-

Rep. Maxine Waters, the top Democrat on the House Financial Services Committee, introduced legislation Thursday to reform consumer credit reporting.

May 19 -

A study commissioned by the Massachusetts Bankers Association found a correlation between a spike in credit unions with low-income designations and an increase member business lending in the state.

May 18 -

CU Companies plans to expand into five additional states.

May 16 -

Certain types of member business loans will no longer require a personal guarantee under the new NCUA rules.

May 13 -

CU Companies added 12 new retail and correspondent mortgage lending partners since the end of 2015.

May 11 -

IMM, a provider of eTransaction automation, announced that its eSignature capabilities are fully integrated with CU Direct's Lending 360 loan origination and account enrollment platform.

May 10 -

The Treasury Department on Tuesday capped off a nearly yearlong inquiry into the burgeoning marketplace lending industry with a policy paper that recommends increased transparency and customer protections while also highlighting the sector's potential for expanding credit access.

May 10 -

As credit unions continue to experience robust growth in auto lending, the need to polish up their underwriting and decision processes also grows as well as managing all the data that comes with it.

May 9 -

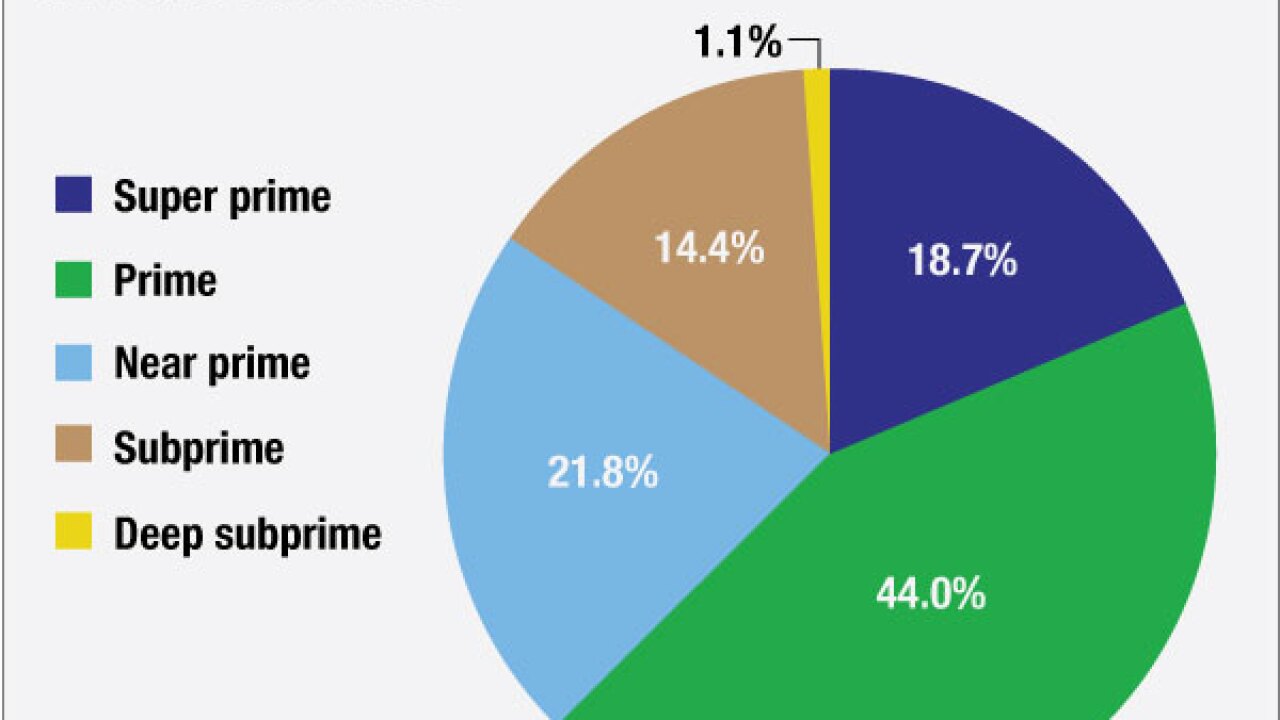

The biggest growth area in auto lending is in the subprime market, but serving that market comes with significant risks. Learn how four credit unions have met that challenge.

May 5 -

U.S. college students, already burdened by spiraling student loan debt, dont know much about using credit cards responsibly, according to a new survey.

May 2 -

The Consumer Financial Protection Bureau is set Thursday to propose new disclosures for federal student loans that would require servicers to provide several repayment options for borrowers.

April 28 -

Borrowers continue to get smarter about the mortgage process, but from questions about closing costs to the minimum down payment and credit score needed to qualify, there's still a lot that can keep consumers confused during the origination process, or worse, on the sidelines of the market entirely.

April 27 -

ONTARIO, Calif. -- CU Direct has become the latest organization to take an ownership stake Members Development Co., the firm announced in a Tuesday news release.

April 26 -

Auto lending has enjoyed a serious boost in volume, and one segment subprime loans has followed suit, but a recent study suggests a spike in delinquencies and charge-offs is in the offing.

April 25 -

Senate Banking Committee Chairman Richard Shelby, R-Ala., is seeking input from the Government Accountability Office and the Congressional Budget Office on the future of policies dealing with Fannie Mae and Freddie Mac.

April 19 -

Even while FHFA finally embarked on a principal reduction plan, critics argued it was a dangerous idea that made Fannie Mae and Freddie Mac less safe while helping relatively few people.

April 15