-

Echoing House members, five Republican senators called on the Federal Reserve Board to rethink its surcharge in order to eliminate “excessive” capital requirements.

August 2 -

The Federal Reserve’s forthcoming rules for banks with assets of $100 billion-$250 billion hinge on their perceived risk to the financial system.

August 1 -

The agency said multiple stakeholders had requested more time to evaluate the proposal.

July 31 -

The letter from 29 Republicans, including some who may chair the House Financial Services Committee next year, urges the Federal Reserve’s top regulator to "recalibrate" the capital surcharge for banks like JPMorgan Chase and Citigroup.

July 30 -

The central bank has encountered criticism for allowing three banks to direct funds to dividends and buybacks even though their capital levels fell below required minimums.

July 17 -

The president’s signature tax reform law muddled this year’s stress test results, causing several banks to incur greater-than-expected losses and spurring the Federal Reserve to constrain capital distributions at a handful of banks.

June 28 -

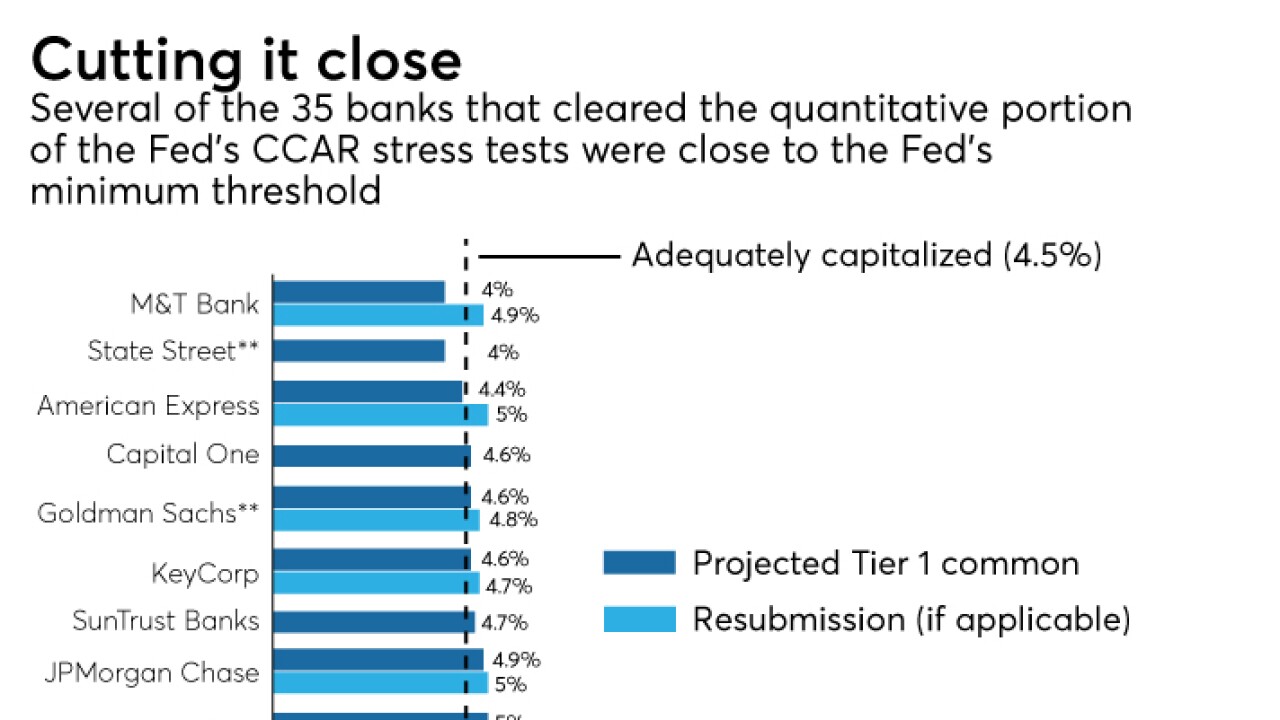

All 35 banks passed the Federal Reserve's first round of tests, but their results were not as stellar as last year's.

June 21 -

Some continue to doubt there will be a premium cut, while others say there's no telling which way Brian Montgomery will go.

June 21 -

The central bank's rule-writing workload is expected to remain busy for the foreseeable future, thanks in large part to enactment of the recent regulatory relief bill.

June 17 -

No plan will be implemented as long as Fannie Mae and Freddie Mac remain in conservatorship, but a capital framework for the companies could still have a substantive impact.

June 15 -

Federal Reserve Chairman Jerome Powell said the agency has its hand full between proposals on liquidity and capital requirements and additional mandates made by the recently enacted regulatory relief law.

June 13 -

The agency proposed new minimum capital requirements for Fannie Mae and Freddie Mac that would only go into effect if the government ends its conservatorships.

June 12 -

The bank's $17 billion investment in growth businesses is not seen as a game changer; Synchrony working with retail partners to make credit decisions on the fly.

June 12 -

The agency will release the results of the Dodd-Frank Act Stress Test on June 21 and the Comprehensive Capital Analysis and Review on June 28.

June 7 -

In the continued absence of legislation, Fannie Mae and Freddie Mac’s regulator announced work on a new capital framework.

May 23 -

Commenters will have more time to weigh in on the plan, by the Fed and OCC, that has triggered divisions among the federal regulators.

May 18 -

A pair of nominees to the Federal Reserve Board vowed Tuesday to protect the independence of the agency if confirmed, but avoided taking hard stances on pending regulatory issues.

May 15 -

The Fed and FDIC are at odds over how proposed changes to the supplemental leverage ratio would change megabanks’ capital levels. Here's why both estimates are right but misleading.

May 14 -

The Federal Reserve’s top regulator says proposed capital changes make system safer while overall capital levels are unchanged.

May 4 -

The outgoing No. 2 of the Federal Deposit Insurance Corp. and the agency's former chair say the proposed changes would increase the likelihood of another financial crisis.

April 27