-

The Alabama-based bank also said that its outlook for net interest income is brightening. Several other regional banks have offered similarly upbeat guidance in recent days.

July 19 -

Evergreen Money offers affluent savers both high returns and ready access to their money. The startup's founder, former PayPal CEO Bill Harris, says that increased regulatory scrutiny of bank-fintech partnerships is a positive development.

July 11 -

Higher funding costs, lower loan demand and the potential for increased credit costs continue to drag on the sector heading into second-quarter earnings season.

July 11 -

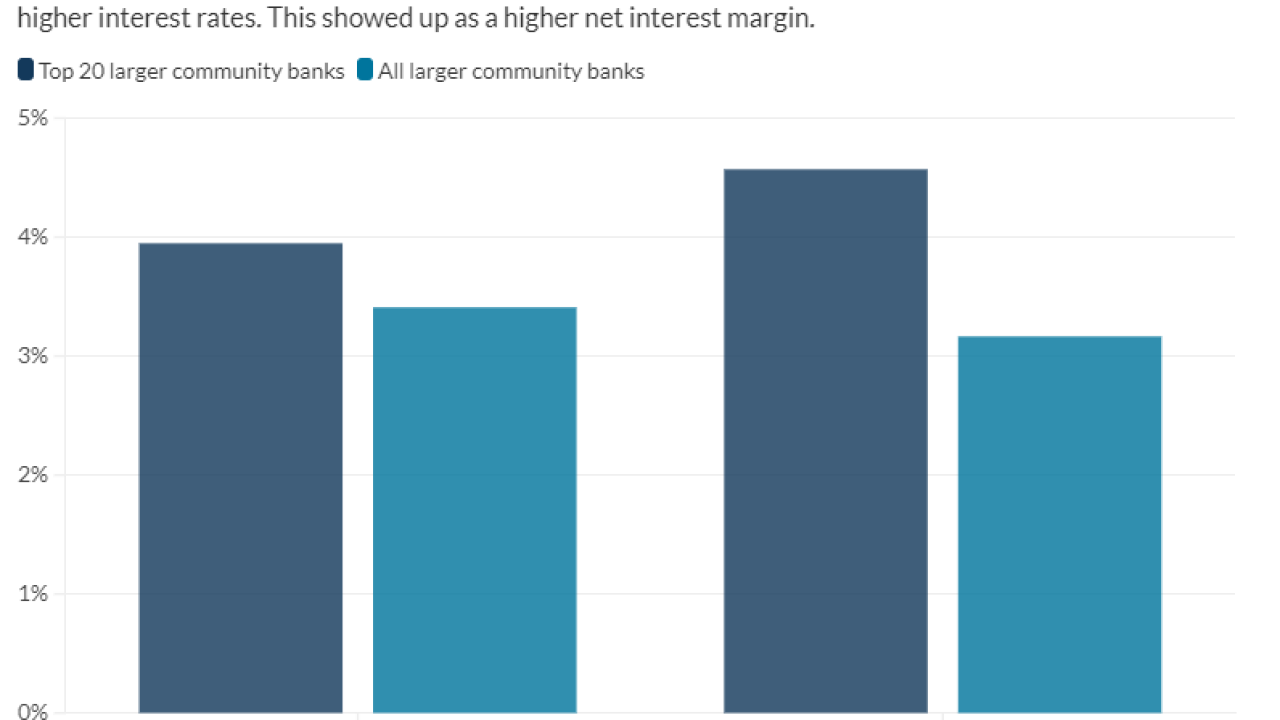

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

Though hard times put a dent in profitability, asset quality and net interest margin continued to shine among the list of the best performing publicly traded community banks.

June 9 -

Irvine-based CBC Bancorp's $121 million deal for Bay Community Bancorp in Oakland stands out at a time when high rates have put a damper on both the number of deals taking place and the multiples sellers are paying.

May 21 -

Bank stocks are up this year as interest rates have leveled off and there are hopes that pressure on lenders' profits could moderate.

May 8 -

Nearly 15 years ago, Les Lieberman and other organizers of Porticoes Capital used a shelf charter to buy a spate of failed banks. Now they're hoping to replay the strategy.

May 2 -

What's the point of regulatory capital rules that ignore demonstrated problems, like unrealized losses? We need to rethink what banks' disclose to investors and regulators.

May 2

-

Banks and other financial market participants have been keyed into the central bank's communications around monetary policy expectations. But in an unpredictable economy, the guidance doesn't always hit the mark.

April 29 -

The San Antonio-based bank said that loan growth, fueled in part by its expansion in key Texas markets, may compensate for pressure on deposits. It slashed the number of rate cuts it expects this year from five to two.

April 26 -

Brendon Falconer, finance chief of the Indiana company since 2019, faces felony child molestation charges. But CEO James Ryan says management is focused on the CapStar integration and organic growth.

April 23 -

The company reported $4.74 billion in net revenue in the first quarter, down 7.3% from a year earlier but exceeding analysts' estimates of $4.71 billion.

April 15 -

JPMorgan Chase and Wells Fargo said the battle for deposits isn't over — a reality denting their ability to earn more interest income. Regional banks will likely report similar pains next week.

April 12 -

Citigroup's earnings topped analysts' estimates as corporations tapped markets for financing and consumers leaned on credit cards.

April 12 -

The company reported net interest income that slightly missed analyst estimates, a sign the benefit of higher interest rates may be waning amid pressure to pay out more to depositors. Costs rose on higher compensation and an FDIC assessment.

April 12 -

Some online banks that offer high-yield savings accounts are making those products a little less high-yielding. Banks are also shortening the duration of new CDs, hoping that anticipated rate cuts by the Fed will enable them to start paying less to consumers.

April 9 -

Based on the pace of deals through late March, the banking industry is on track for the most branch sales since 2021. Buyer interest has mounted alongside the need to acquire deposits, following hits to funding bases last year.

April 5 -

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

A key bank stock index ticked up after the Federal Reserve hinted that it could lower rates later this year. But there are still a number of economic uncertainties that are holding shareholders back.

March 20