michigan was chosen to be the launch site after holding meetings with a number of stakeholders and regulators to discuss the vision and purpose the credit union.

“In our estimate, Michigan best represented the path forward of bringing our vision for a credit union to life,” said Myers.

The first?

While Superbia claims to be the nation’s first credit union "by and for the LGBTQ community and its allies across the nation," the issue of a financial institution for that community is anything but new.

Some reports have credited the Dallas Gay Alliance with attempting to form the first such institution more than 30 years ago, but more recent attempts in Washington State helped pave the way for Superbia, and organizers say one key difference is the new institution's attempt at a nationwide reach.

Philip Endicott, a Washington-based LGBTQ advocate, spent years

“They’re doing identically what we sought to do,” he said. “They kind of picked up in our footsteps. We overlapped by maybe a year. I spent roughly five years working and researching the need and the hope for solvency with a credit union and the community.”

Along with those efforts, Endicott also contributed to a

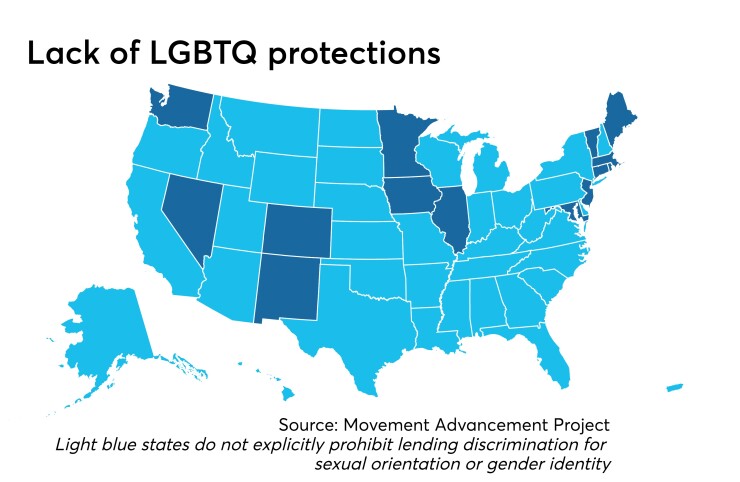

Financial institutions in more than half of all states can

A 2018 study from Experian found 62% of LGBTQ respondents had experienced financial challenges as a result of their sexuality or gender identity. Among the most common responses were higher housing costs as a result of discrimination (11%), marriage inequality leading to a reduction in retirement security for couples (11%) and discrimination or harassment while at work (13%).

These consumers also face higher borrowing costs. While an average of 0.2 percentage points is minimal for an individual borrower, analysis from the Proceedings of the National Academy of Sciences found that equates to as much as $86 million per year in additional fees for this market.

The right time

Many said that the timing is right for a credit union focused on this demographic.

“Things were going quite well with the Supreme Court decision [in 2015 legalizing same-sex marriage] and then a year or so later we had transgender people being disqualified from the military [and] people losing their jobs because of a choice to become who they feel and believe they are,” said Endicott. “So that’s a really great reason why a financial institution dedicated to this community is important.”

Anna Foote, southeast regional director for Inclusiv, said the new institution will fit well with the movement’s tradition of serving communities in need.

“A marginalized community typically has been discriminated against for a long time, and its members feel they would be better served by someone who understands them – and that is what credit unions are all about,” Foote said.

This story was updated at 4:21 P.M. on Sept. 30, 2019.