-

Federal Reserve Gov. Lisa Cook said in a speech Monday the central bank is monitoring record highs in the stock market to see if it proves to be a bubble.

March 25 -

A key bank stock index ticked up after the Federal Reserve hinted that it could lower rates later this year. But there are still a number of economic uncertainties that are holding shareholders back.

March 20 -

A trio of Republican Congressmen stated they will investigate how the program got fast-tracked by the Biden Administration.

March 19 -

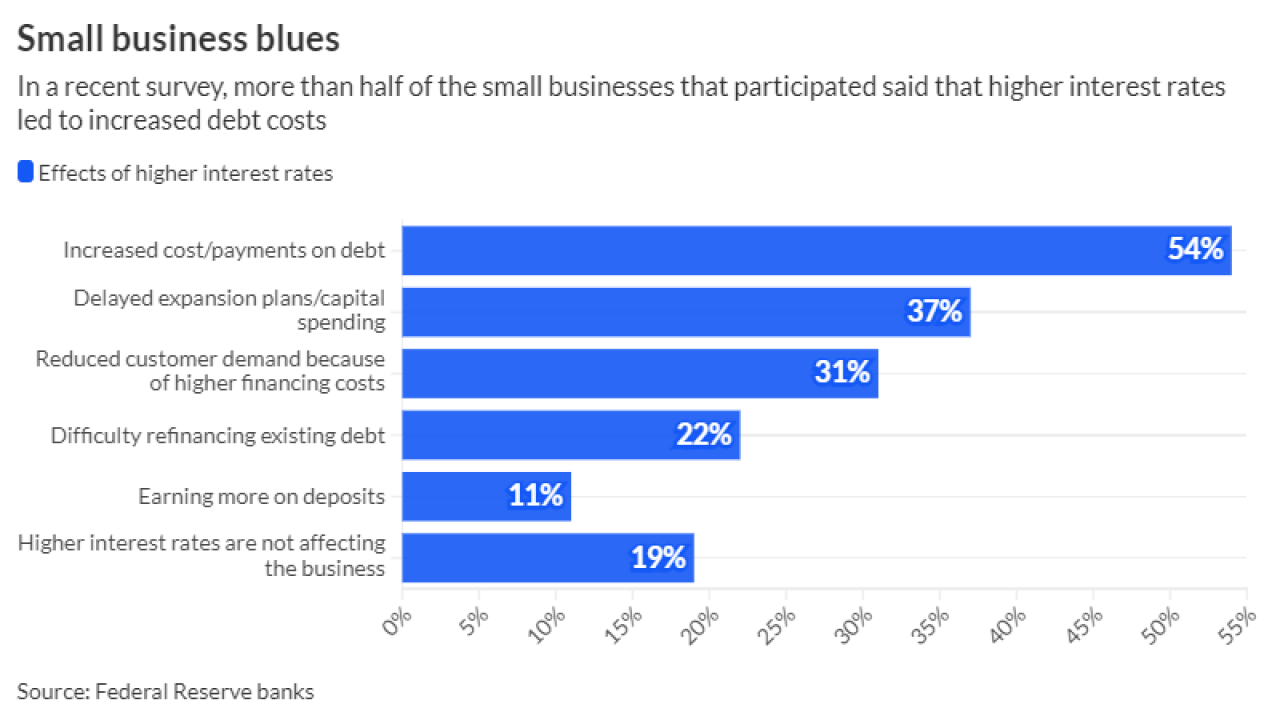

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18 -

Investing in Main Street Act has passed the House three times with overwhelming majorities but has failed to gain traction in the Senate. Backers, including banks that invest in the funds, hope to flip the script with a third version.

March 18 -

Peapack-Gladstone's wealth unit is pursuing an ambitious de novo expansion in New York and perhaps elsewhere because M&A has become expensive as private equity money has inflated seller expectations.

March 13 -

Midsize lenders have largely defied the most dire predictions following Silicon Valley Bank's demise. But the nation's largest banks still have structural advantages, and the regionals remain hampered by their real-estate heavy portfolios and the continuing impact of high interest rates.

March 11 -

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

March 11 -

Here's how the former regulator thinks Fannie Mae and Freddie Mac could exit conservatorship and where he sees the residential market headed this year and next.

March 8 -

MoneyLion saw continued financial growth in 2023, achieving four straight quarters of positive earnings. In 2024, it plans to develop a partnership with EY to bolster its enterprise services.

March 7 -

Former Trump administration officials Steven Mnuchin and Joseph Otting are headlining an investment group that's seeking to rescue the troubled Long Island lender. Otting is expected to serve as CEO, and Mnuchin will have a board seat.

March 6 -

Contenders see plenty of room for the market of EFTS investing in CLOs to grow. The question is if they can potentially usurp some of banks' dominance in AAA-tranche investing.

March 5 -

The fintech has grown its way into the black for the first time since going public in January 2022, CEO Jason Wilk says, capitalizing on AI-underwritten cash advances of up to $500.

March 5 -

The bank has also hired some analysts to its infrastructure group over the past several weeks as it plans to beef up its muni team.

March 4 -

Federal Reserve Governor Christopher Waller said he'd like to see the central bank's holdings of mortgage-backed securities go to zero.

March 1 -

The Toronto bank has been under investigation by U.S. and Canadian supervisors for alleged shortcomings in anti-money-laundering compliance. CEO Bharat Masrani pledged "comprehensive enhancements" but declined to pinpoint the exact fixes and their costs.

February 29 -

The changes made to the schedule of bringing advanced credit metrics to major mortgage investors Fannie Mae and Freddie Mac affect bi-merged reports and Vantagescore 4.0's implementation.

February 29 -

Citing missed deadlines for an annual meeting and key regulatory filing, the Norcross-Braca group has called off a plan to invest $35 million in the Philadelphia bank.

February 29 -

Canadian Imperial Bank of Commerce benefited from growth in its domestic retail business even as it set aside more money than analysts expected for potentially sour loans.

February 29 -

The proposed capital rule risks driving borrowers away from the traditional banking industry and into the arms of shadow banks, whose support during stressful times can be fleeting.

February 29 The University of Chicago, Booth School of Business

The University of Chicago, Booth School of Business