-

Of all the types of malicious software targeting businesses, ransomware continues to be one of the most pervasive, according to recent studies. Here's an overview of the things banks, especially small ones, are doing to stop it.

June 15 -

The new chair of the Conference of State Bank Supervisors argues that state regulators will keep protecting consumers if the CFPB curtails oversight.

June 15 Conference of State Bank Supervisors

Conference of State Bank Supervisors -

Businesses are tasked with carrying too much of the burden of protecting customers' personal information, and typically turn to Social Security numbers. The advent of self-sovereign identity may give consumers a chance to reclaim control over their data and how it’s used, Finicity's Nick Thomas writes.

June 15 Finicity

Finicity -

The legislation unveiled this week left out a requirement — included in an earlier version — for new companies to report their true owners.

June 14 -

Dan Heine and Diana Yates were accused of hiding Bank of Oswego's condition by inaccurately reporting bad loans.

June 14 -

Institutions that have been opening consumer accounts without consent need to prepare for the fallout, even if the OCC has said it won't name names.

June 14 MWWPR

MWWPR -

Security Group was fined $5 million for abusive collection tactics; the Dutch payments company is now valued at nearly $16 billion.

June 14 -

In his inaugural hearing as comptroller of the currency, Joseph Otting defended his decision not to publicly rebuke banks for Wells Fargo-like problems.

June 13 -

The House Financial Services Committee is preparing to vote on legislation to modernize anti-money-laundering rules, but the latest version of the bill excludes a key provision involving the collection of beneficial ownership information.

June 13 Transparency International U.S.

Transparency International U.S. -

Acting CFPB Director Mick Mulvaney had sided with two industry trade groups that sued the CFPB in April to invalidate the tough restrictions.

June 13 -

Republican congressmen Blaine Luetkemeyer and Steve Pearce say their new legislation would update anti-money-laundering and counterterrorism requirements for small financial institutions.

June 13Missouri -

Wong was placed on administrative leave in February and arrested in May in connection with alleged embezzlement and fraud at the credi tunion.

June 12 -

Legislation with bipartisan support would raise the threshold for reporting suspicious activity, a goal banks have long sought.

June 12 -

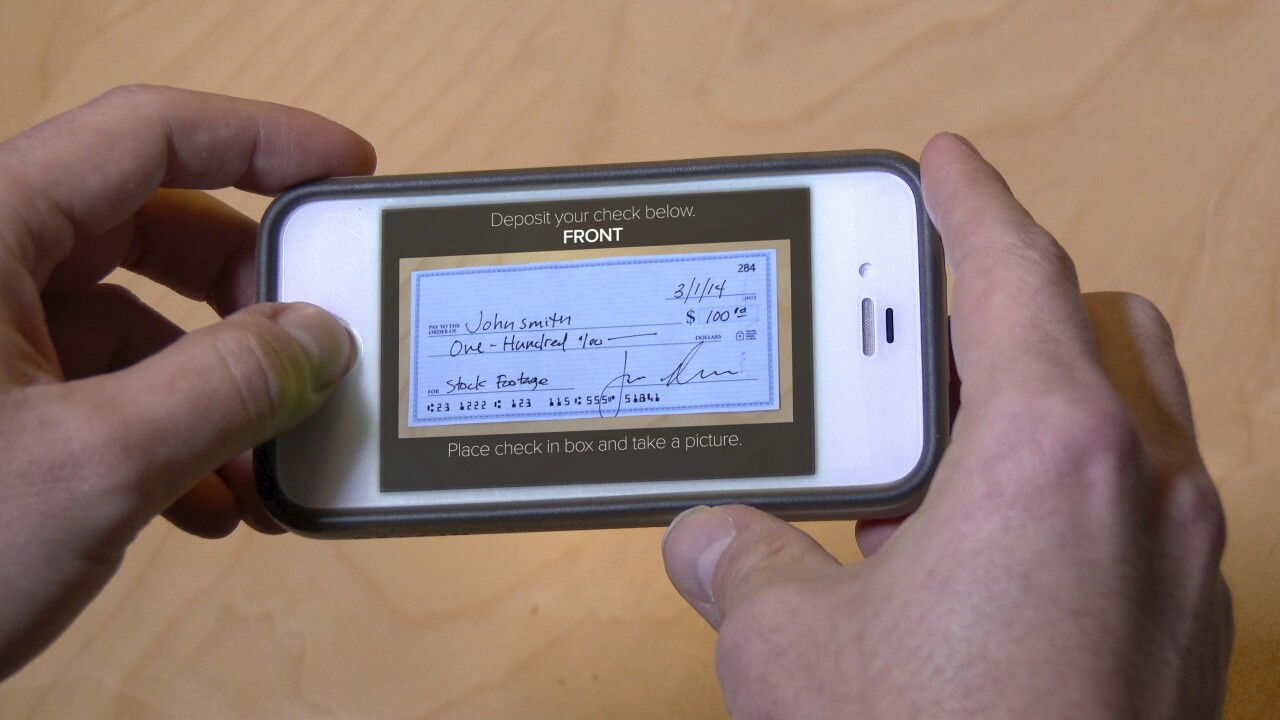

USAA's lawsuit accusing Wells of infringing on its remote-deposit patents is new territory: bank-on-bank fights over intellectual property.

June 11 -

When asked if other banks were being sued, USAA said the lawsuit names only Wells Fargo because the bank is one of the biggest adopters of remote mobile deposit capture and has failed to license the technology.

June 8 -

Financial institutions can improve monitoring of suspicious activity and potentially risky customers using algorithms, but they need to treat this new technology with caution.

June 8 IBM Global Business Services

IBM Global Business Services -

Institutions that have been opening consumer accounts without consent need to prepare for the fallout, even if the OCC has said it won't name names.

June 8 MWWPR

MWWPR -

The agency found no “systemic issues” in its review of other banks’ sales practices; some churches say the lenders are needed, others see the devil.

June 8 -

Only the collective efforts of cardholders, issuers, merchants and acquirers will significantly impact payment fraud, writes Stephanie Ericksen, vice president of identity and risk products for Visa.

June 8 Visa

Visa -

That’s the question executives of publicly traded banks are asking themselves as they try to make sense of new — and somewhat vague — guidance from the SEC on procedures for disclosing data breaches.

June 7