NEW YORK-- U.S. college students, already burdened by spiraling student loan debt, don't know much about using credit cards responsibly.

A survey conducted in April at three universities by LendEDU, a marketplace for student loans and loan refinance, found what while 38.5% of students polled currently have a credit card in their own name, a good number of them are unaware of their cards' interest rates and late payment charges.

The survey, said Nate Matherson, co-founder & CEO of LendEDU in Cedar Rapids, Iowa, was designed to "better understand financial literacy and credit card usage among current college students."

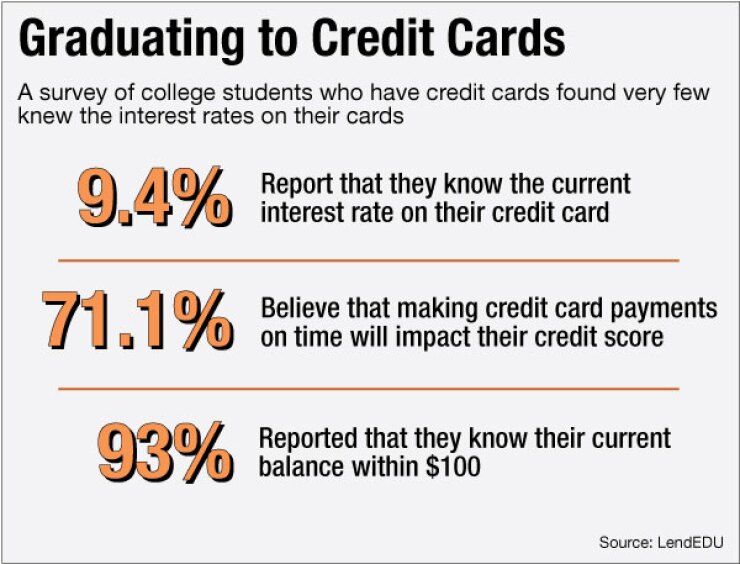

Of those students with credit cards, only 9.4% said they knew the current interest rates on their credit cards; only 20.6% knew the late payment charges on their credit cards; and 58.9% knew the balance limits on their credit cards.

Moreover, only 28.9% knew the over-balance fees charged on their credit cards; 67.8% had a credit card balance; and 93.3% said they knew the size of their current credit card balance within $100.

Finally, 71.1% believe that paying their credit card bill on-time would impact their future credit scores; 23.3% reported that they currently have more than one credit card account; and two-thirds with credit cards reported carrying a balance.

LendEDU surveyed over 460 undergraduate and graduate students at three different four-year institutions (two public and one private). Two colleges were located in the San Francisco Bay Area and the other was on the East Coast.

Some credit union industry insiders note credit cards can be beneficial to college students, as long as they are used responsibly.

"Student credit cards can help young adults manage money and develop a credit score for life after college," said Barney Moore, director, portfolio consulting services at CSCU in St. Petersburg, Fla.. "This provides an opportunity for credit unions to obtain future auto loans, mortgage loans and continued credit union membership through the shared branching network (if enrolled) and mobile banking platforms."

Moore suggested that CUs consider offering student credit cards to members' children with or without the parent as a co-borrower. "Many students will continue to use a credit union credit card after college when appropriate credit line increases are provided," he noted.

Nate Matherson, co-founder and CEO of LendEDU, said he was "surprised" that a relatively small percentage (38.5%) of current college students even had credit cards. "Memories of the financial crisis and rising student loan balances may be deterring young Americans from utilizing credit cards," he said. "Additionally, in 2009, the Credit Card Accountability Responsibility and Disclosure Act… clamped down on marketing at colleges and universities."

Migdalia Gomez, financial education services specialist at Harvard University Employees Credit Union, a $516 million institution in Cambridge, Mass., said HUECU encourages "students to pay off their credit card balances in full each month. Cash back and travel rewards are only a benefit if interest isn't being paid."

Gomez added that HUECU challenges students to "identity their spending personalities" and financial goals.

"It is easier to control spending when you have other places you want your money to go towards," she said. "By showing students the true cost of credit cards, and other uses for their money, credit unions can help our students become better money managers."

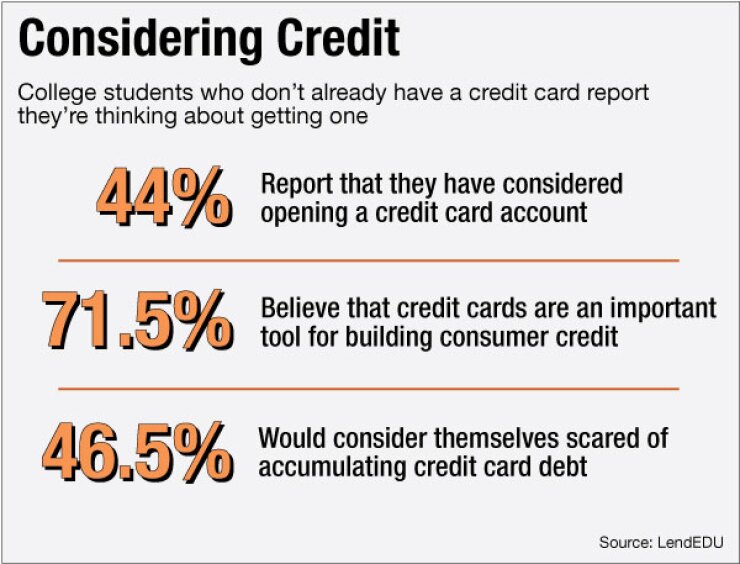

Of those students who did not have credit cards, a significant portion would like to have them. The survey revealed that 43.8% of the card-less students said they have considered opening up credit card accounts; 71.5% believed that credit cards are an "important tool" for building consumer credit; but 46.5% worried about the possibility of accumulating credit card debt.

"Credit cards are a powerful tool when used correctly," LendEDU's Matherson noted. "Credit cards can help young adults build credit, earn rewards, and learn financial responsibility. However, when used incorrectly credit cards can be as crushing as high interest student loan debt."

Indeed, according to data from the New York Federal Reserve, outstanding student loan balances reached $1.23- trillion as of Dec. 31, 2015. Of that amount, 11.5% was more than 90 days delinquent or in default. Meanwhile, credit card balances stood at $733 billion on that date.

LendEDU said it did not ask respondents for the specific size of their credit card balances, but a report from 2013 by Fidelity Investments revealed that college graduates from that year had accumulated, on average, about $3,000 in card debt (on top of debt they had already incurred from student loans and other types of loans).

"Our nation has a serious issue," Matherson said. "There needs to be greater personal finance education for young adults, especially at the high school level."