-

Loans and tax-subsidized investments by financial institutions have helped fund food markets and pantries in low-income communities. But there is still more work to do to close the grocery gap.

April 28 -

The Senate Banking Committee chairman told an audience of community bankers that he supports legislation to close "chartering loopholes" for industrial loan companies and financial technology firms. He also pitched a plan to give all consumers a free digital wallet backed by the Federal Reserve.

April 27 -

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

April 26 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

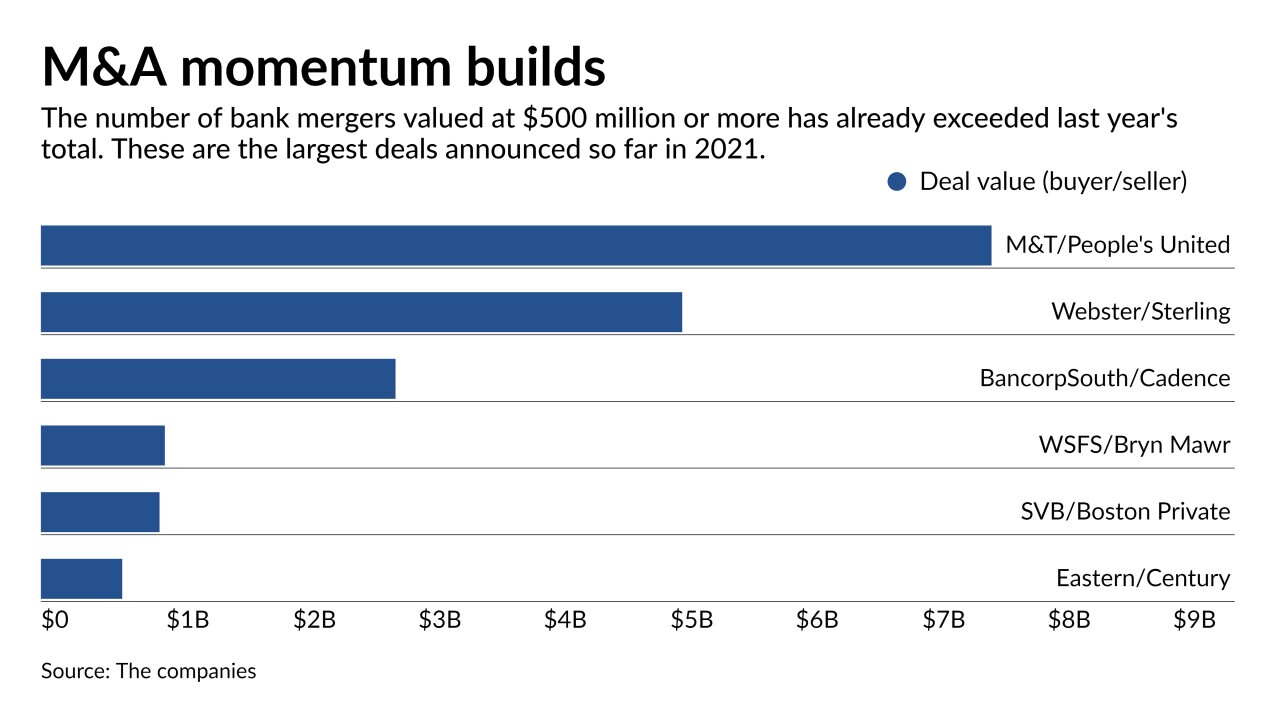

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

April 21 -

Oil and gas companies — flush with cash from rising oil prices — are catching up on debt payments and will seek new credit later in the year as the economy recovers, the Oklahoma company says.

April 21 -

House and Senate GOP members have stepped up criticism of a plan to include banks in a global push to cut emissions, saying it could cut off financial services access for energy and fossil fuel companies.

April 21 -

With Congress pouring billions into a new grant program and state-based lending initiatives, community development financial institutions say they can move past survival mode to test new products and partner with larger financial institutions.

April 20 -

The Ohio company has opened just 32 of 120 new branches it plans in the region by 2022, but those offices are making a sizable contribution to growth.

April 20 -

Climate First Bank has raised $29 million in initial capital, surpassing the $17 million target set by the Federal Deposit Insurance Corp.

April 20