-

For anyone who wants a phony pay stub or doctored tax return, an easy source is just a click away.

April 6 -

The number of grievances about evictions and federal student loans declined between January 2020 and May 2021. Nonetheless, the Consumer Financial Protection Bureau warned financial firms that poor customer service can undermine government efforts to provide aid.

July 2 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

The agency will allow an additional three months of forbearance for loans backed by Fannie Mae and Freddie Mac, giving homeowners up to 18 months to suspend payments due to the pandemic.

February 25 -

Treasury Secretary Steven Mnuchin approved the extension of the Main Street Lending Program, which offers loans to midsize companies affected by the pandemic, to Jan. 8.

December 29 -

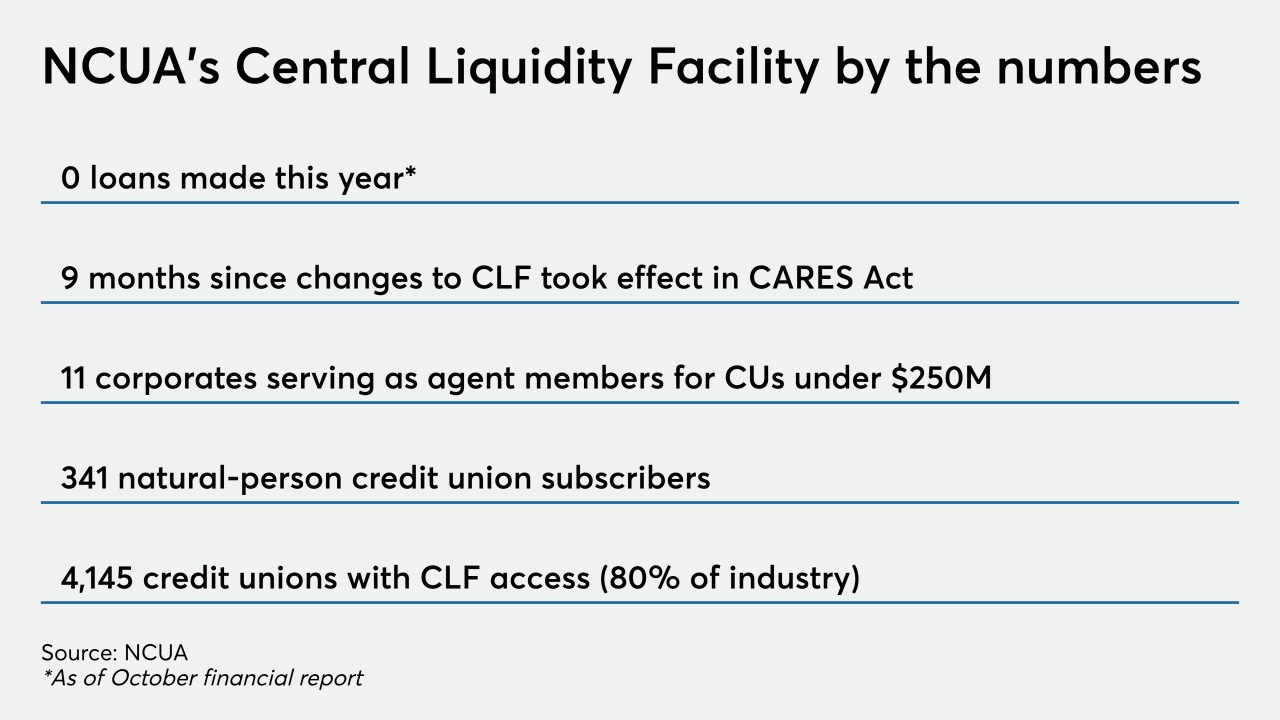

Provisions implemented under the CARES Act that made it easier for institutions to utilize NCUA's Central Liquidity Facility have been extended for a year with the signing of Consolidated Appropriations Act.

December 28 -

The Pennsylvania senator, who will chair the Banking Committee if Republicans hold their majority, agreed to modify an amendment restricting the Federal Reserve’s emergency powers that Democrats had criticized as too extreme.

December 21 -

The amendment backed by Sen. Pat Toomey and other Republicans to block the central bank from reviving CARES Act lending facilities has emerged as a flashpoint in congressional negotiations over pandemic relief.

December 18 -

The Federal Reserve has already agreed to shut down emergency credit programs funded by the Coronavirus Aid, Relief and Economic Security Act, but Sen. Pat Toomey, R-Pa., and others want Congress to ensure the central bank cannot revive them.

December 17 -

This could be the final opportunity for Congress to extend a pair of key measures for credit unions that took effect earlier this year.

December 7 -

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

Tuesday's hearing on the CARES Act was dominated by bickering over Treasury's decision to shut down the Fed's emergency lending facilities, drowning out pleas from some lawmakers for more aid.

December 1 -

The latest bipartisan plan to accelerate the economic recovery would appropriate roughly $300 billion for the Paycheck Protection Program, but the legislative package still faces long odds in the divided Congress.

December 1 -

Treasury Secretary Steven Mnuchin called on the Federal Reserve Thursday to let several of its emergency lending facilities expire at yearend and return unused funds provided by Congress. But the central bank wants the programs to continue.

November 19 -

It is a frustrating reality during a time of national crisis that emergency payment options for vulnerable populations remain such a complex and inefficient landscape, says Flourish Ventures' Sarah Morgenstern.

November 4 Flourish Ventures

Flourish Ventures -

Underwhelming participation in the middle-market loan program has forced the central bank to reduce the minimum borrowing amount for the third time, to $100,000.

October 30 -

Businesses that received Paycheck Protection Program loans and Economic Injury Disaster advances discovered later they can't get full forgiveness. Lenders want the rules changed.

October 26 -

Defaults have been milder than expected thanks to government relief and stricter underwriting. But with the crisis dragging on and policymakers unable to agree on a stimulus plan, loans to highly indebted companies remain at risk.

October 15 -

Executives are urging Congress and the White House to prioritize another round of help for businesses amid concerns that the continuing restrictions on reopening could lead to more loan defaults.

October 13 -

The banking giant may be sitting pretty with plenty of money reserved for bad loans — or it could have to set aside billions more in coming quarters. It hinges on an ongoing U.S. recovery and the passage of a new stimulus package.

October 13