-

Vice President Mike Pence congratulated credit unions on their work with consumers but he also urged attendees at CUNA's Governmental Affairs Conference to promote the controversial wall.

March 12 -

Michael Bright is resigning as acting president of Ginnie Mae to run the Structured Finance Industry Group, a trade association that's been without a CEO since Richard Johns resigned in July amid a reported split with the group's board.

January 10 -

The Massachusetts senator said a private event where Mick Mulvaney briefed donors about the party’s midterm prospects may violate the Hatch Act.

September 19 -

With strategic changes at key trade groups and attention shifting away from regulatory relief for community banks, the interests of large institutions have taken on more prominence.

August 22 American Banker

American Banker -

The senator's proposed legislation includes a ban on individual stock ownership and restrictions on government employees joining the lobbying ranks.

August 21 -

The banking industry has been raising alarms about the growth of a few credit unions, but the critiques ignore the vast size differences between the two sectors and the tremendous growth banks have seen since the crisis.

August 20 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

The banking industry has been raising alarms about the growth of a few credit unions, but the critiques ignore the vast size differences between the two sectors and the tremendous growth banks have seen since the crisis.

August 20 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

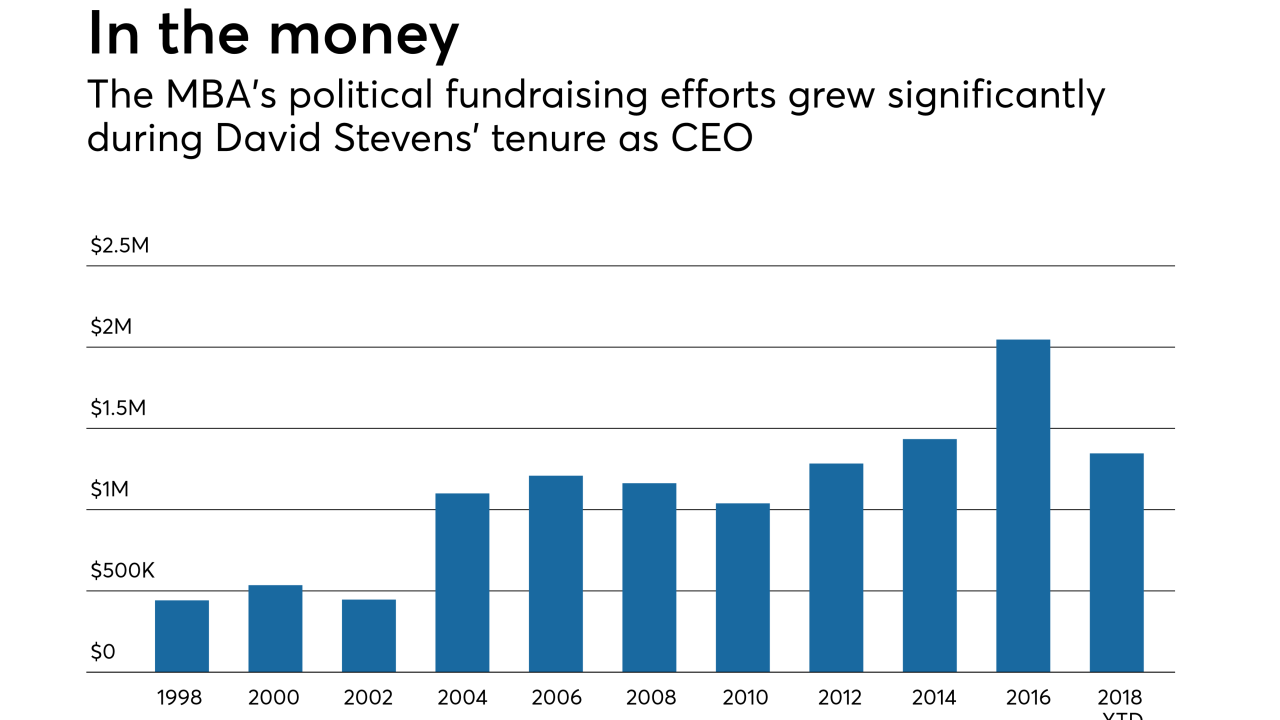

Robert Broeksmit has a tough act to follow succeeding David Stevens, the CEO revered for navigating the Mortgage Bankers Association through one of its most tumultuous eras on record. But in doing so, Broeksmit has a distinct advantage over many of his predecessors: inheriting an organization on the upswing.

June 8 -

The firms were initially slated to be included in a newly merged trade association, but they were blocked after some executives objected to adding more Wall Street banks.

June 8 -

With comment periods quickly closing, responding to the agency’s abundant requests for information is proving a logistical hassle for the industry and consumer advocates.

June 6 -

The Massachusetts senator and architect of the CFPB offered a sharp contrast to the administration's deregulatory agenda and sent strong signals of a presidential run.

June 5 -

The Japanese bank, owner of Union Bank in San Francisco, has hired RBC alum Roger Blissett to raise its profile among lawmakers, oversee compliance and build deeper relationships with regulators as its recent charter switch continues to stir controversy.

May 8 -

The acting Consumer Financial Protection Bureau director should be investigated for potential Hatch Act violations following his controversial remarks at a banking industry conference, Senate Democrats said Tuesday.

May 1 -

Sen. Elizabeth Warren, D-Mass., is asking the CFPB’s top ethics official if the agency has taken steps to ensure its acting director, Mick Mulvaney, is excluded from matters involving banks and other firms that contributed to his campaign when he was a congressman.

April 27 -

Critics of the acting CFPB director have a new line of attack as he takes fire for remarks made at an industry conference earlier this week.

April 25 American Banker

American Banker -

The San Francisco Fed chief, an economist, is seen as a complement to Fed chair Powell; the proposal would make it easier for banks to comply with the law.

April 4 -

Rebeca Romero Rainey, while known as compassionate banker and less of a firebrand than her predecessor at the trade group, will take firm stands for small banks on reg relief, innovation and fair play, say those who know her.

March 21 -

The merger of the Financial Services Roundtable and The Clearing House Association is likely to bring a more analytical approach to the combined group’s dealings with lawmakers, emphasizing detailed research over simplified talking points.

March 13 -

Timothy Zimmerman is optimistic about regulatory relief and the capabilities of the association's next CEO, but he remains wary of nonbank competition and cybersecurity risk.

March 13 -

As the credit union faithful descend on Capitol Hill for CUNA's GAC, advocates prepare to defend the movement's tax status in the wake of Sen. Hatch's letter questioning the exemption.

February 26