-

Advocates of CU payday products offer mixed reviews of the bureau's proposed rule aimed at curbing predatory lending.

June 10 -

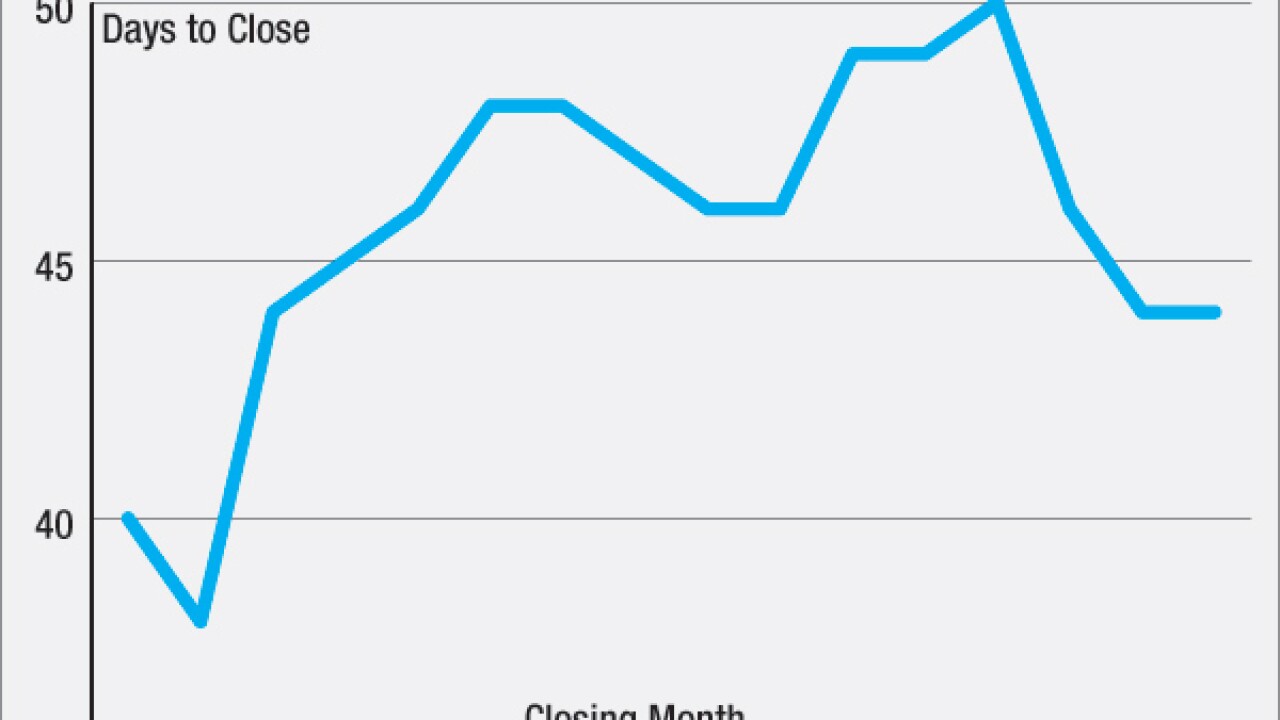

With the Consumer Financial Protection Bureau expected to clarify its integrated disclosure rules in July, lenders want to know how to remain compliant when unexpected changes come up right before a closing.

June 7 -

While economists, auto dealers and some banks have suggested auto lending will soon be on the decline, credit union executives report volume is still going strong.

June 3 -

A credit union executive was among the 12 appointees to the Department of Housing and Urban Development's new Housing Counseling Federal Advisory Committee aimed at making counseling more accessible for new homebuyers and troubled homeowners.

June 2 -

Although the Consumer Financial Protection Bureaus long-awaited proposal to establish the first federal rules for payday, auto title and high-cost installment loans offers a nod to NCUAs Payday Alternative Loans (PALs) program, CUs are concerned the plan will stifle their ability to offer consumer-friendly alternatives to an often predatory market.

June 2 -

Many appraisers are charging more or simply refusing to do FHA work, which to their minds now comes close to, if not crossing into, the remit of the home inspector.

May 27 -

The Department of Housing and Urban Development is telling lenders that down payment assistance programs still qualify for FHA backing despite concerns raised last year by HUDs inspector general.

May 25 -

WASHINGTON The House passed a bill by a voice vote Monday that will make it easier for mortgage originators to take a new job across state lines or move from a federally regulated bank to a nonbank lending shop.

May 24 -

Ninety-two percent of homebuyers are reviewing their mortgage documents before closing on the loan since the Truth-in-Lending Act/Real Estate Settlement Procedures Act integrated disclosures, or TRID, went into effect in October, versus 74% previously, a survey by the American Land Title Association found.

May 23 -

Two recent court rulings affirmed that lenders can enforce electronically signed and transferred notes, laying important groundwork for wider adoption of electronic mortgage technology that could improve the customer experience for borrowers and save lenders and servicers a bundle.

May 20 -

Rep. Maxine Waters, the top Democrat on the House Financial Services Committee, introduced legislation Thursday to reform consumer credit reporting.

May 19 -

A study commissioned by the Massachusetts Bankers Association found a correlation between a spike in credit unions with low-income designations and an increase member business lending in the state.

May 18 -

CU Companies plans to expand into five additional states.

May 16 -

Certain types of member business loans will no longer require a personal guarantee under the new NCUA rules.

May 13 -

CU Companies added 12 new retail and correspondent mortgage lending partners since the end of 2015.

May 11 -

IMM, a provider of eTransaction automation, announced that its eSignature capabilities are fully integrated with CU Direct's Lending 360 loan origination and account enrollment platform.

May 10 -

The Treasury Department on Tuesday capped off a nearly yearlong inquiry into the burgeoning marketplace lending industry with a policy paper that recommends increased transparency and customer protections while also highlighting the sector's potential for expanding credit access.

May 10 -

As credit unions continue to experience robust growth in auto lending, the need to polish up their underwriting and decision processes also grows as well as managing all the data that comes with it.

May 9