ESG

ESG

-

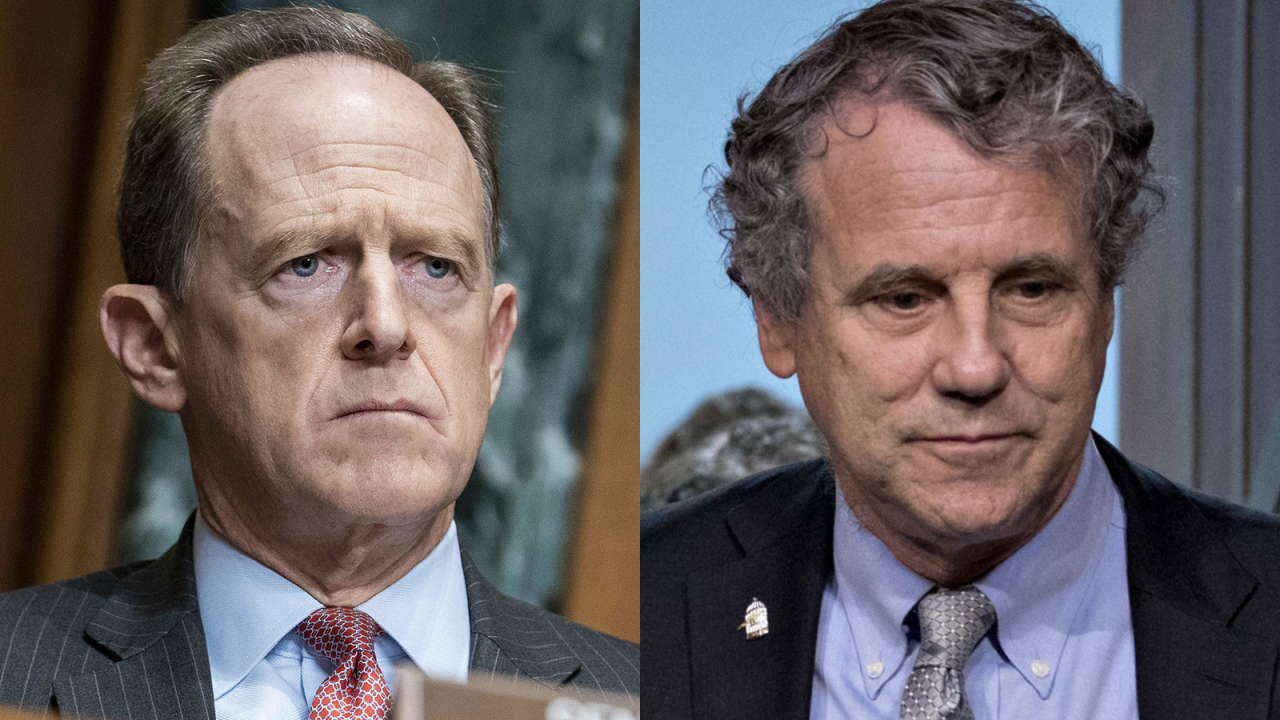

Sen. Pat Toomey, R-Pa., warned the regional Federal Reserve bank that its papers about environmental, social and corporate governance policies hurt its ability to stay neutral on partisan issues.

March 29 -

The Rainforest Action Network says the 2020 decline stemmed more from weak energy demand during the pandemic than banks’ pledge to reduce financing to firms that contribute to climate change.

March 25 -

Executive vice presidents and above will be evaluated on how they contributed to progress on efforts to curb the firm’s use of carbon, improve financial inclusion and reach gender-pay parity, CEO Michael Miebach said in a memo to staff.

March 24 -

The Treasury Department and U.S. regulators aim to boost demand for assets that tackle climate change, while preventing companies from making claims that could be considered “greenwashing,” or overstating the significance of emissions reductions and sustainability efforts.

March 19 -

Democrats want regulators to actively protect the financial system from losses tied to extreme weather events, while Republicans say climate policy is "beyond the scope" of their mission.

March 18 -

Big banks led the push to offer multibillion-dollar bonds that fund affordable housing, education and nonprofits that serve needy communities. But Truist's recent $1.25 billion bond is a sign that regionals want to attract progressive institutional investors — and burnish their images.

March 15 -

The bank also committed to finance $500 billion in sustainable businesses and projects by 2030.

March 8 -

Hector Negroni, a leader in pushing the needle in municipal finance, talks policy, infrastructure, ESG and a growing global audience for investing in state and local governments.

-

The bank’s new holding company, Amalgamated Financial Group, is the first publicly traded financial services company to become a public benefit corporation. It says the legal designation will help officers and directors balance the interests of shareholders and the public.

March 1 -

Going green takes time, so lenders need to start revamping entire business relationships now, according to one sustainability-focused nonprofit. That process could include setting environmental goals for fossil-fuels companies and other customers that are conditions for continuing to finance them.

February 26