-

Most real estate agents and home builders have heard about the new mortgage disclosures that take effect Oct. 1 but are light on the details, and many of the lenders they rely on lack sufficient understanding to help them.

August 3 -

Signs of optimism are growing for acquisition, development and construction loans as banks hone strategies in a market transformed by the crisis.

July 27 -

By targeting construction lending, 1st Financial Bank USA aims to expand beyond its hefty concentration in credit card loans while entering a business segment that has shrunk mightily since the financial crisis.

January 9

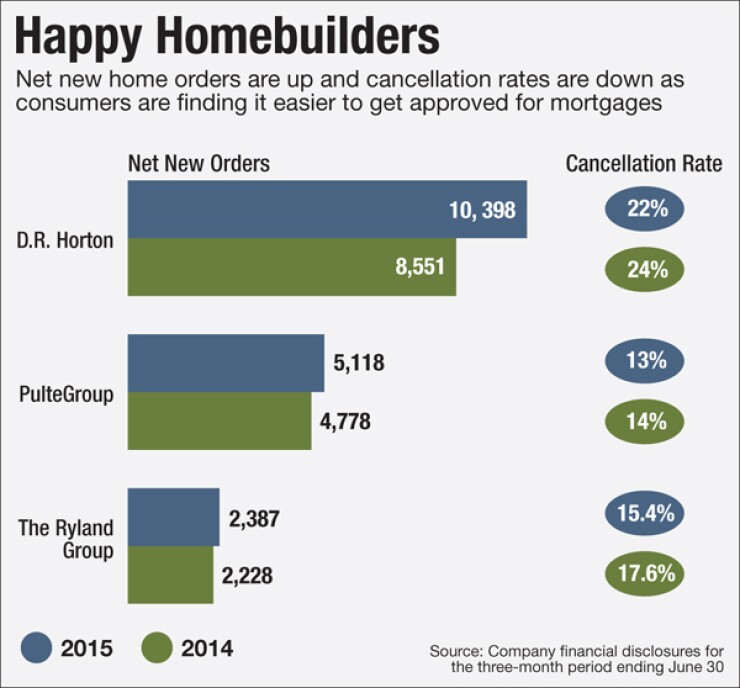

Consumers' growing confidence about their ability to qualify for a mortgage is generating more foot traffic, sales orders and loan volume for some of the nation's largest homebuilders.

Even after the annual rate of new-home sales dropped 6.8% in June,

D.R. Horton is seeing more foot traffic at its model homes and buyers are "feeling better about their ability to qualify" for a mortgage, Jessica Hansen, vice president for communications, said during a recent conference call to discuss the builder's quarterly results.

D.R. Horton reported a 28% increase in homes closed during its fiscal-year third quarter ending June 30, compared to a year ago. In addition, the Fort Worth, Texas, builder saw a 33% increase in loans originated and brokered through it lending unit, DHI Mortgage.

The lending unit originated 5,100 mortgages during the quarter, up from 3,830 in the same period a year ago. The average credit score on Horton loans was 716.

Horton also saw a pickup in demand for Federal Housing Administration mortgages in line with its expanded offering of lower cost, entry-level homes. FHA-insured loans comprised 31% of loan volume, compared to 24% a year ago, when Horton was in the rollout stage of its entry-level Express Homes brand.

"I think what you are seeing is an impact of pricing getting more favorable on FHA, coupled with a higher share of Express Homes," Hansen said. Horton sold 1,975 Express Homes in the fiscal third quarter, up from 800 in its first quarter that ended Dec. 31, 2014. The average selling price on an Express Home is $188,000.

Pretax income from Horton's financial services activities jumped 140% to $31.7 million in the third quarter from $13.2 million a year ago. DHI Mortgage sells almost all of its loan production. As of June 30, the outstanding principal balance of mortgages held for sale totaled $557.5 million.

While most sales orders are canceled because the buyer can't qualify for a mortgage, nearly 80% of Horton homebuyers are qualifying for mortgages today. "Our cancellation rate has settled into the low 20s," Hansen said. It has declined to 22% from 24% a year ago.

While the cancellation rates of competitors like The Ryland Group and PulteGroup are in the midteens, Hansen said Horton's rate is "not unusually high or something we're uncomfortable with."

Overall, D.R. Horton had 10,400 new sales orders in the third quarter ending June 30, up 21% from the same quarter a year ago. As of June 30, Horton also had a huge backlog of sale orders.

"With a sales backlog of 12,710 homes at the end of June, solid sales trends in July and a well-stocked supply of land, lots and homes, we are well positioned to end the year strong and have an even stronger 2016," said chairman Donald R. Horton.

PulteGroup, another publicly traded builder, has a well-established first-time homebuyer brand called Centex. The average price of a Centex Home was $214,000 in the second quarter ending June 30.

The Atlanta-based builder completed 3,744 home sales in the second quarter and 24%, or 898 closings, were Centex Homes.

However, Pulte Mortgage didn't see a pickup in FHA lending. During the first half of this year, 11% of loans originated by Pulte were FHA loans, compared to 12% of originations in the same period a year ago. The share of conventional (Fannie/Freddie) loans was unchanged at 70%.

Pulte Seeks Millennials in Urban Settings

"Pulte is increasing its focus on the entry-level buyer and millennials," said Richard Dugas, chairman, president and chief executive of PulteGroup, during a conference call July 23.

But he said the traditional view of an entry-level consumer buying their first home in their mid-20s is changing.

"In fact we are seeing a lot of people actually skip the Centex entry-level product at $200,000 and buy a Pulte brand home at $300,000 in their early- or mid-30s." Centex sales slipped 7% in the most recent quarter.

The Pulte brand was originally designed for the buyer looking to move up, and out, in the suburbs. However, the builder is breaking ground at urban infill sites to reach the "upwardly mobile millennial buyer," Dugas said. The PulteGroup also has its upscale Del Webb brand, which is targeted at active baby boomers.

PulteMortgage originated 2,507 loans in the second quarter of 2015, up just 1.5% from a year ago. It still reported $10 million in pretax income from the mortgage unit, up 11% from a year ago.

During 2014, The Ryland Group built 33% of its homes for entry-level buyers. But that slipped to 28% during the first half of this year.

Ryland president and chief executive Larry Nicholson expects entry-level buyer activity will account for 25% to 30% of sales going forward. And he expects demand will pick up as millennials move into the market.

"It is just hard to predict when they are coming in, but that will be a big buyer segment going forward," he said during a July 30 conference call. His company completed the sale of 1,814 homes in the second quarter, up 7% from a year ago.

Ryland Expects TRID Will Give Its Mortgage Unit an Edge

Ryland Mortgage Co. financed nearly two-thirds of the builder's customers that needed a mortgage. Its recapture rate rose five percentage points over the past four quarters to 65% as of June 30. Ryland executives expect their recapture rate will rise after the new integrated mortgage disclosures known as TRID take effect this October.

Currently, closings are delayed because small outside lenders don't respond in a timely manner, Nicholson said. TRID will make the process more complex, and the CEO expects homebuyers will choose the most efficient processors for closings. "I think that will be a selling point to the customers of our mortgage company going forward," Nicholson said.

The Ryland Group reported 2,387 new sales orders in the second quarter, up 7% from year ago, and a backlog of 4,116 new orders, up 6.4%. It marks the highest number of new orders and backlog for the West Lake Village, Calif.-based builder since 2007.

RMC originated 1,053 loans in the second quarter, up 26% from a year ago. It had $129.8 million in mortgages held for sale as of June 30. The average FICO score on 2Q loans was 729.

Overall, Ryland's financial services unit posted $8.8 million in pretax earnings, compared to a $1.9 million loss in 2Q 2014. The loss resulted from a $5.8 million charge due to a settlement regarding loans RMC sold to Countrywide Home Loans.

Later this year, The Ryland Group expects to close a planned merger with Southern California-based homebuilder Standard Pacific. The combined company will be called CalAtlantic Group and trade on the New York Stock Exchange under the ticker symbol CAA. Its primary brands will be called CalAtlantic Homes, CalAtlantic Mortgage, CalAtlantic Title and CalAtlantic Insurance.