-

In 1979, mortgage bankers worried that they could be undercut by "sleeping giants" like Merrill Lynch, Sears Roebuck and what was then called Master Charge.

August 14

-

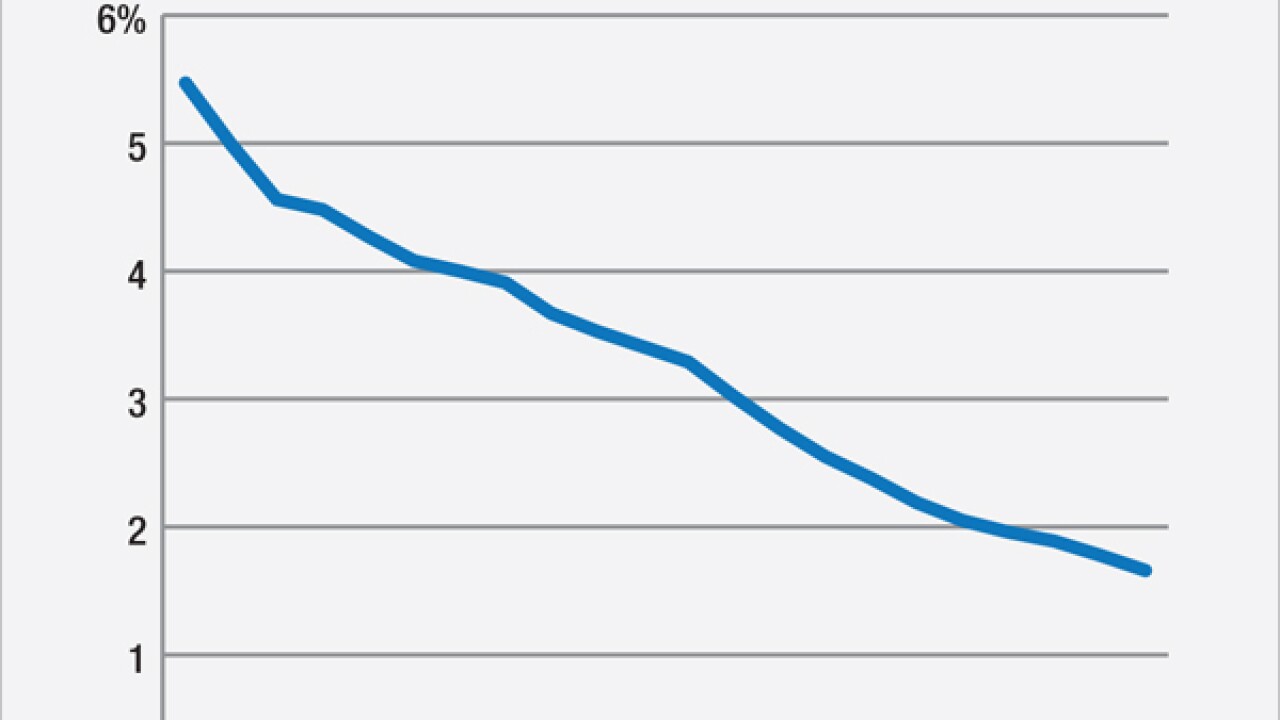

Just 8% of U.S. mortgage origination volume in the second quarter went to borrowers with subprime credit scores, according to new research by the New York Fed. The findings suggest that mortgage standards have loosened only slightly, if at all.

August 13 -

The Federal Housing Finance Agency is expected to issue a proposal soon that would require Fannie Mae and Freddie Mac to purchase manufactured housing loans from lenders.

August 13 -

Homeownership is out of reach for too many Americans. The next president could change that with a few simple policies aimed at encouraging private capital to invest in residential mortgages.

August 13

-

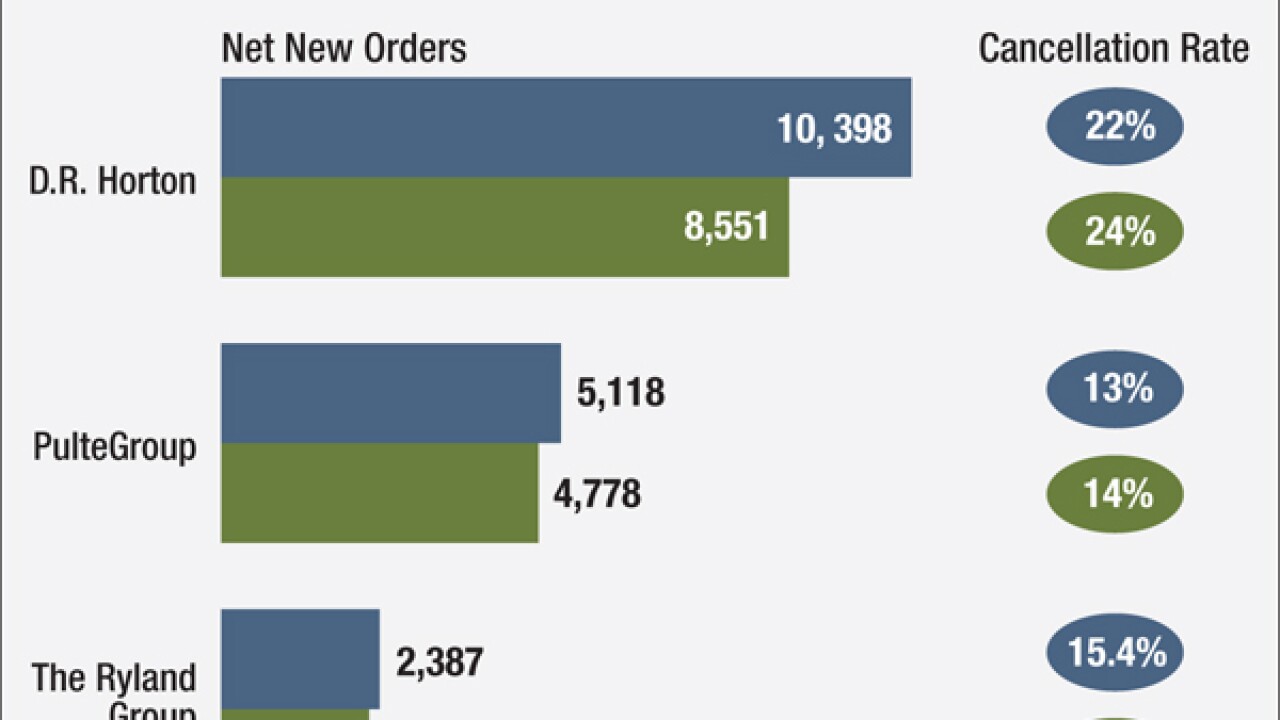

Consumers' growing confidence about their ability to qualify for a mortgage is generating more foot traffic, sales orders and loan volume for some of the nation's largest homebuilders.

August 12 -

Ocwen Financial's internal review group is "independent," and the Atlanta servicer is in compliance with the national mortgage settlement, settlement monitor Joseph A. Smith said Tuesday.

August 11 -

A federal judge has overturned a New York City law that would have required banks to make new disclosures regarding their investments in local communities.

August 10 -

The New York Bankers Association is challenging the legality of a local law that is designed to cajole banks into making larger investments in poorer communities. The outcome could be an important precedent in relation to similar laws in other cities.

August 6 -

Despite being introduced to the market with great fanfare, Fannie Mae's 3% down payment mortgage offering has yet to gain much traction with lenders and consumers.

August 6 -

M&T Bank said it's in discussions with U.S. officials to settle an investigation into the lender's origination and sale of federally insured home loans.

August 6