-

Sen.-elect Kyrsten Sinema, D-Ariz., and Sen. Tina Smith, D-Minn., will join the panel as their caucus loses two other committee members who suffered election defeats.

December 13 -

Synovus has given CFO Kevin Blair the additional title of COO. He will oversee three business lines, plus tech, operations and product and treasury management.

December 12 -

Millyard Bank aims to become the state's second post-crisis de novo. Primary Bank opened in 2015.

December 12 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

Associated will gain low-cost deposits and branches in 13 new markets after the deal closes.

December 11 -

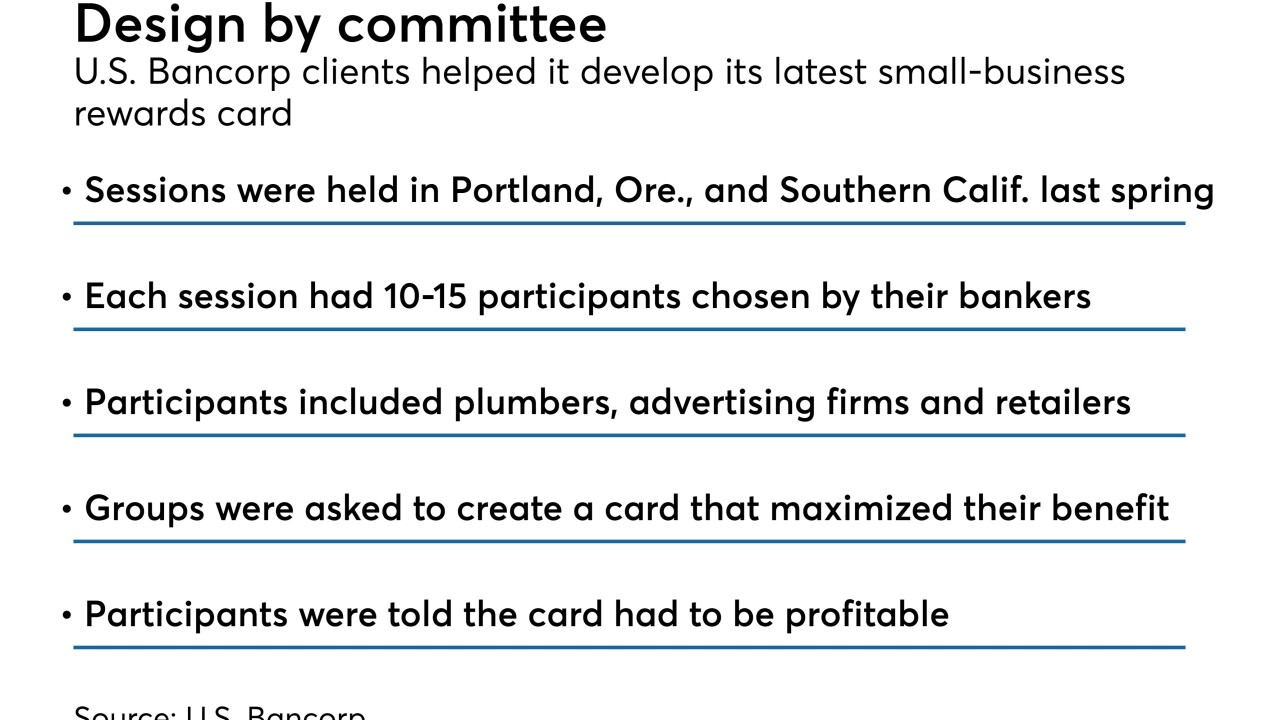

The regional bank is working with customers to help develop and launch new products, including a small-business credit card.

December 7 -

Readers sound off on the CFPB's name change, whether the Post Office should be allowed to engage in banking services and the FDIC's call to revamp the de novo process.

December 6 -

Men on Wall Street take a cue from Vice President Mike Pence in refusing to dine one-on-one with women; Coinbase adds fertility benefits; and the CFPB has a new leader. Plus, Bank of America's Katy Knox gets promoted.

December 6

-

The agency's request for comment about the deposit insurance application process is among a series of actions aimed at streamlining charter applications.

December 6 -

The CFPB ordered Village Capital & Investment in Henderson, Nev., to issue refunds and pay a penalty for allegedly misrepresenting the cost savings in a refi product.

December 6 -

A pipeline of new banks is critical to the long-term health of the industry and communities across the country, argues FDIC Chairman Jelena McWilliams.

December 6 Federal Deposit Insurance Corp.

Federal Deposit Insurance Corp. -

Organizers of Community Bank of the Carolinas still need to raise $25 million and secure approval from the state's banking commissioner.

December 6 -

Speaking at an investor conference Wednesday, John Turner said that sellers’ asking prices are too high and that Regions would prefer to buy a nonbank that could help boost fee income.

December 5 -

Murals on the walls and pizza parties are just a couple of ways Studio Bank is trying to court music and entertainment clients as part of a broader niche-lending strategy.

December 4 -

Big-bank execs downplayed gloomy economic forecasts and said a commercial lending rally, niche M&A and smart tech spending will drive growth in 2019.

December 4 -

Our Best in Banking honorees for 2018 share some of the smartest bits of advice and blows from the school of hard knocks that they've received over the years — and who (or what) supplied them.

December 2 -

The federal regulator cited recent “cost savings” and promising projections for costs and revenue next year in announcing the reduction in assessments.

November 30 -

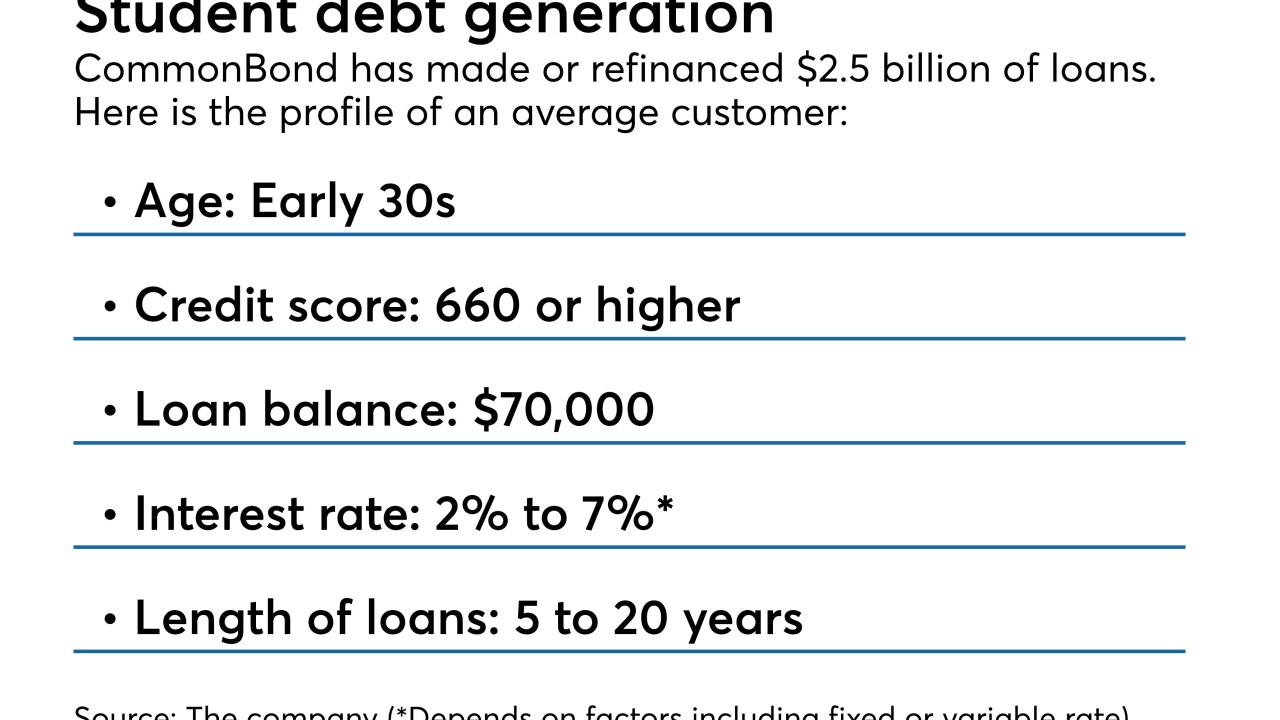

The Midwest regional recently announced a referral partnership with the fintech lender CommonBond. By offering customers an option to refinance student loans at more favorable terms, the bank is hoping to cultivate their loyalty.

November 30 -

The new CEO is trapped in the same feedback loop of negative news, rising funding costs and declining revenue that foiled his predecessor.

November 30 -

Building alliances with startups is the most affordable route for community banks that want to offer innovative services, but industry officials cautioned that they must be balanced with smart internal investments, too.

November 29