-

United Federal Credit Union plans to enter the state through a merger next year, and that could be a problem for Keystone-state banks and credit unions that are already struggling to grow.

December 4 -

As CEO, Gary Fukuroku has helped turn the Hawaiian-based institution into one of the largest in the state and has raised significant funds to help those affected by this year's wildfires.

November 15 -

Credit unions are seeing tepid growth at best, due in part to banks using online offerings to win over consumers.

October 18 -

The National Credit Union Administration approved Dade County Federal Credit Union's application to add almost 2 million potential members — giving it a total field of membership of 4.6 million. It's the largest-ever community charter expansion in terms of total resulting potential members.

August 25 -

Critics slam their proposed reach as unfair competition.

August 10 -

A hefty advertising budget combined with a worldwide pool of potential members has now pushed Navy FCU beyond the 13 million-member mark, substantially larger than its nearest competitors.

July 25 -

The state where the first U.S. credit union opened in 1909 reported fewer members in the first quarter compared to a year earlier, due in part to the competitive threat from banks.

June 20 -

State legislators plan to allow credit unions to serve more people below the poverty line, including those living in banking deserts, but the state's banks say the credit unions could use the legislation to dodge field-of-membership limits.

May 8 -

Centric Federal Credit Union, which previously covered only Ouachita and Lincoln parishes in north Louisiana, has received regulatory approval to add an additional 26 parishes and counties in its home state and neighboring Arkansas.

February 23 -

The National Credit Union Administration proposed a rule that would, among other changes, allow remote workers to join credit unions in their employer's market.

February 21 -

In a state where two-thirds of residents use a credit union, a growing populace translates to even more membership, employment and loan growth with those institutions, according to data from the National Credit Union Administration.

January 23 -

Regulators are calling for creative alternatives to the arduous de novo process. Pairing groups that want to open credit unions with lagging institutions would be quicker and could help preserve the sector, one credit union service organization says.

August 27 -

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21 -

The Michigan-based institution has positioned itself for additional growth by making it easier to qualify for membership.

April 13 -

Regulators have approved the credit union's request to add 477 underserved census tracts to its field of membership, allowing it to reach roughly 2.5 million consumers.

April 8 -

A plan to make expansion easier for credit unions is getting pushback not just from bankers, but also from the regulator's current chairman and a former board member.

February 12 -

The Flint-based credit union is the state's third in just over one year to get the OK for an expansion allowing anyone who lives or works in the state to join.

February 3 -

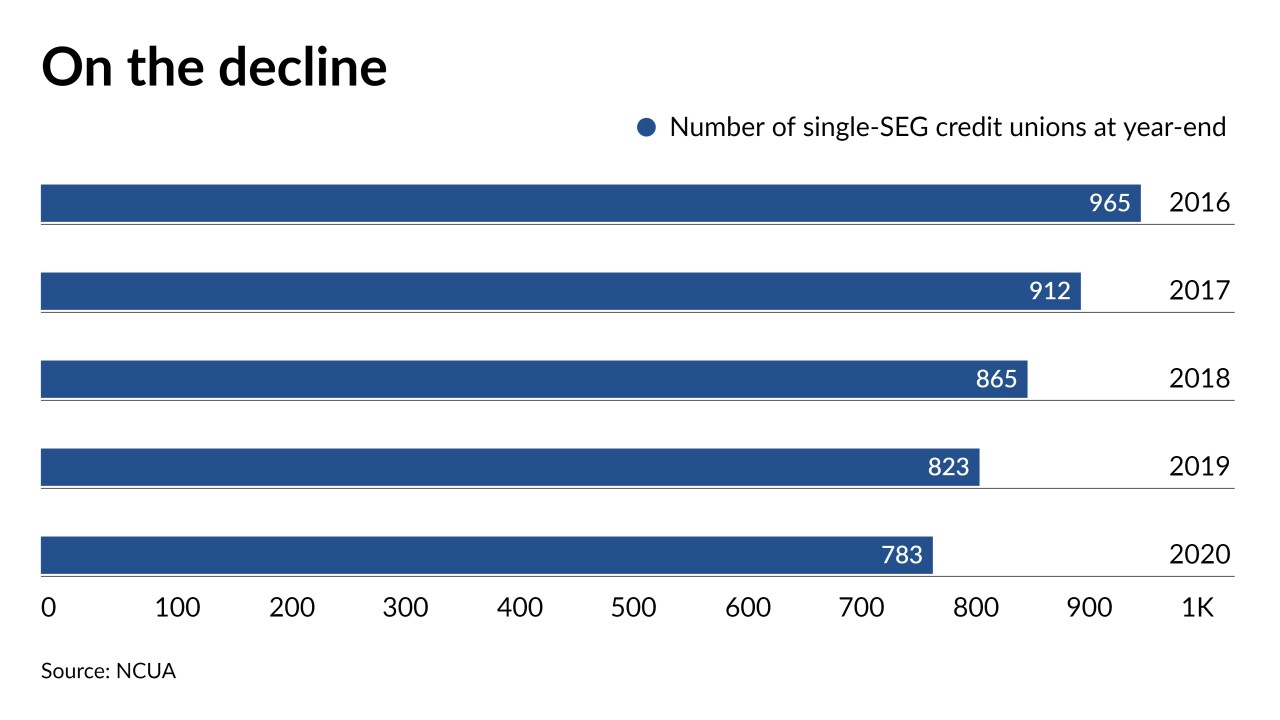

Industry groups say the coronavirus has highlighted additional risks faced by institutions without a diverse member base.

January 12 -

In a letter to credit unions, NCUA urged federally chartered shops to expand their fields of membership to underserved areas, regardless of geography, in order to boost financial inclusion in the wake of the pandemic.

January 8