-

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

Not a penny of the $1 billion fine against Wells Fargo will end up in the hands of customers harmed by practices flagged by regulators.

April 27 -

The costly order against Wells Fargo contains both unexpected good news for the bank and more potential problems for its CEO.

April 20 -

Months after President Trump vowed that Wells Fargo would pay a severe penalty, the CFPB and OCC hit the bank with a $1 billion fine to settle claims it overcharged customers for auto insurance and home loans.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

The CFPB and OCC are expected to assess a $1 billion fine against Wells Fargo for allegedly overcharging customers for auto insurance and home loans.

April 19 -

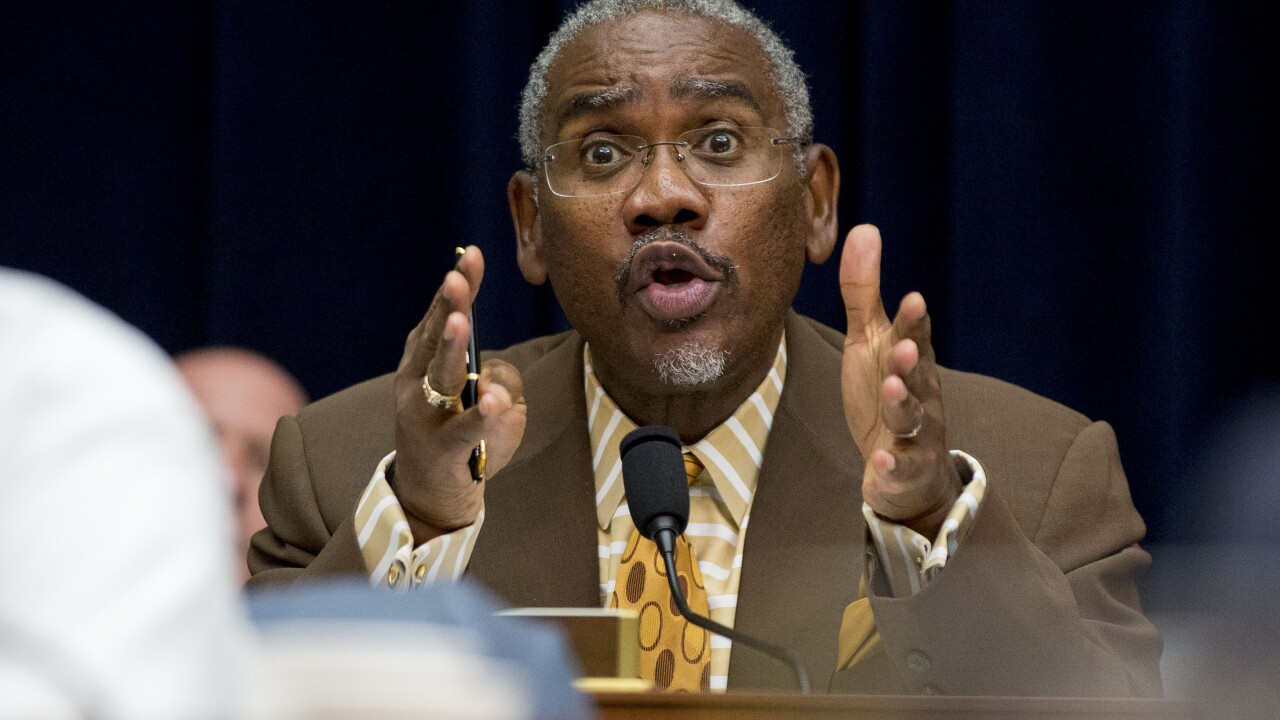

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

The agency said Cross River Bank and an affiliated debt settlement company misled customers into thinking a debt consolidation program would settle their debts and boost their creditworthiness.

March 28 -

In the joint report with the Federal Trade Commission on debt collection practices, the CFPB said it had initiated four enforcement actions last year, had resolved one case and has five others pending.

March 21