-

The Maryland-based credit union sued the nation's largest CUSO over call center services, but the two sides didn't take long to come to an agreement.

December 20 -

The Indiana-based institution has increased its starting pay for the last three years.

December 19 -

The Minnesota-based institution expects to $10,000 per month by switching its core systems.

December 17 -

Cash recyclers have their place in a branch. But other solutions may help credit unions save time and money when processing large transactions.

November 26 Cummins Allison

Cummins Allison -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

Raises for the rank and file have fueled investor complaints that banks aren’t keeping a lid on expenses. Executives say the pay increases have lowered turnover and improved customer service.

November 8 -

The New York-based online lender plans to spend an additional $15 million next year, largely on bank partnerships and international expansion.

November 6 -

The Cleveland bank gave details on a program for trimming 5% in expenses next year in order to ensure its efficiency ratio goals are met.

October 30 -

The custody bank was very profitable, and it raised its cost-saving forecast for year-end, but its nearly 3% increase in third-quarter noninterest expenses prompted an investor backlash.

October 19 -

Strong net interest income and other factors made up for a drop in investment banking and other noninterest income at the Atlanta bank, which reported double-digit earnings growth.

October 19 -

Commercial and industrial lending rose 8% in the third quarter at the Cleveland bank, but other factors drove its double-digit gain in profits as overall loan growth was modest.

October 18 -

The Dallas bank has picked a bad time to shift from cost-cutting to expansion as big banks are in a commercial lending funk.

October 16 -

The largest U.S. bank's strong third quarter did not insulate its leaders from being pressed about the downside of pricey investments in technology, whether capital rules make commercial lending growth hard for big banks to achieve, and whether another economic downturn is edging closer.

October 12 -

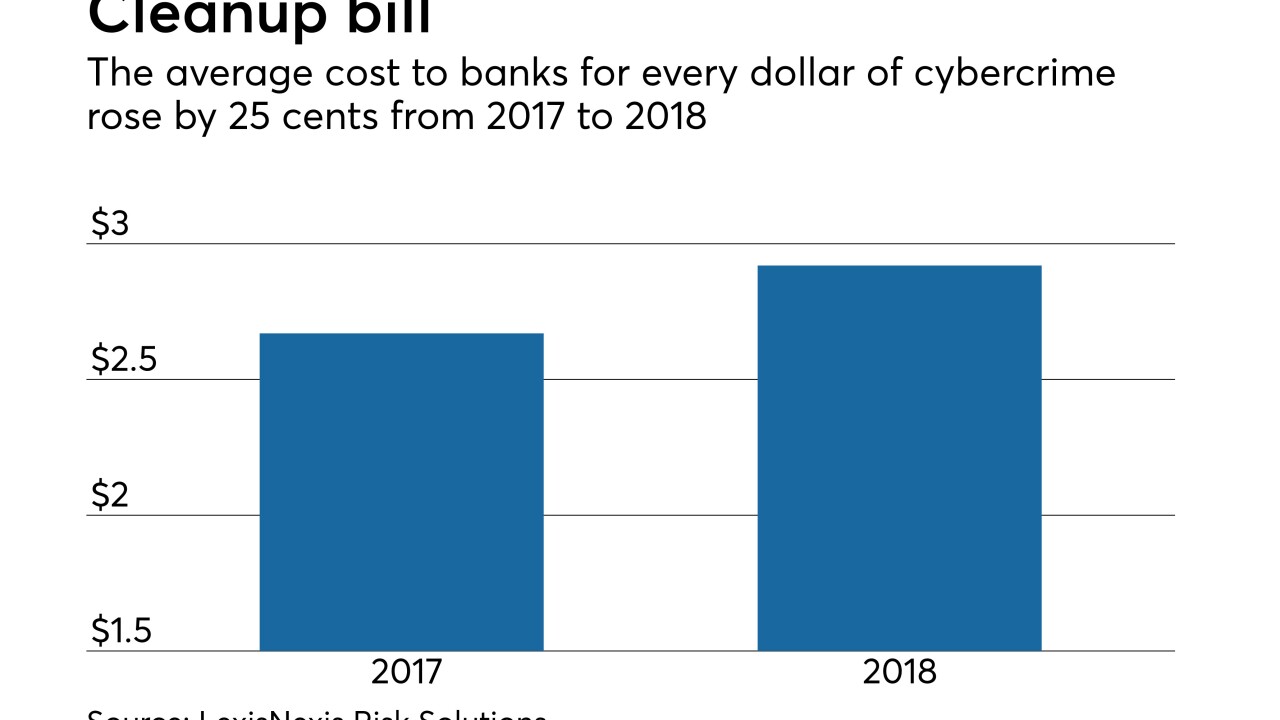

Banks’ tab to fight hackers rose 9% from last year by one measure. Investors want them to rein in tech investments, but security experts say the crooks are getting smarter and smarter.

October 2 -

The cuts are part of a broader effort to trim expenses by roughly $3 billion a year by 2020.

September 20 -

The company said the move should address investor concerns about potential margin compression, slower loan growth and an economic slowdown.

September 20 -

Prosperity Bancshares in Houston said that its earnings increased 19% from a year earlier as its efficiency ratio rose.

July 25 -

Banks could shed as much as 20 million square feet of office space over the next five years as they shift many functions to high-tech operations centers in markets with cheaper rents.

July 6 -

Banc of California in Santa Ana will cut roughly 9% of its workforce as it looks to trim $15 million in expenses.

June 29 -

The Seattle company is firing 127 people, or a tenth of its mortgage staff, after enduring months of slow activity.

June 14