-

Commercial and industrial lending rose 8% in the third quarter at the Cleveland bank, but other factors drove its double-digit gain in profits as overall loan growth was modest.

October 18 -

The Dallas bank has picked a bad time to shift from cost-cutting to expansion as big banks are in a commercial lending funk.

October 16 -

The largest U.S. bank's strong third quarter did not insulate its leaders from being pressed about the downside of pricey investments in technology, whether capital rules make commercial lending growth hard for big banks to achieve, and whether another economic downturn is edging closer.

October 12 -

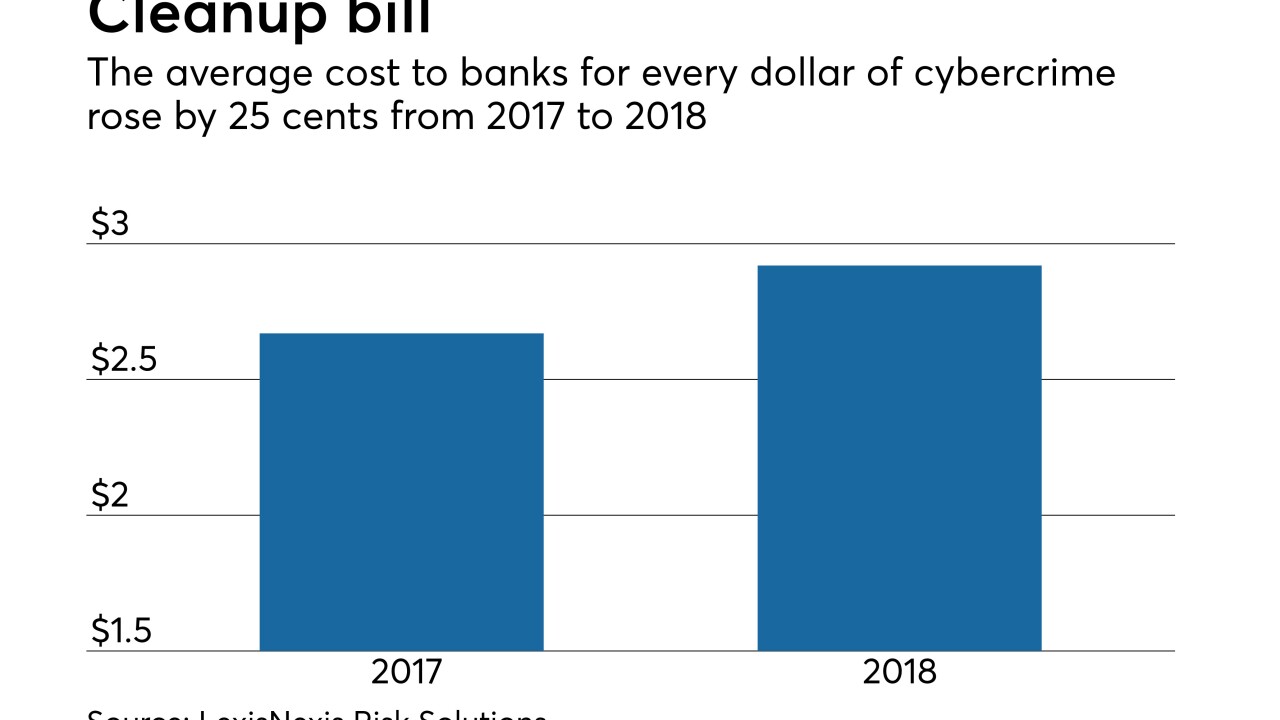

Banks’ tab to fight hackers rose 9% from last year by one measure. Investors want them to rein in tech investments, but security experts say the crooks are getting smarter and smarter.

October 2 -

The cuts are part of a broader effort to trim expenses by roughly $3 billion a year by 2020.

September 20 -

The company said the move should address investor concerns about potential margin compression, slower loan growth and an economic slowdown.

September 20 -

Prosperity Bancshares in Houston said that its earnings increased 19% from a year earlier as its efficiency ratio rose.

July 25 -

Banks could shed as much as 20 million square feet of office space over the next five years as they shift many functions to high-tech operations centers in markets with cheaper rents.

July 6 -

Banc of California in Santa Ana will cut roughly 9% of its workforce as it looks to trim $15 million in expenses.

June 29 -

The Seattle company is firing 127 people, or a tenth of its mortgage staff, after enduring months of slow activity.

June 14 -

Whether they’re thwarting cyber thieves or building out new apps, bank chiefs say hefty tech investments are now a cost of doing business — but they have to convince shareholders.

May 30 -

The $1.9 trillion-asset bank is under pressure to provide investors more information about when it expects to resolve the numerous headaches that have arisen in the wake of its phony-accounts scandal.

May 30 -

The Chicago company will close 19 branches and eliminate 150 jobs, partially reflecting changing customer preferences.

May 21 -

The company said the move would help it become more efficient at a time when clients are making greater use of digital channels.

May 21 -

The Seattle company has faced criticism from an investor over its commitment to the business, which lost money in the first quarter.

April 24 -

The Louisiana company has vowed to meaningfully improve investor returns and efficiency over the next two years.

April 20 -

Investing in technology has been an important focus for banks. But big questions remain about these investments, including how best to pay for them.

April 19 -

The North Carolina company's efforts to contain expenses made up for a marginal increase in revenue.

April 19 -

The Alabama company, as part of an efficiency effort, is streamlining its organizational structure and creating a division focused on community engagement.

March 2 -

A debate is brewing about whether rising rates mean banks must pay more to hold onto deposits from city and county governments — and whether they are worth it. Some would say no question on both counts, while others say it all depends on the financial strategy of the client and how badly the bank needs that client.

February 28