-

The acrimonious debate in the bitcoin community turns in part on whether one prioritizes using the digital currency as an investment or as a means of expanding global financial inclusion.

July 15 The Cato Institute

The Cato Institute -

Nintendo is known for taking an experimental approach to making video games, and this same mindset carries over to how it handles money. The company's hardware, software and business strategies show a forward-thinking strategy for payment acceptance.

July 15 -

The hit smartphone game Pokemon Go is not a mobile wallet or a loyalty app, but it is arguably far more successful at driving traffic to retailers' stores than many of the apps designed for that purpose.

July 13 -

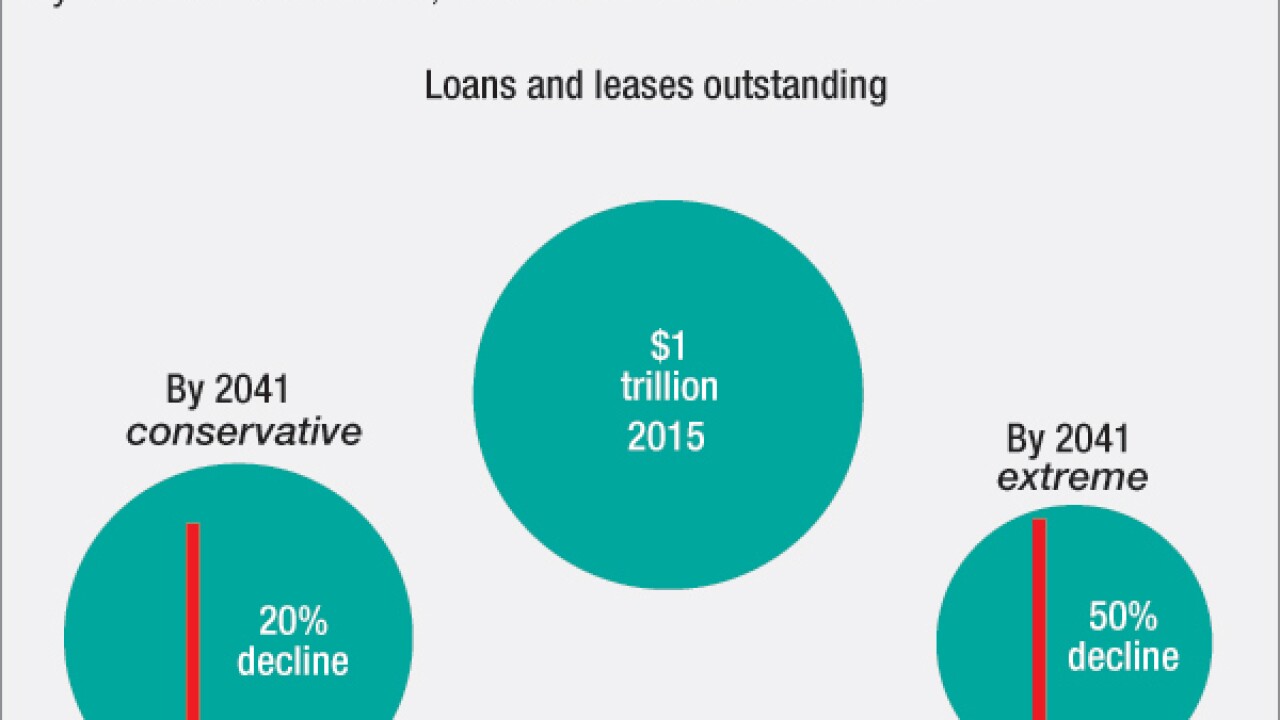

Despite recent controversy over Tesla crashes, the march toward autonomous driving technology continues. And that means big changes for auto lenders.

July 12 -

A couple of years ago, the activist investor Joseph Stilwell said Anchor Bancorp in Lacey, Wash., deserved more time to try to right itself. Apparently he thinks that time is up.

July 12 -

WASHINGTON The head of the American Bankers Association on Tuesday defended financial institutions' partnerships with fintech firms but argued that banks top nonbank startups in serving as "trusted custodians" for their customers' funds.

July 12 -

Walmart Pay is the culmination of years of efforts that Walmart has put into building its brand as a trusted provider of payments. In addition to its new mobile wallet, Walmart has been involved in numerous innovative projects to help its customers move money.

July 7 -

Seven months after revealing its branded mobile payment app, Walmart is making Walmart Pay available in more than 4,600 of its stores throughout the U.S., with early figures indicating consumers approve of its "connected" app model.

July 6 -

While fintech companies are urging federal regulators to create a federal charter that would allow them to follow a single national standard instead of a myriad of state rules, such a benefit will almost certainly come with strings attached, including possible compliance with the Community Reinvestment Act.

July 5 -

Affirm's head of new markets, Brad Selby, says hidden fees and onerous compounding interest terms are trapping too many consumers in deep credit card debt.

July 1