-

The tight labor market and public pressure to raise minimum wages are expected to nudge noninterest expenses upward in a year when the watchword is cost control.

February 13 -

Ed Skyler, the bank's global head of public affairs, says a newly established $150 million fund will make equity investments in firms seen as having a positive impact on society.

February 10 -

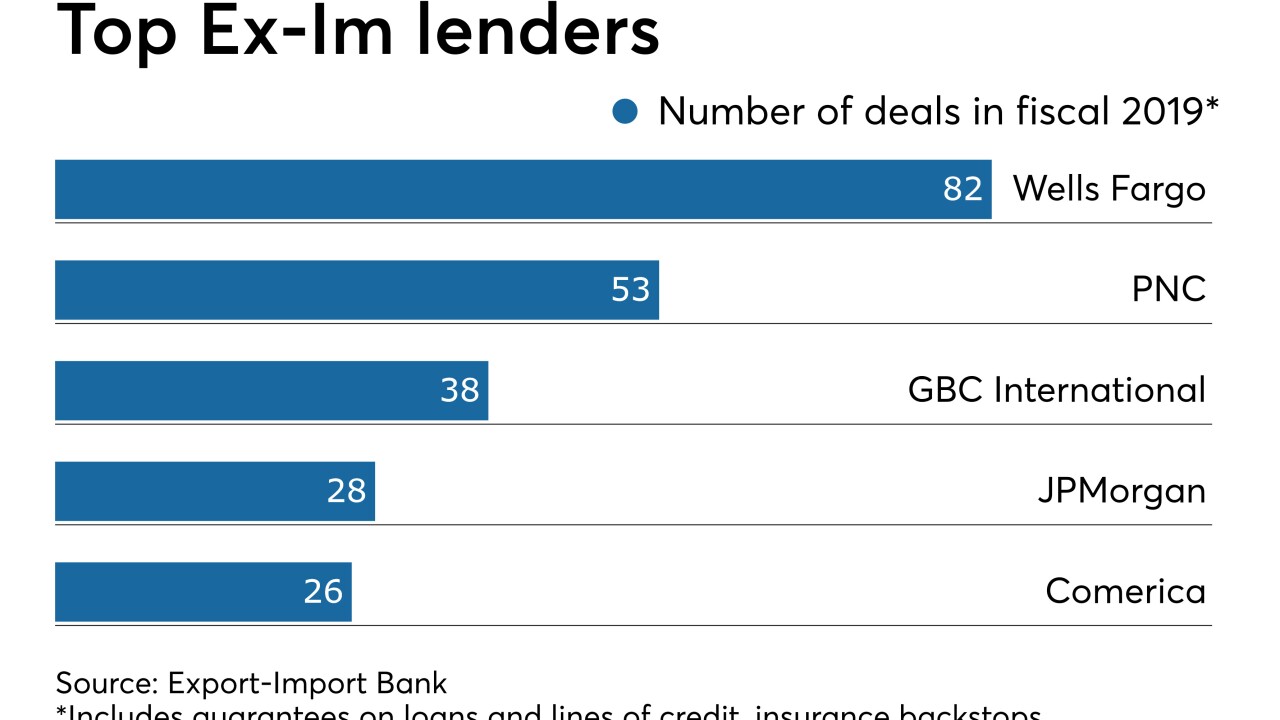

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

JPMorgan Chase gave its chairman and CEO a 1.6% hike in total compensation in 2019 after a second consecutive year of record profits.

January 23 -

The central bank is aiming to finish a rule creating a streamlined capital buffer ahead of the upcoming round of stress testing, but industry experts say that timeline may be too ambitious.

January 16 -

The country's biggest bank is leaning more on fee income to offset rate pressures, expanding in selected U.S. cities and laying the groundwork for operations in China that CEO Jamie Dimon hopes will endure “for 100 years.”

January 14 -

Stateside banks are starting to play catch-up to banks worldwide that are incorporating environmental, social and governance factors into their underwriting. Pressure from big shareholders is a driving force.

January 13 -

The effort is part of a push by interim Chief Executive Officer Noel Quinn to cut costs at Europe’s largest lender by assets.

January 10 -

Morgan Stanley is the latest firm to make a year-end efficiency push, eliminating about 1,500 jobs, according to people familiar with the matter.

December 27 -

The Federal Reserve and Federal Deposit Insurance Corp. found issues with the firms' ability to compile data on how they would be unwound during a period of financial stress.

December 17