-

An Oct. 7 trial date looms in a case involving allegations of document destruction. The high-stakes lawsuit could complicate BMO's pending acquisition of Bank of the West.

June 6 -

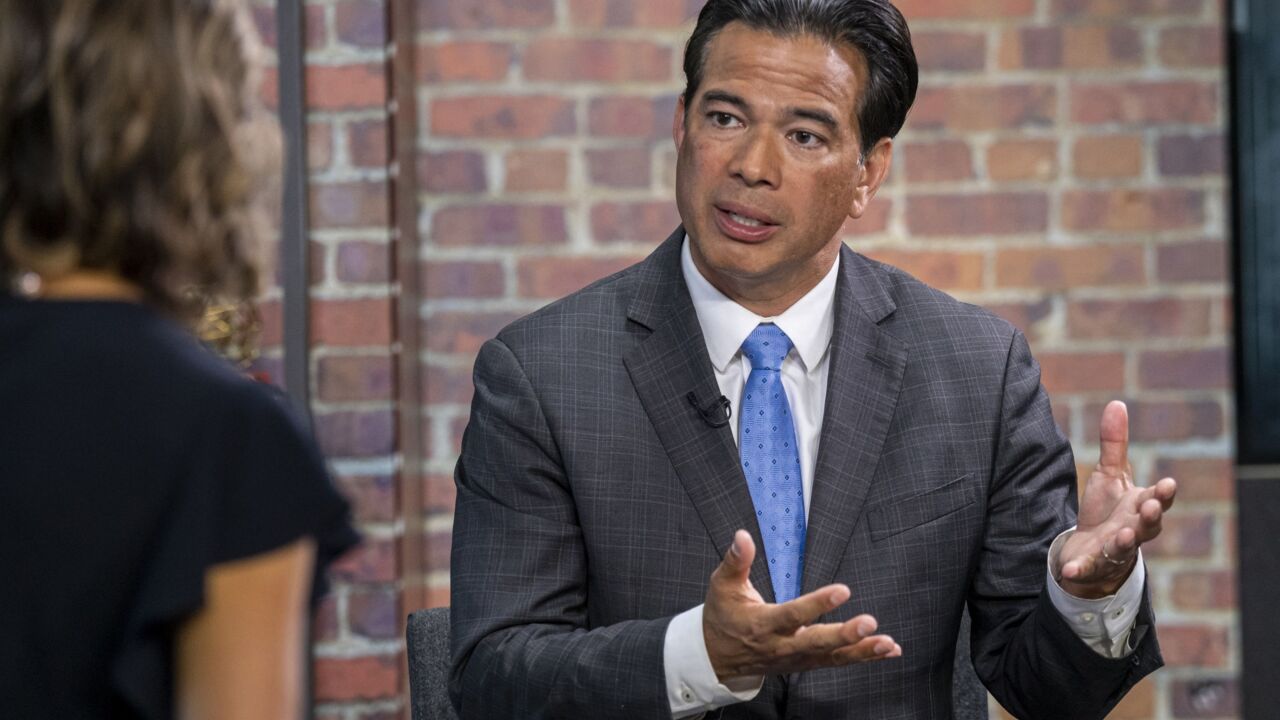

District attorneys in the Golden State are tangling with Credit One Bank over its debt-collection practices. The bank says the prosecutors have overstepped, but Democratic Attorney General Rob Bonta argues that the legal action should continue.

May 31 -

A $1.9 billion lawsuit against Bank of Montreal — which is accused of lying to a judge after a predecessor bank destroyed documents — may go to trial late this year. The legal imbroglio is coming to a head as regulators examine the Canadian banking giant’s proposed acquisition of Bank of the West.

March 22 -

The company has filed a lawsuit against the banking commissioner for threatening to end its partnership with a bank that enables consumer loans to exceed the state’s 36% interest rate cap. OppFi’s argument: Its bank partner is the true lender.

March 10 -

The Federal Trade Commission recently issued an advisory opinion that could make it easier for consumers to recover their legal costs from banks in situations where they were defrauded by a car dealer.

February 9 -

The Conference of State Bank Supervisors abandoned a lawsuit against the Office of the Comptroller of the Currency that had challenged the San Francisco fintech's effort to become a national bank without deposit insurance. The company recently amended its application to drop that controversial element.

January 14 -

Under an agreement with 40 state attorneys general, the student lender and servicer agreed to cancel debt for over 66,000 borrowers and pay restitution to another 350,000 borrowers placed in certain types of forbearance.

January 13 -

The payout will help the Delaware bank recover legal costs that stemmed from its 2010 purchase of Christiana Bank & Trust. It expects a 23-cent boost to earnings per share in the most recently completed quarter.

January 7 -

Two co-founders of the company are expected to give depositions this month in a suit brought by an entrepreneur who says one of them stole her idea of providing credit to immigrants and turned it into a multimillion-dollar venture. Petal denies the allegations.

January 5 -

The agreement resolves a lawsuit over consumer loans that had annual percentage rates as high as 198%. Chicago-based OppFi denied allegations that it engaged in unfair lending practices.

December 1 -

Mary Mack testified last week about the cultural problems she encountered after joining the bank's consumer unit in 2016. Recalling small group meetings she held with employees, she said: "People would stand up, and they were fearful."

November 1 -

The levy targets large financial institutions as a source of revenue. Industry groups argued that it discriminates against out-of-state banks, but the Washington Supreme Court disagreed.

October 3 -

Square, the mobile payments company, has joined with other tech companies in a cross-licensing platform to reduce patent lawsuits over cryptocurrency and promote the growth of digital currencies.

September 14 -

A predecessor bank, Allegiant Bancorp of St. Louis, was accused of fraud and breach of fiduciary duty in connection with a scheme run by a seller of funeral contracts.

September 1 -

The bureau said two rules related to communications with debtors will go into effect as originally planned on Nov. 30. The agency had previously proposed an extension to consider consumer advocates' concerns about the regulations.

July 30 -

A three-judge panel determined that a lower-court ruling against two law firms specializing in mortgage repair had used the wrong measure to calculate restitution.

July 27 -

DMB Financial, a debt-settlement firm near Boston that operates in 24 states, agreed to pay $5.4 million in restitution to consumers for allegedly charging upfront fees before providing any service, the CFPB said.

May 17 -

Collectors are mulling a procedural overhaul after a three-judge panel said the practice of using vendors to inform consumers about outstanding debts is illegal. The case may also complicate the CFPB's upcoming rule on electronic messaging.

May 11 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

May 7 -

The state's Department of Financial and Professional Regulation will reduce assessments by 61% this year because of overpayments in 2020, helping state-chartered credit unions deal with economic fallout from the pandemic.

April 30