-

The rebate, which would be geared toward boosting U.S. manufacturers, would be issued at the end of the year to offset the effects of retaliatory tariffs.

April 8 -

Loans and tax-subsidized investments by financial institutions have helped fund food markets and pantries in low-income communities. But there is still more work to do to close the grocery gap.

April 28 -

The proposed changes laid out by banking regulators would clear up confusion about what qualifies for CRA credit within so-called Opportunity Zones. But not all community development advocates are convinced that the changes are for the better.

December 17 -

The bipartisan proposal aims to renew banks' interest in low-income housing tax credits and bring more lower-priced homes to markets that badly need them.

June 18 -

The merging banks, whose new headquarters would be Charlotte, N.C., will each double their charitable giving over the next three years in Atlanta and Winston-Salem, N.C.

June 5 -

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

Several banks could lose money over tax credits tied to DC Solar, a California firm wrestling with a fraud claim.

March 8 -

At least five banks have warned about the potential loss of tax benefits if it is proven that DC Solar operated an investor scheme.

March 1 -

Multiple agencies are looking into its purchase of certain credits tied to low-income housing developments, the bank said in a securities filing Friday.

August 3 -

Readers react to a drive for more public banks, weigh in the launch of an online-only bank, chime in on what millennials need and more.

March 29 -

Lawmakers approved a measure to increase the program's funding by nearly $3 billion over four years.

March 26 -

Lawmakers should preserve the credit meant to spur economic development as part of sweeping tax reform being debated in Congress this week.

December 13 Community Development Bankers Association

Community Development Bankers Association -

The House-passed tax bill would eliminate the New Markets Tax Credit while the Senate bill would not reauthorize it when it expires in two years. Bankers and other proponents say that if it is discontinued many economic development projects in rural and low-income communities won’t be funded.

November 17 -

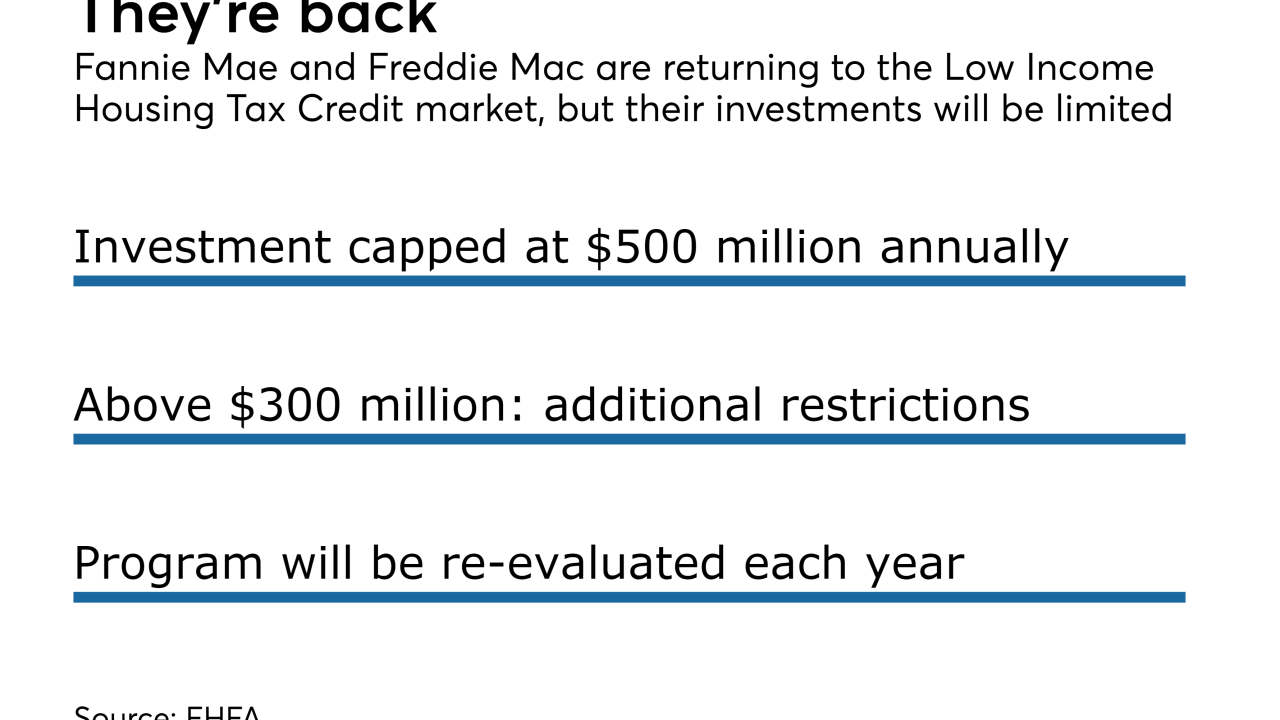

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Banks have started reconsidering how much they are willing to pay for low-income housing tax credits.

January 12