-

The National Credit Union Administration board held its monthly open board meeting Thursday – likely board member Rick Metsger's last hearing with the panel before two new members join.

March 14 -

Despite strong performance in the industry overall, analysts expect regulators to shutter more institutions in the years ahead.

January 3 -

The National Credit Union Administration board voted to decrease the normal operating level for the share insurance fund in addition to prioritizing alternative capital as part of its regulatory reform.

December 13 -

The National Credit Union Administration on Thursday approved a two-year budget as the board credited the merger of two funds with helping CUs stave off assessments amid a surge in liquidations.

November 15 -

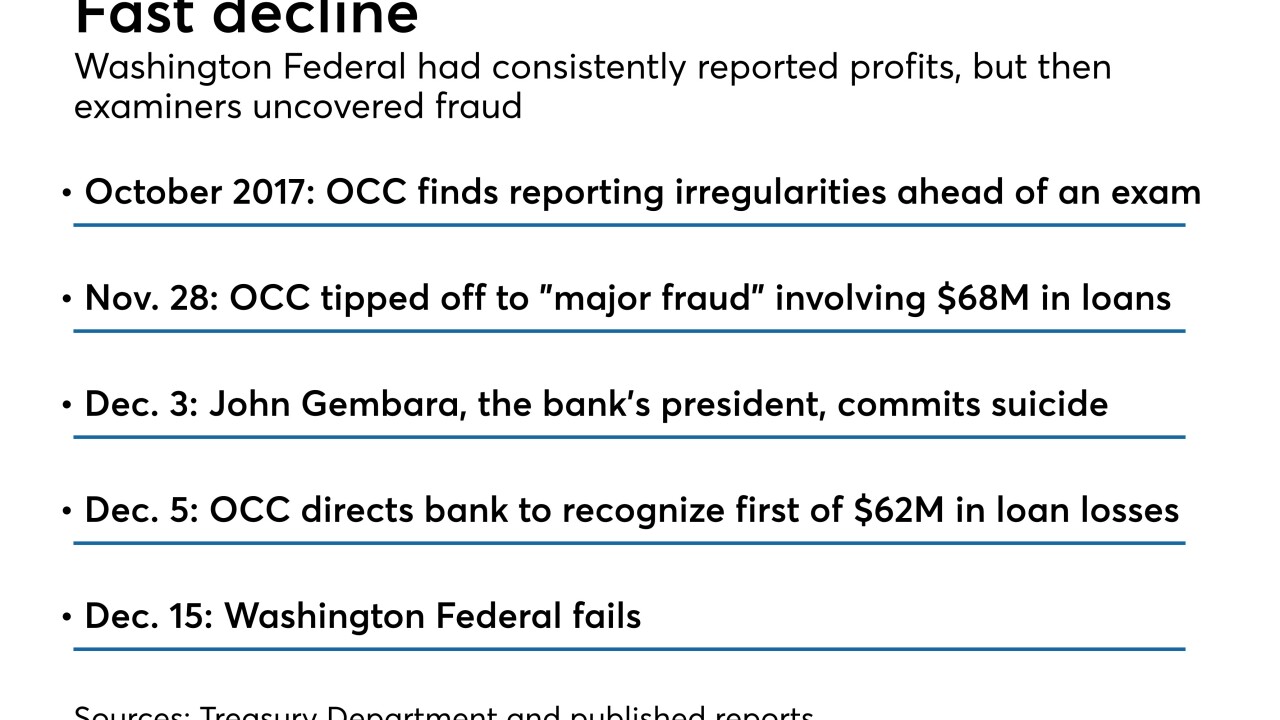

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

The $263 million portfolio has been covered by a loss-share agreement since an investor group bought the failed BankUnited in 2009.

November 5 -

Federal regulators shuttered the institution, which had just $3 million in assets, after it became insolvent with no viable path forward.

October 12 -

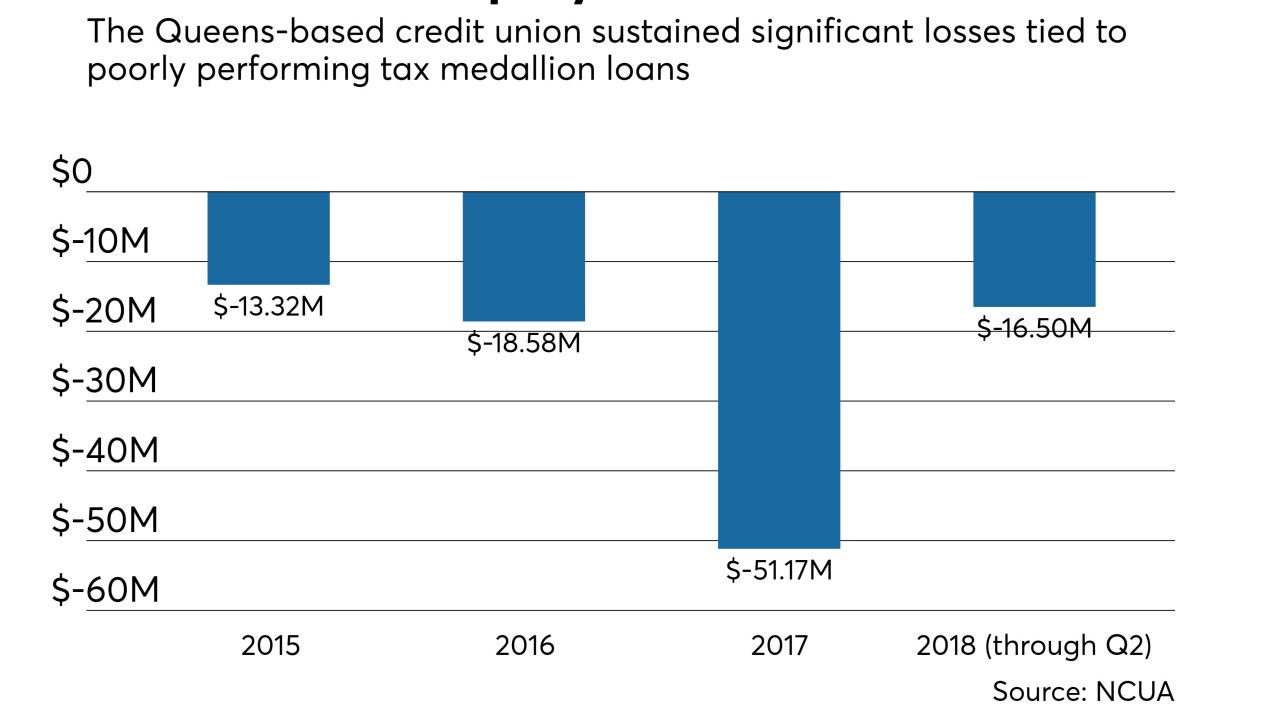

NCUA liquidated LOMTO Federal Credit Union following years of significant losses due to poorly performing taxi medallion loans.

October 1 -

After months of negative headlines, including administrative charges against a former CEO, regulators shuttered the NYC-based credit union.

August 31 -

A credit union in Swansea, Wales, has collapsed and will cost the UK's Financial Services Compensation Scheme nearly $647,000 to reimburse members' insured funds.

August 31 -

Bankers at Sonoma Valley Bank were convicted of bank fraud, money laundering and other offenses.

August 6 -

Greater Christ Baptist Church Credit Union had assets of just $608,000, and saw mounting losses during each of the last three years.

July 31 -

Good times end eventually. And it is inevitable that some new approach to banking will cause financial institutions to fall flat in a downturn.

July 11American Banker Magazine -

A judge rules the accounting firm should have detected the fraud that brought down Colonial Bank; Fed deal with Goldman and Morgan Stanley shows softer side.

July 3 -

The agreement was tied to the Puerto Rico company's 2010 purchase of the failed Westernbank.

May 24 -

First Jersey is the second federally insured CU to be liquidated this year.

March 1 -

The Puerto Rico-based bank failed in 2015. The FDIC, its receiver, is seeking unspecified economic and punitive damages from 16 lenders, including Bank of America, Barclays and Credit Suisse.

February 21 -

The Fed determined that Jacob Goldstein, who was also president of NBRS Financial Bank, improperly signed off on loans without telling the board that he would benefit from them. The bank failed in 2014.

February 8 -

The tiny Chicago-based CU, with less than $1 million in assets -- is the first credit union failure of 2018.

January 30 -

But bank will benefit long-term from tax reform; judge says accounting firm failed to detect mortgage fraud that did in Colonial Bank.

January 2