-

Forget China for U.S. banks, Canada carries more weight. Canada's energy-led recession looks harmless for now, but the tight connections between Canada and American banks make it potentially dangerous if it becomes prolonged.

September 4 -

Wells Fargo has named Michael DeVito head of mortgage production, making him responsible for its retail and correspondent lending divisions.

September 3 -

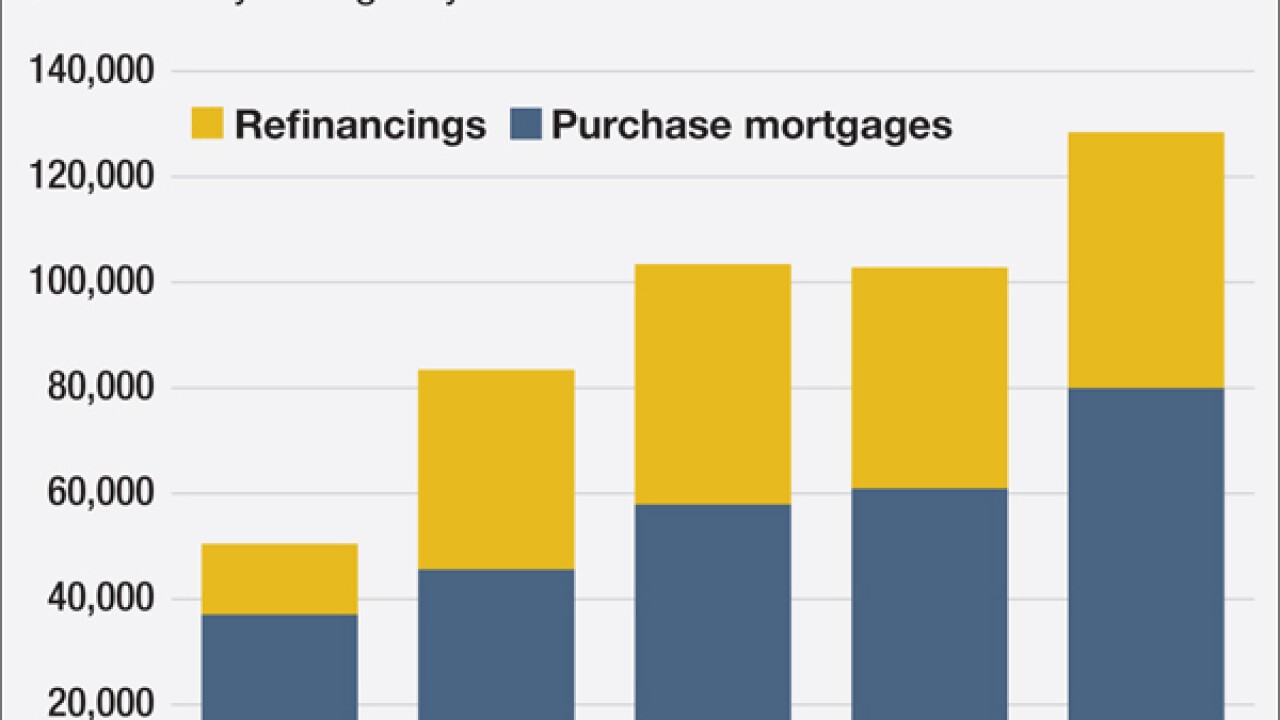

The Home Mortgage Disclosure Act data set to be released in the next few weeks will offer new proof that mortgage lending activity was stronger than expected last year. That fresh data, the likely delay in Fed action on rates and other factors could prompt higher volume estimates for 2015.

September 2 -

More than half of real estate agents are planning to extend their sales contracts to provide more time for the closing processing due to the coming implementation of new mortgage disclosures.

September 1 -

Marketplace lenders seek to disrupt traditional financial services with online platforms that connect borrowers to investors. But in real estate, this burgeoning sector has taken an approach that seeks to coexist with, rather than supplant, the traditional mortgage market.

September 1 -

Walter Investment Management has received approval from Freddie Mac to hold the mortgage servicing rights on $3.3 billion in residential mortgage loans.

August 27 -

The Federal Housing Administration has resolved a long-standing conflict with municipalities and private companies that back "green energy" loans that is expected to benefit banks and other mortgage lenders. The next question is whether the regulator of Fannie Mae and Freddie Mac mortgages will do the same.

August 25 -

Fannie Mae is revamping its affordable mortgage program to make it easier for low- and moderate-income families to qualify for low-down-payment loans.

August 25 -

Loans to first-time homeowners and others with low credit scores are a big part of the Federal Housing Administration's growth in purchase mortgages since the agency cut premiums.

August 25 -

Stock fluctuations will fuel investment banking fees in the short run, but a prolonged shock would complicate bank M&A and could tighten margins, crimp wealth management fees and present other risks.

August 24