-

The deal for the Salt Lake City-based home improvement lender, which Home Depot tried to acquire more than a decade ago, is part of a larger effort by Regions Financial to diversify its home lending business.

June 8 -

During a House Financial Services Committee hearing, Democrats largely praised the policy decisions of acting regulators named by the Biden administration and knocked their predecessors. But Republicans warned that moves to reverse Trump-era policies would leave financial institutions without a clear road map.

May 19 -

The industry has raised concerns about nontraditional bank owners, and some lawmakers have backed limits for industrial loan companies and cryptocurrency firms. But members of the House and Senate have been unable to reach a consensus on legislation.

May 4 -

The Senate Banking Committee chairman told an audience of community bankers that he supports legislation to close "chartering loopholes" for industrial loan companies and financial technology firms. He also pitched a plan to give all consumers a free digital wallet backed by the Federal Reserve.

April 27 -

Brian Milton, who ran MUFG Union's digital bank, was named head of banking and would become CEO of Thrivent Bank, which plans to have a digitally focused platform and operate as an industrial loan company.

March 3 -

The payment processing company will offer loans and deposit accounts to its small-business customers through a Utah-based industrial bank.

March 1 -

The Fortune 500 conglomerate has had discussions about merging Thrivent Credit Union, which operates independently of the company, into the bank if the charter is approved.

February 24 -

Brex currently relies on bank partners to offer credit cards and cash management accounts to small and midsize businesses. It is looking to charter its own FDIC-insured institution to be a direct provider.

February 19 -

The Detroit automaker says it will stick to car loans and steer clear of mortgage lending if regulators approve its application to establish an industrial bank.

December 17 -

The agency's principals are scheduled to meet Dec. 15 to vote on a new definition for brokered deposits and on regulatory standards for industrial bank parents.

December 11 -

The automaker is reportedly planning to apply for a bank charter so it could collect deposits and grow its own auto-finance business. That could create more competition for Ally, which was spun off from GM in 2006 but remains a key lending partner.

December 9 -

The success of some fintechs in getting bank charters this year only underscores how onerous the process remains for many others. That’s unlikely to change unless policymakers reconsider what it means to be a bank.

November 18 -

The e-commerce leader’s return to the drawing board alleviates immediate concerns about its banking plans. But the company intends to reapply, and it will be harder for the industry to persuade policymakers to block industrial loan companies more broadly.

August 26 -

The Japanese conglomerate first applied for deposit insurance in July 2019 and again in May 2020.

August 18 -

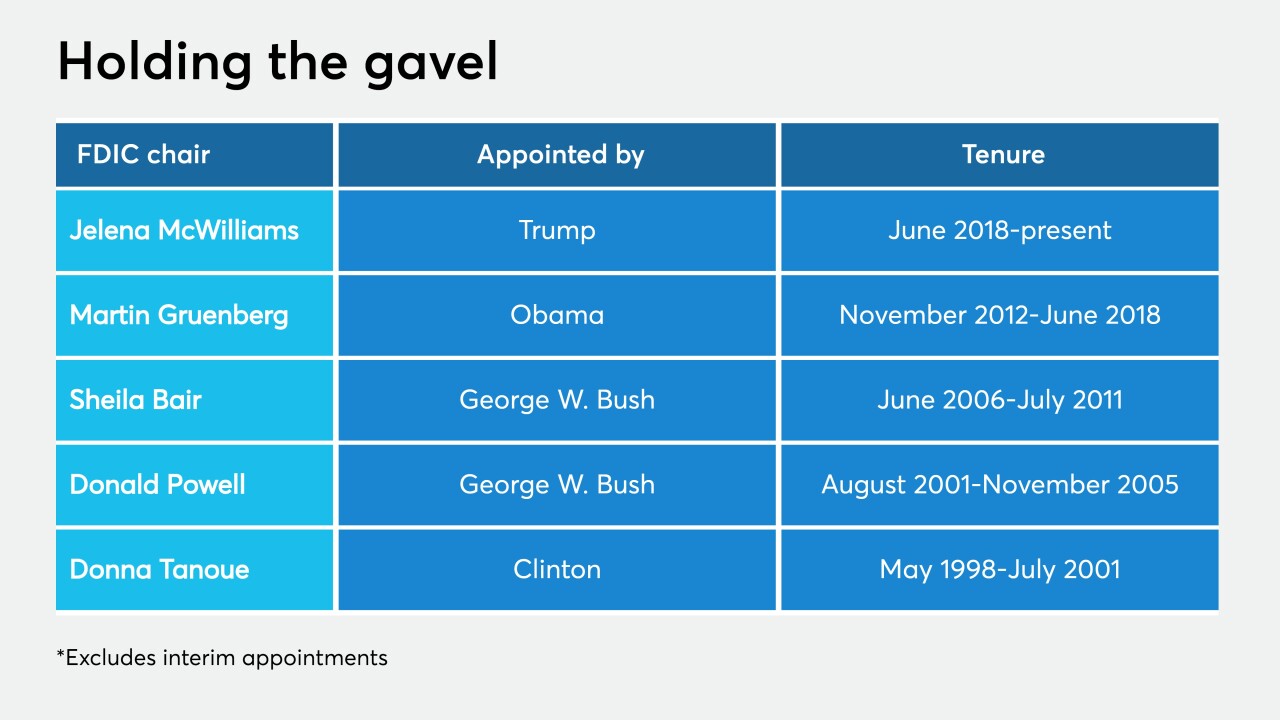

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

For too long, nonbanks have been allowed to form industrial loan companies to operate as banks without Fed oversight. This regulatory pass should not be given during a crisis.

July 31 Calvert Advisers LLC

Calvert Advisers LLC -

Two trade organizations and a consumer group urged lawmakers to establish a three-year moratorium to block the charter bids of companies that they said were attempting to skirt regulatory requirements.

July 29 -

New president of Promontory Interfinancial Network says recession will cause "hundreds" of nonbank disruptors to fail; lenders face dilemma over offering Main Street loans to noncustomers; PNC Financial expands, diversifies executive leadership team; and more from this week’s most-read stories.

July 11 -

If it’s approved, the charter is expected to lower the fintech’s cost of funds and allow for more product offerings. It comes nearly three years after SoFi pulled the plug on an earlier effort to open an industrial bank.

July 9 -

Small banks have long led the campaign against industrial loan companies, arguing they can be used to violate the separation of banking and commerce. But now the industry’s heavyweights are also taking a hard line in response to an FDIC proposal that would give tech companies a smoother path into the lending business.

July 6