-

A joint venture formed by a regional credit union trade group and a loan servicer has a simple mission: to help small credit unions that lack expertise in SBA lending jump into the booming 7(a) market.

November 17 -

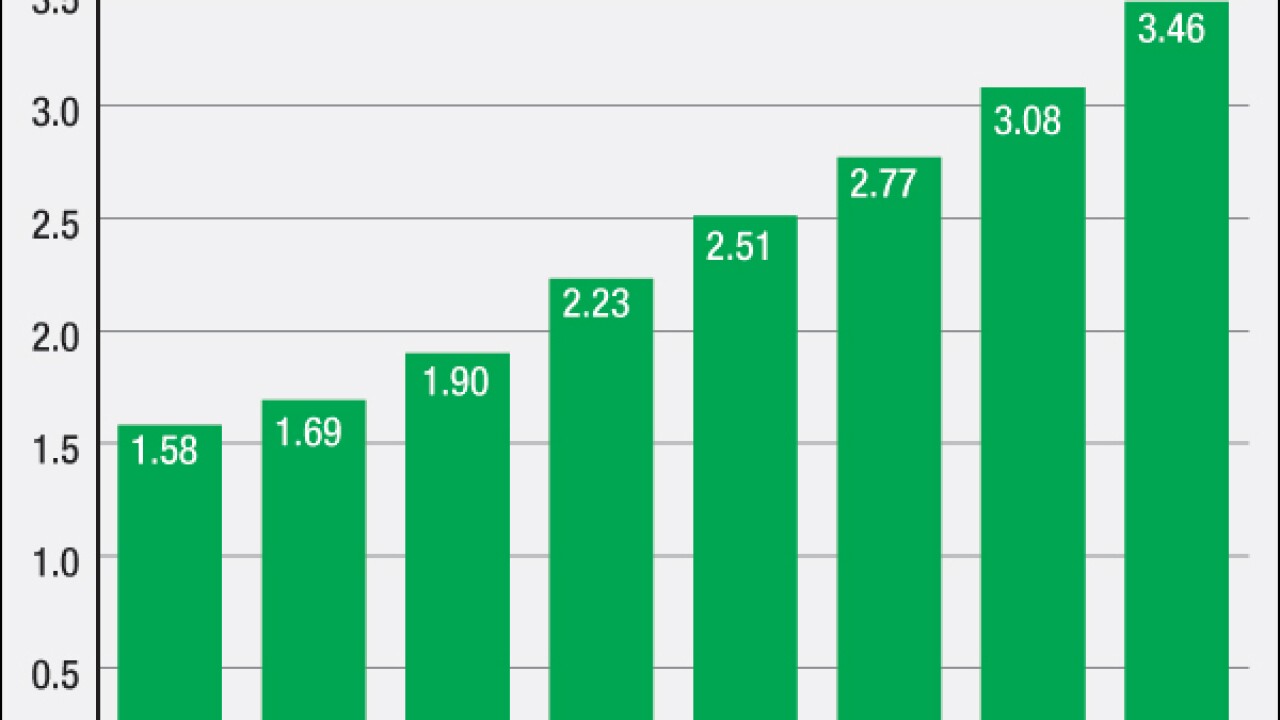

Though lending is still where much of a CUs income comes from, and CUs have seen 18 straight quarters of loan growth, CUs are seeing weaker profits, according to SNL Financial.

November 17 -

The Federal Housing Administration's unexpected windfall is already generating industry talk about another premium cut by the agency but FHA officials insist such discussion is premature.

November 17 -

While national mortgage fraud risk is on the decline, here's a look at six markets where loan defects are rising.

November 16 -

Peer-to-peer lending (P2P) is growing by such leaps and bounds that credit unions would be wise to develop strategies to either deal with this emergent force in financial services or form partnerships with these online lenders that have sprouted like mushrooms across the landscape.

November 9 -

Automobile lending reached its highest level ever at the end of the third quarter while showing few signs of credit weakness, the credit bureau Experian reported Wednesday.

November 4 -

WASHINGTON Though the deadline for compliance is more than two years away, lenders are already warning that they do not have enough time to comply with a new rule that requires institutions to report additional data to regulators on home loans.

November 4 -

EL SEGUNDO, Calif. Xceed Financial Credit Union is preparing to launch a new CUSO offering an array of interrelated products and services primarily aimed at bolstering loan growth.

November 3 -

The National Credit Union Administration will host a webinar on auto lending next month.

October 29 -

The financial condition of the Federal Housing Administrations mortgage insurance fund has improved significantly over the past year, Department of Housing and Urban Development Secretary Julian Castro predicted late Monday.

October 27 -

Online auto-buying resource GrooveCar has formed partnerships with four credit unions across the U.S.

October 26 -

CU Direct announced that eight new credit unions have joined the companys Lending Insights platform, a system that provides credit unions with analytic tools to manage risk, meet regulatory requirements, increase profitability, and optimize loan portfolio performance.

October 22 -

The government's spotlight on servicing problems means companies should be taking steps now in the face of regulators' current enforcement authority and the potential of coming rules.

October 20 -

Mortgage servicers have gotten a rare reprieve from the Federal Housing Administration.

October 20 -

Next year Fannie will require that mortgage lenders use so-called trended credit data for all mortgage borrowers, a move it says could broaden access to credit.

October 19 -

Rule would add datasets to the information lenders report to regulators under the Home Mortgage Disclosure Act.

October 15 -

The auto lending front continues to improve for credit unions, as car loans comprised 32.9% of total outstanding balances in the second quarter of the year.

October 13 -

Should credit unions step into a giant breach gradually being vacated by the big banks, or is the bank pull-out a sign that CUs should do the same?

October 9 -

The House voted 303 to 121 on Wednesday to pass a bill that would delay enforcement of new mortgage disclosures that went into effect on Oct. 3.

October 8 -

Despite their major push to overhaul the housing finance market last Congress, Sens. Bob Corker, R-Tenn., and Mark Warner, D-Va., offered little optimism Tuesday that structural reform is on its way anytime soon.

October 6