-

The regulator cited "unsafe and unsound practices" at the Georgia-based institution, which is the first credit union to be conserved this year.

June 11 -

Members of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

June 2 -

The closure of IBEW Local Union 712 Federal Credit Union marks the first CU to shut its doors in the wake of the coronavirus.

May 29 -

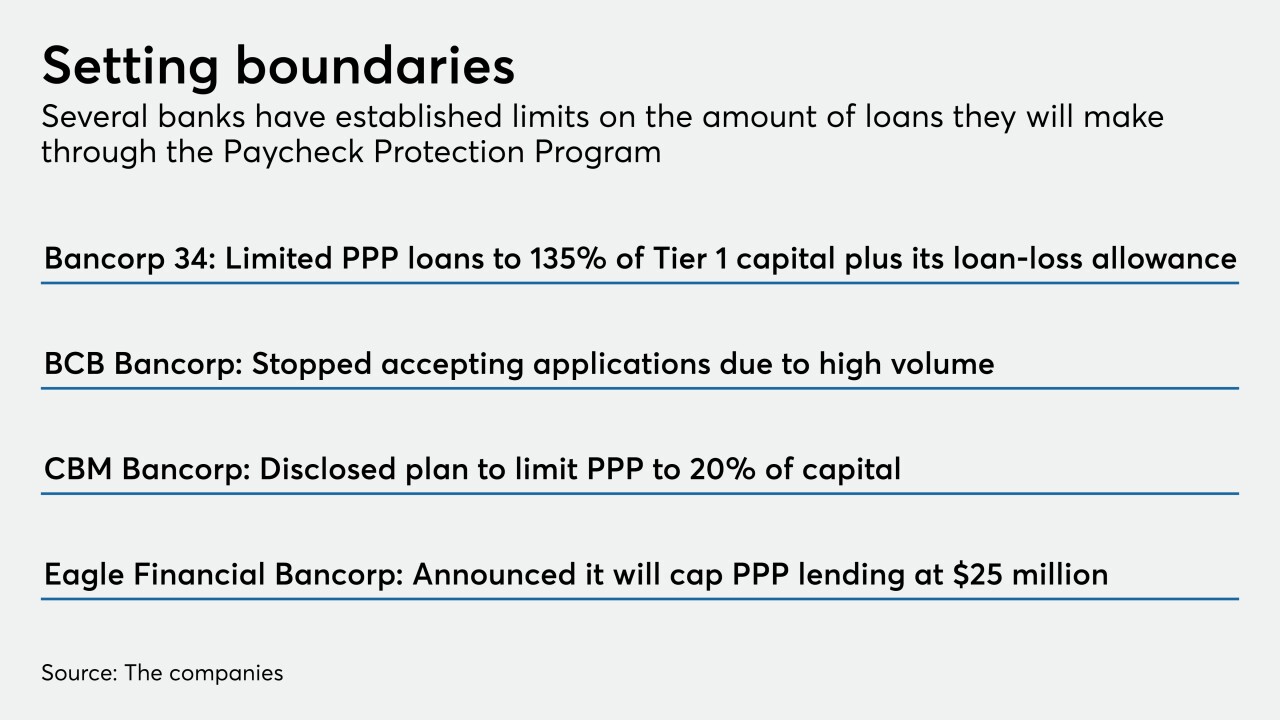

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

Members of the Banking Committee pressed the Treasury secretary and Fed chief to ensure CARES Act funds are deployed as Congress intended. They also debated the need for more stimulus to ease the economic effects of the coronavirus.

May 19 -

Congress authorized the Federal Deposit Insurance Corp. to intervene if the pandemic caused a liquidity scare, but nearly two months later deposits are through the roof and the agency has not acted on the expanded authority.

May 14 -

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

May 13 -

The Ohio Democrat's criticism of Rodney Hood, chairman of the National Credit Union Administration, echoed complaints from bankers that the regulator was using the chaos from the pandemic to push through changes.

May 12 -

All 11 corporates have signed on as agent members of the CLF, boosting its borrowing authority by $13 billion.

May 11 -

A letter from Todd Harper, a member of the National Credit Union Administration board, called on lawmakers to make a variety of legislative changes to help credit unions and consumers weather the pandemic.

May 5