-

The agency’s mission is popular with the public, which has a long memory when it comes to the past misdeeds of the banking industry.

July 11 Mike Lux Media

Mike Lux Media -

Wall Street lenders are calling on the U.S. government to hold off on launching a digital dollar, arguing that a virtual currency backed by the Federal Reserve risks draining hundreds of billions of dollars out of the banking system.

May 23 -

Facing a crackdown from regulators in Washington, the crypto industry is turning to New York Sen. Kirsten Gillibrand for help.

May 9 -

West Virginia’s legislature has approved a proposal that could restrict the state’s work with financial institutions that have limited their business with coal and oil companies.

March 14 -

The business of influencing cryptocurrency policy in Washington exploded last year and has more than quadrupled in the past four years, according to a new study.

March 8 -

People are increasingly moving between jobs in crypto and the government agencies that police the industry, raising potential conflicts of interest that could undermine efforts to rein in the sector, according to a watchdog group.

February 23 -

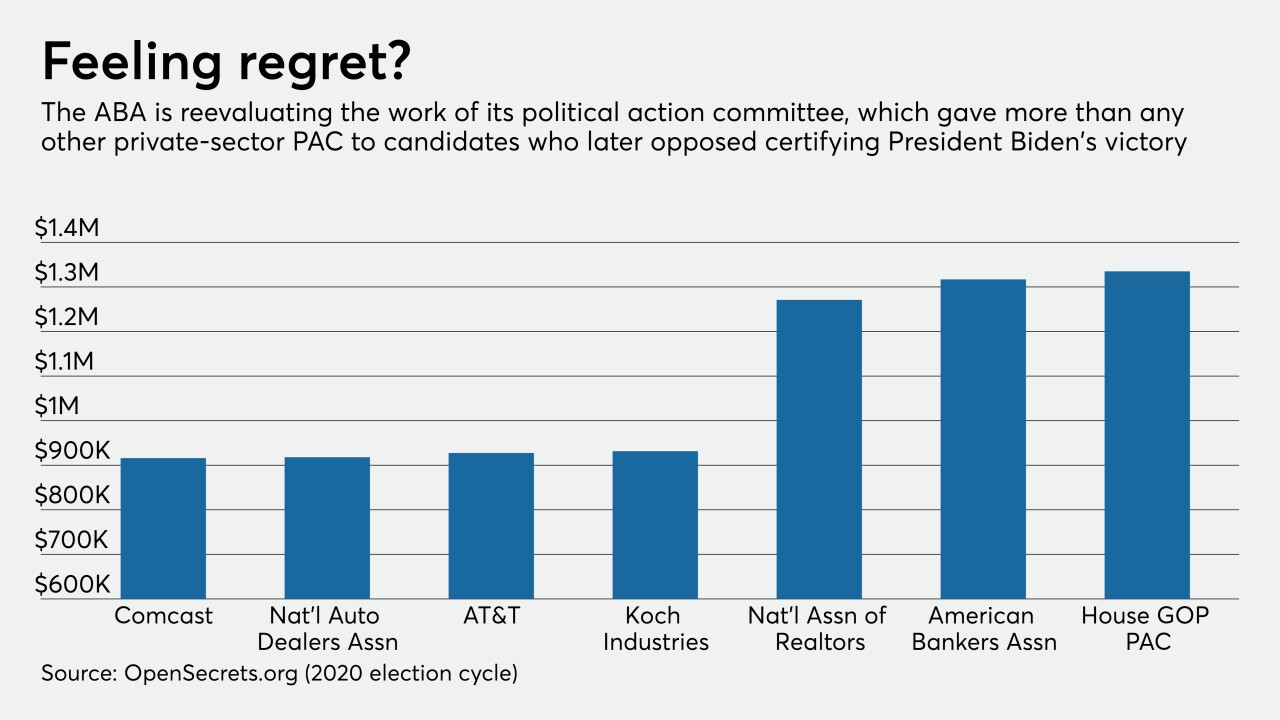

Election-reform advocates say the American Bankers Association and other organizations should take into account candidates’ commitment to democracy, not just their stances on issues, in directing donations.

February 17 -

Following similar decisions by big banks, the Consumer Bankers Association and Mortgage Bankers Association said they will halt all political contributions to elected officials as some lawmakers face harsh criticism for comments that incited the storming of the U.S. Capitol.

January 11 -

Several members of Congress challenging the result of the 2020 presidential contest received financial support from trade groups that could find themselves in hot water with some constituents.

January 6 -

Banking trade organizations are usually cautious about making endorsements. But with Democrats winning the White House and control of Congress on the line in the two races, some groups are pouring in cash for the GOP candidates.

December 6 -

The league has altered its formula for calculating member dues, a move expected to save credit unions nearly $800,000 next year.

November 19 -

With many Americans and members of Congress questioning the results of the presidential election, financial services trade associations quickly vowed to work with the incoming administration.

November 11 -

The trade group supported 11 incumbents running for re-election, including the embattled Maine Sen. Susan Collins, and may have helped Republicans maintain control of the Senate.

November 4 -

A look at how credit unions and the industry at large have intersected with the 2020 election.

November 3 -

Industry groups have launched new programs that are expected to carry over into 2021, while others are raising new calls for Congress to tackle data security.

October 19 -

The industry supports candidates on both sides of the aisle but has tilted toward Democrats during this cycle. Experts say that's partly a reflection of the current makeup of Congress.

October 19 -

New research reveals the financial services industry both prefers and predicts an incumbent win in November.

September 28 -

Industry groups are also pushing the federal regulator to improve how off-site examinations are conducted.

August 31 -

Political donations from the sector and interviews with industry experts highlight a wide range of views on affordable housing resources, the appropriate level of regulatory relief and how policymakers should enforce fair housing rules.

August 27 -

Trade groups are still pushing for the industry's priorities, such as temporarily lifting the member business lending cap, as negotiations over the next round of aid continue.

August 10