-

The first commercial mortgage-backed security to comply with "skin in the game" requirements was extremely well received. Market participants credit the way the large banks sponsoring the deal retained the risk a strategy unavailable to nonbank lenders.

August 19 -

Arch U.S. MI's acquisition of United Guaranty Corp. will make one of the smallest private mortgage insurers the sector's new market leader. While the move is likely to ease pricing competition among the six remaining players, it's not expected to set off a wave of further consolidation.

August 16 -

United Community and Wells Fargo are among the banks building platforms to lend to senior-care facilities. Demographics suggest the business should grow significantly in coming years.

August 12 -

A Federal Housing Finance Agency rule that will force some members of the Federal Home Loan Bank System out next year is likely to have a material effect on several of the cooperative institutions.

August 11 -

Mortgage lenders can expand their businesses by catering to borrowers who aren't proficient in English, but doing so requires strategic recruiting and hiring and compliance with federal and state regulations.

August 11 -

The Inspector General of the Department of Housing and Urban Development has found a new ally in his fight to reform the down payment assistance programs run by HUD and state and local housing finance agencies.

August 8 -

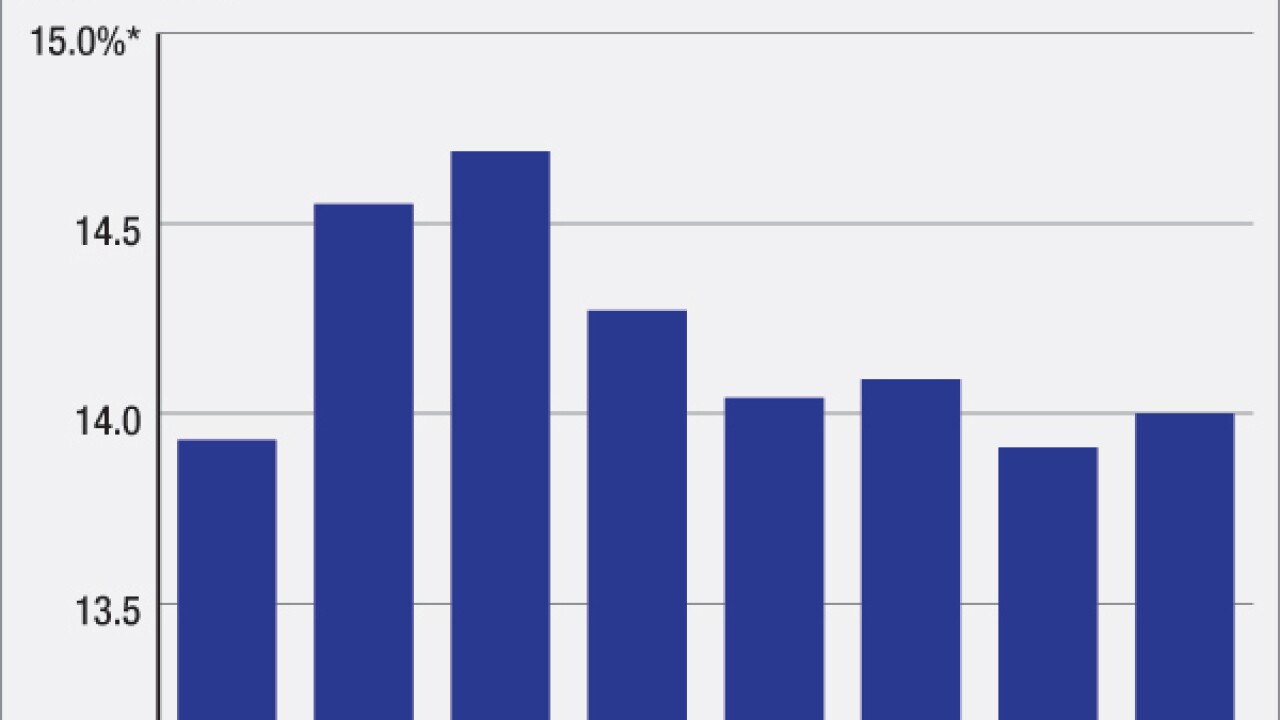

Under pressure from regulators to beef up risk management in commercial real estate lending, banks are using new software tools to improve analysis.

August 8 -

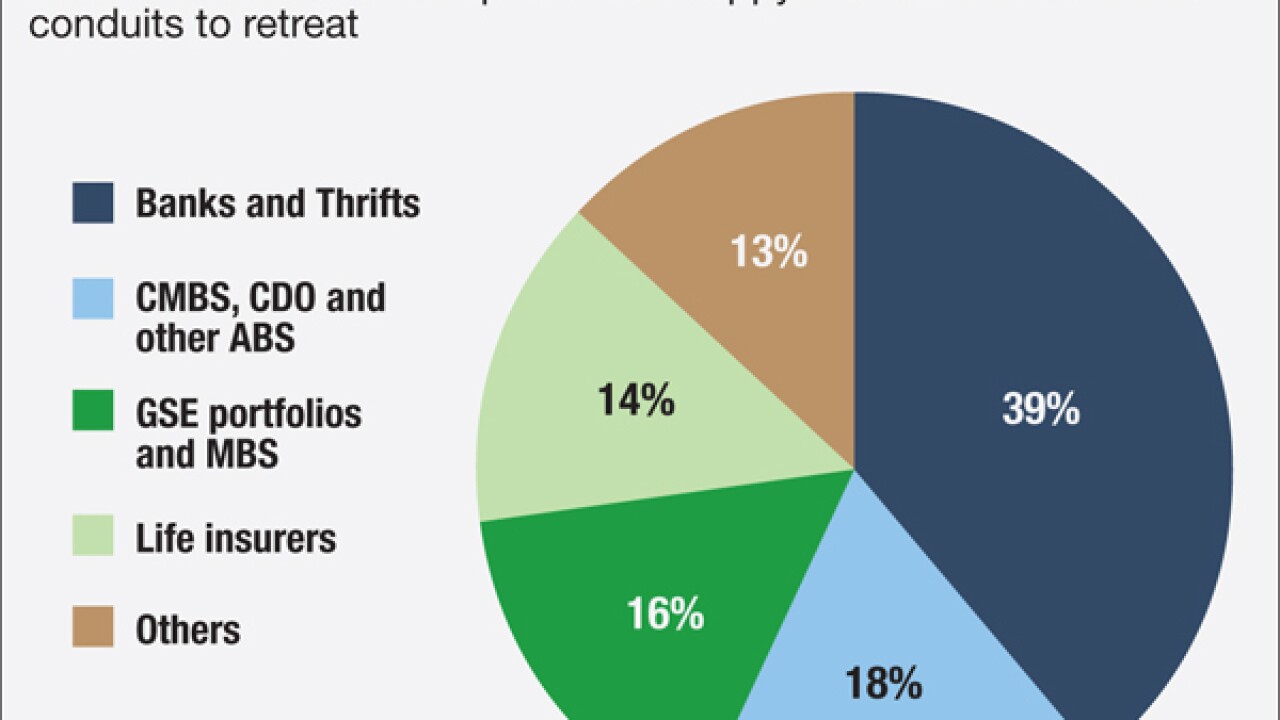

The biggest change in banking in the last 60 years is the shift in balance sheets from business lending to real estate finance and therefore more risk tied to volatile real estate prices.

August 8

-

Independent mortgage banking and brokerage firms added a whopping 5,900 fulltime employees to their payrolls in June, according to a report issued Friday by the Bureau of Labor Statistics.

August 5 -

Settlements related to court fights over private-label mortgage-backed securities are significantly boosting the bottom lines at a few Federal Home Loan banks.

August 4