-

The biggest growth area in auto lending is in the subprime market, but serving that market comes with significant risks. Learn how four credit unions have met that challenge.

May 5 -

U.S. college students, already burdened by spiraling student loan debt, dont know much about using credit cards responsibly, according to a new survey.

May 2 -

The Consumer Financial Protection Bureau is set Thursday to propose new disclosures for federal student loans that would require servicers to provide several repayment options for borrowers.

April 28 -

Borrowers continue to get smarter about the mortgage process, but from questions about closing costs to the minimum down payment and credit score needed to qualify, there's still a lot that can keep consumers confused during the origination process, or worse, on the sidelines of the market entirely.

April 27 -

ONTARIO, Calif. -- CU Direct has become the latest organization to take an ownership stake Members Development Co., the firm announced in a Tuesday news release.

April 26 -

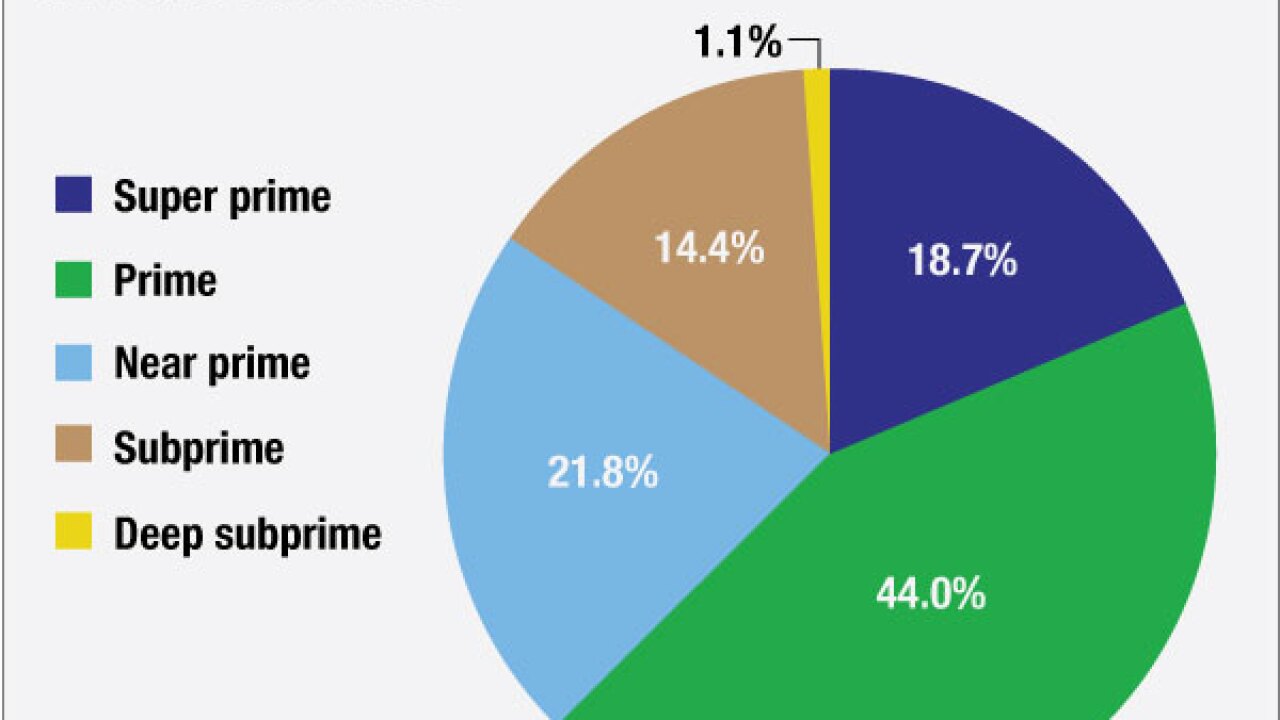

Auto lending has enjoyed a serious boost in volume, and one segment subprime loans has followed suit, but a recent study suggests a spike in delinquencies and charge-offs is in the offing.

April 25 -

Senate Banking Committee Chairman Richard Shelby, R-Ala., is seeking input from the Government Accountability Office and the Congressional Budget Office on the future of policies dealing with Fannie Mae and Freddie Mac.

April 19 -

Even while FHFA finally embarked on a principal reduction plan, critics argued it was a dangerous idea that made Fannie Mae and Freddie Mac less safe while helping relatively few people.

April 15 -

The Credit Union National Association has released a new Financial Flash entitled Concentration Risk: Guidance on Policy and Metrics.

April 14 -

While many CUs avoid the product that some consumer advocates deem predatory, the CUs that do offer them say it's a service members want and need and can be done in consumer-friendly way.

April 1 -

GrooveCar Inc. has partnered with 40 more credit unions that can use its online auto-buying service.

April 1 -

The Coalition for Safe Loan Alternatives intends to become a peer-to-peer forum for best practices among the alternatives to payday loans. The group will not advocate for policy changes. Rather it aims to offer a platform for local organizations to share information and compare ways to offer low-cost access to credit.

March 29 -

Credit unions have a dominant auto lending presence in the West, boasting as much as a 50% marketshare in some areas. Credit Union Journal explores what is driving that dominance.

March 29 -

Five policy heavy-hitters issued a proposal this week to merge Fannie Mae and Freddie Mac into a single government corporation as a way to move beyond the conservatorships of the two government-sponsored enterprises.

March 24 -

The Consumer Financial Protection Bureau has implemented a new rule that broadens the ability of lenders in rural and underserved areas to originate qualified mortgages.

March 23 -

The Consumer Financial Protection Bureau faces a tough balancing act as it seeks to issues a proposal to rein in high-cost payday loans. A chief concern is what will replace payday lenders if federal regulations force many of them to shut down.

March 22 -

CU lobby emphasizes movement's commitment to keeping people in their homes but expresses concern about setting a 'dangerous precedent' with principal cuts.

March 22 -

Homefield Credit Union in North Grafton, Mass., will be able to offer first-time homebuyers assistance with down payments and closing costs for the second consecutive year through the Equity Builder Program with the Federal Home Loan Bank of Boston.

March 22