-

Online auto-buying resource GrooveCar has formed partnerships with four credit unions across the U.S.

October 26 -

CU Direct announced that eight new credit unions have joined the companys Lending Insights platform, a system that provides credit unions with analytic tools to manage risk, meet regulatory requirements, increase profitability, and optimize loan portfolio performance.

October 22 -

The government's spotlight on servicing problems means companies should be taking steps now in the face of regulators' current enforcement authority and the potential of coming rules.

October 20 -

Mortgage servicers have gotten a rare reprieve from the Federal Housing Administration.

October 20 -

Next year Fannie will require that mortgage lenders use so-called trended credit data for all mortgage borrowers, a move it says could broaden access to credit.

October 19 -

Rule would add datasets to the information lenders report to regulators under the Home Mortgage Disclosure Act.

October 15 -

The auto lending front continues to improve for credit unions, as car loans comprised 32.9% of total outstanding balances in the second quarter of the year.

October 13 -

Should credit unions step into a giant breach gradually being vacated by the big banks, or is the bank pull-out a sign that CUs should do the same?

October 9 -

The House voted 303 to 121 on Wednesday to pass a bill that would delay enforcement of new mortgage disclosures that went into effect on Oct. 3.

October 8 -

Despite their major push to overhaul the housing finance market last Congress, Sens. Bob Corker, R-Tenn., and Mark Warner, D-Va., offered little optimism Tuesday that structural reform is on its way anytime soon.

October 6 -

COLUMBUS, Ohio Business lending CUSO Cooperative Business Services, LLC on Wednesday reported it has closed more than $225 million in Central Ohio business loans since opening its first regional office here in October 2006.

October 5 -

Southeast Financial Credit Union in Franklin, Tenn. has filed a lawsuit against The College Network, an Indiana online test preparation company that is facing charges of fraud.

October 5 -

In comments to the Treasury Department, traditional financial institutions are calling for more oversight of an industry that is fast becoming a big competitive threat.

September 30 -

Federal financial regulators are teaming up to produce a webinar on fair lending law compliance targeted for credit unions.

September 28 -

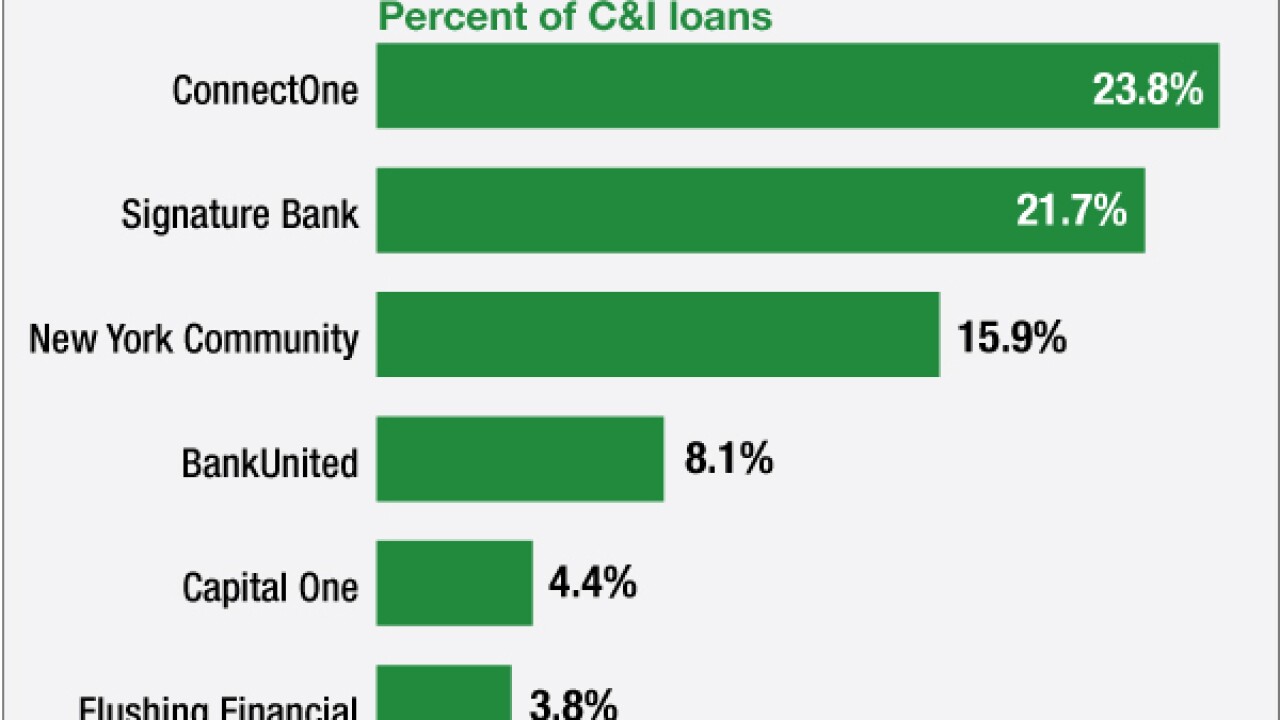

A number of New York financial institutions are stepping away from medallion lending as delinquencies rise and competition for fares intensifies.

September 28 -

The Consumer Financial Protection Bureau has struggled internally with how to end potential discrimination in auto lending, including debating whether it should cite a large lender in the hopes of effectively ending the ability of partnering dealers to mark up loans with all lenders.

September 24 -

Five credit unions are beta testing a Small Business Administration-compliant lending tool as part of a partnership between the National Federation of Community Development Credit Unions and Minneapolis-based Community Reinvestment Fund, USA.

September 22 -

The number of mortgage originations dropped 31% to 6 million in 2014 due largely to a decline in refinancing as interest rates increased, according to a report issued Tuesday by the Federal Financial Institutions Examination Council.

September 22 -

As a new entrant to the lending arena, marketplace lenders pose a new, untraditional competitor for borrowers business, but credit unions might be able to find ways to work with them, not against them.

September 17 -

Though loan performance has improved since the housing crisis, credit challenges persist as higher housing costs combined with stagnant wages have put increased strain on some borrowers' finances.

September 15