-

President-elect Donald Trump might attempt to remove Consumer Financial Protection Bureau Director Richard Cordray from his post and boost legislative efforts to weaken its powers.

November 9 -

As voters in California, Florida and nine other states decide whether to legalize marijuana, the results may force Congress to resolve differences between federal and state laws that have paralyzed much of the banking industry.

November 7 -

Guidance on regulatory expectations is helpful, but it is not yet clear whether such guidance gives financial institutions impetus to onboard or keep clients they perceive to be riskier.

November 7

-

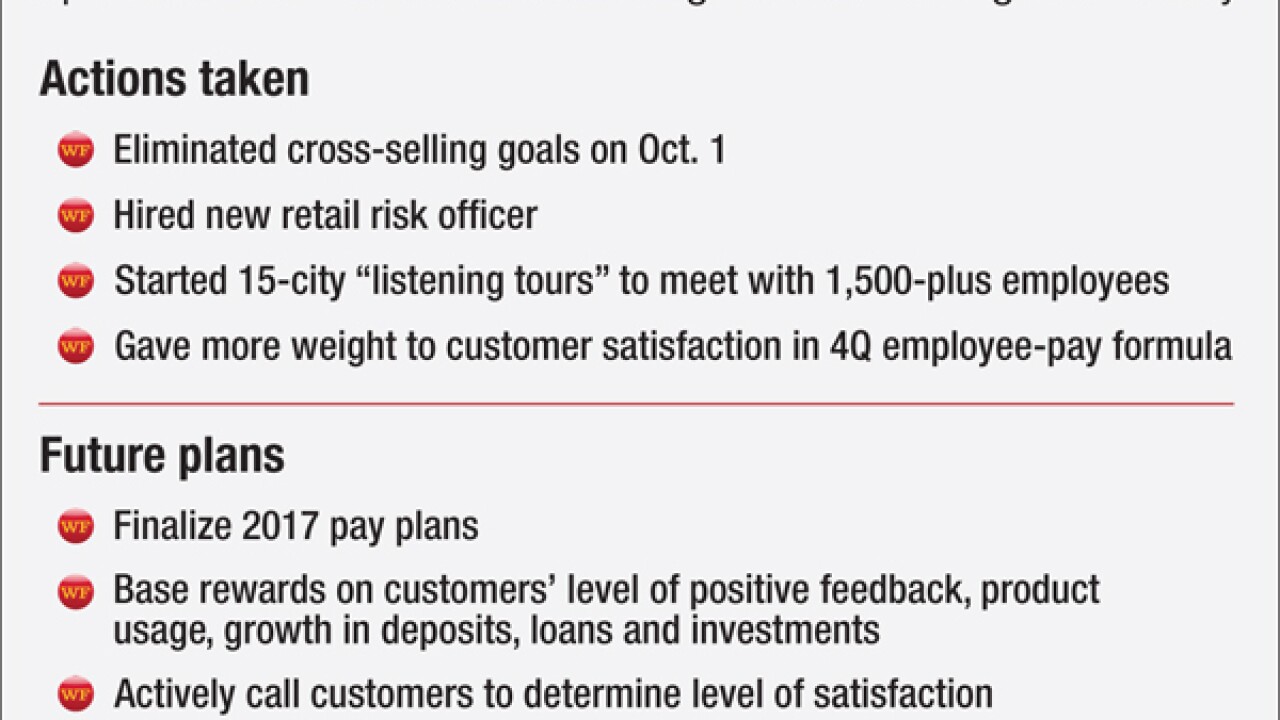

In her first major presentation as Wells Fargo's head of retail banking, Mary Mack took on the doubters, making the case for why she is the best fit to lead the embattled retail unit. She laid out plans to revamp compensation and internal culture.

November 3 -

Two top executives said the scandal-plagued bank has managed to minimize the financial damage and can continue to grow amid some reforms. Yet they acknowledged that the full toll has yet to be realized, and the company announced it had significantly raised its estimated legal exposure.

November 3 -

The former chairman of the failed Premier Bank in Wilmette, Ill., was sentenced to five years in prison after he pleaded guilty to defrauding the Treasury Department's Troubled Asset Relief Program.

November 2 -

The Consumer Financial Protection Bureau and the New York Attorney General filed a lawsuit Wednesday against two New York debt collectors for deceiving and harassing millions of consumers to pay inflated debts.

November 2 -

The piling on at Wells Fargo has reached an unprecedented level, even for a bank. Fifteen investigations are underway into Wells' phony account openings. Experts are quantifying the damage to Wells' reputation and what the bank can do going forward to repair it.

October 25 -

Wells Fargo appears to have offered two different reasons for why it failed to inform investors about the investigation into 2 million phony accounts. That could play a role into whether the Securities and Exchange Commission files charges against the bank for disclosure violations.

October 24 -

Corporate culture is difficult to define and document. But bankers have a responsibility to set high ethical standards in the way they pay and promote their employees, according panelists at a New York Fed conference Thursday.

October 21 -

The California Department of Justice is investigating Wells Fargo for allegations of criminal identity theft.

October 19 -

Two San Francisco supervisors on Tuesday introduced a resolution that would "end all business with Wells Fargo," in response to the fake account scandal and other practices that have harmed consumers.

October 18 -

As a result of the SEC's latest reforms, today's money-market funds are very different products than their precrisis predecessors. Calls for additional layers of burdensome regulation over this industry are unwarranted.

October 17 Investment Company Institute

Investment Company Institute -

Without investigations by the Los Angeles Times and city prosecutors, the Wells Fargo account scandal would never have come to light. Where were federal regulators?

October 13

-

A federal appeals court ruling against the Consumer Financial Protection Bureau has raised questions about whether banks and other firms cited by the agency can protest previous enforcement actions. But doing so may create new risks for firms.

October 12 -

A top Wells Fargo executive and a former employee painted very different pictures of the culture and oversight at the San Francisco bank during a hearing by a California Assembly committee on Tuesday that probed the opening of 2 million phony accounts.

October 11 -

The ramifications for a U.S. Court of Appeals decision against the CFPBs constitutionality go far beyond just the agencys independence, and may have consequences for other federal agencies with similar structures. The ruling may also hamper the CFPBs powers, including its ability to retroactively apply new rules.

October 11 -

More top executives at Wells Fargo will report to President and Chief Operating Officer Tim Sloan, the company announced Monday, a move that comes amid the ongoing fake accounts scandal that has led to calls for the resignation of Chief Executive Officer John Stumpf.

October 10 -

If Wells Fargo employees were fired for trying to stop the banks improper account practices, as has been claimed in court, it shines a spotlight on the need for more whistleblower assistance.

October 6 Murphy McGonigle

Murphy McGonigle -

Fourteen senators including Bernie Sanders, I-Vt., and Elizabeth Warren, D-Mass., sent a letter Wednesday to Attorney General Loretta Lynch calling for the Justice Department to investigate possible criminal wrongdoing by senior executives at Wells Fargo.

October 5