-

The Home Mortgage Disclosure Act data set to be released in the next few weeks will offer new proof that mortgage lending activity was stronger than expected last year. That fresh data, the likely delay in Fed action on rates and other factors could prompt higher volume estimates for 2015.

September 2 -

More than half of real estate agents are planning to extend their sales contracts to provide more time for the closing processing due to the coming implementation of new mortgage disclosures.

September 1 -

Marketplace lenders seek to disrupt traditional financial services with online platforms that connect borrowers to investors. But in real estate, this burgeoning sector has taken an approach that seeks to coexist with, rather than supplant, the traditional mortgage market.

September 1 -

Walter Investment Management has received approval from Freddie Mac to hold the mortgage servicing rights on $3.3 billion in residential mortgage loans.

August 27 -

The Federal Housing Administration has resolved a long-standing conflict with municipalities and private companies that back "green energy" loans that is expected to benefit banks and other mortgage lenders. The next question is whether the regulator of Fannie Mae and Freddie Mac mortgages will do the same.

August 25 -

Fannie Mae is revamping its affordable mortgage program to make it easier for low- and moderate-income families to qualify for low-down-payment loans.

August 25 -

Loans to first-time homeowners and others with low credit scores are a big part of the Federal Housing Administration's growth in purchase mortgages since the agency cut premiums.

August 25 -

Stock fluctuations will fuel investment banking fees in the short run, but a prolonged shock would complicate bank M&A and could tighten margins, crimp wealth management fees and present other risks.

August 24 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and from our social media platforms.

August 21 -

DotLoop, the tech startup Zillow just bought, takes the headaches and duplication out of managing real estate documents up until the hardest part of the transaction, the mortgage. Expanding into mortgages is possible, but would be tricky.

August 20 -

Banks have ramped up foreclosure activity in the past five months, with default notices, scheduled auctions and bank repossessions at their highest levels in two years. It's a positive sign that banks are finally clearing out all the distressed loans still lingering from the housing crisis. Meanwhile, banks remain cautious about new lending, partly because of regulatory actions.

August 20 -

There's nothing like a natural disaster to make people realize how important insurance is to the banking industry.

August 20

-

Bank repossessions of distressed homes hit a 30-month high in July, as financial institutions continue to work through the backlog of bubble-era loans.

August 20 -

WASHINGTON The Federal Housing Finance Agency on Wednesday officially increased the target for loans purchased by Fannie Mae and Freddie Mac that benefit affordable housing, but the uptick is not satisfying housing advocates.

August 19 -

New Supplemental Performance Metric should encourage lenders serve lower credit scores borrowers.

August 17 -

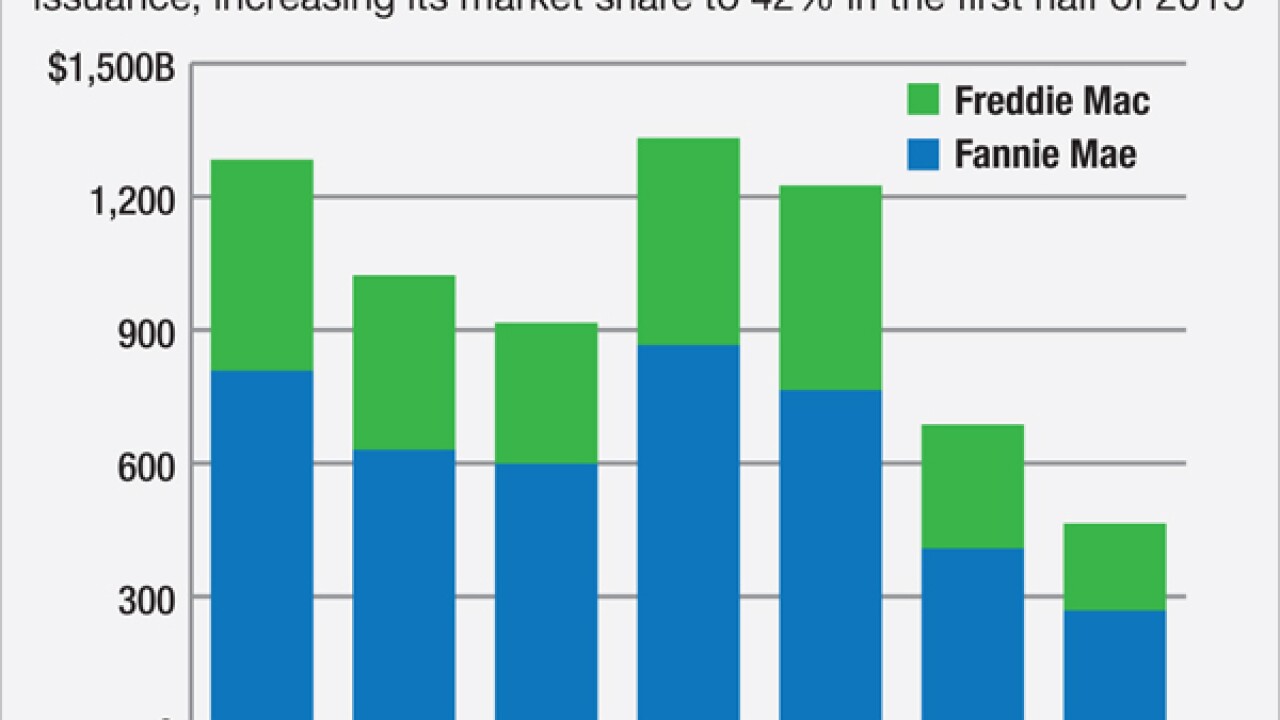

Fannie Mae and Freddie Mac have a regulatory mandate to shrink. But that's easier said than done, given the GSEs' outsized presence in the mortgage industry, as their latest quarterly results show.

August 17 -

WASHINGTON Four more Federal Home Loan Banks have won regulatory approval to participate in a program that allows member institutions to sell jumbo mortgage loans through a conduit to Redwood Trust.

August 14 -

Banks that sold faulty mortgage-backed securities right before the crisis have suffered a string of legal defeats over the timing of government lawsuits, but some experts believe the industry may still have a shot in the Supreme Court.

August 14 -

In 1979, mortgage bankers worried that they could be undercut by "sleeping giants" like Merrill Lynch, Sears Roebuck and what was then called Master Charge.

August 14

-

Just 8% of U.S. mortgage origination volume in the second quarter went to borrowers with subprime credit scores, according to new research by the New York Fed. The findings suggest that mortgage standards have loosened only slightly, if at all.

August 13