-

Court documents reveal how a teller used the drive-through window and work email to aid a scheme that bypassed TD's fraud defenses.

January 30 -

TD Bank has said it's completed "the majority" of the action items for its U.S. compliance remediation.

January 23 -

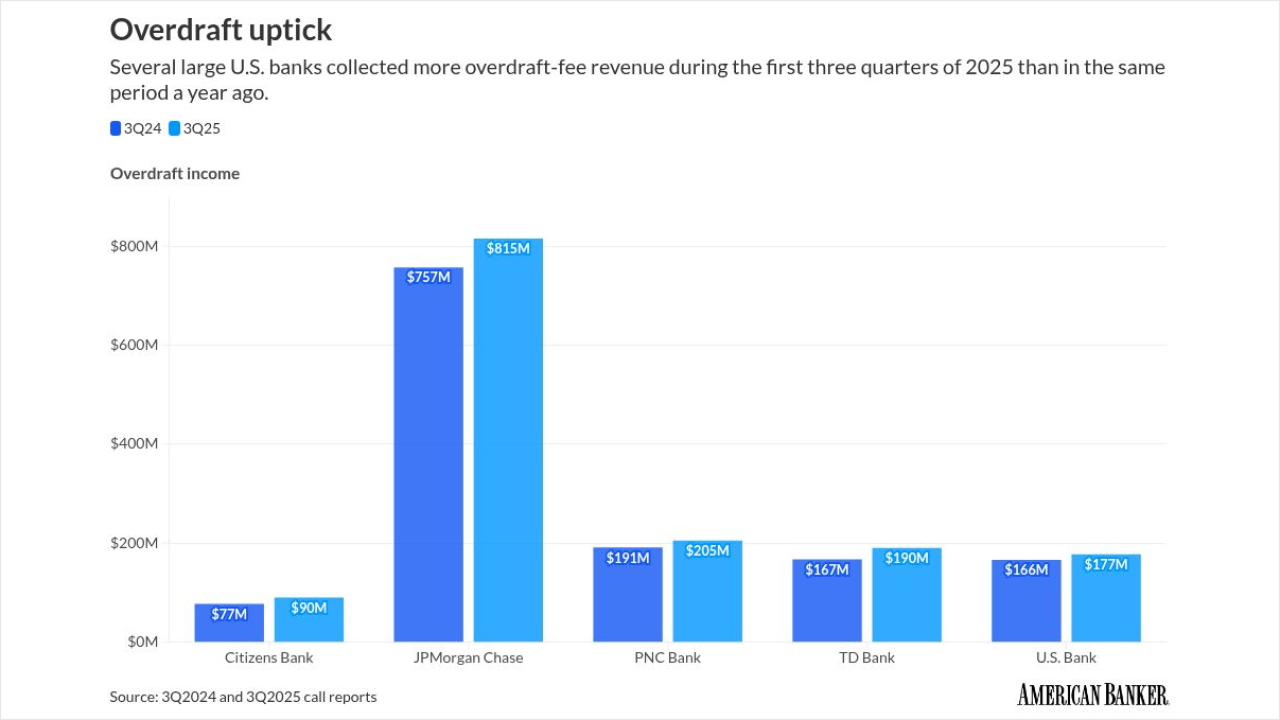

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

The Canadian bank still has more work to do as it rolls out additional processes, technology and training. TD will also have to prove to regulators and the U.S. Department of Justice that its actions are sustainable.

December 4 -

Chris Ward of TD Bank and American Banker reporter Allissa Kline talk about challenges and opportunities in banking small businesses.

-

Reskilling and giving AI the boring work are two approaches banks take to making agentic AI palatable to workers who may fear that bots will take their jobs.

November 20 -

American Banker's 2025 Small Business Banking conference yielded lessons about the need for speed, simplicity and safety in small-business lending. Other key takeaways included the significance of digital payment options and the importance of continuing to process SBA loan requests during the government shutdown.

October 29 -

Jill Gateman, Head of Corporate Banking and Specialized Finance at TD, and American Banker's Mary Ellen Egan discuss the dynamics of banking today.

-

Commercial banking's underserved segments—the upper middle market, for one—are creating new pathways for TD, and Gateman is running the ball.

October 7 -

The fund is designed to generate a financial return, as well as Community Reinvestment Act credit, for TD. Its inaugural investment is in a mixed-use project that will include 49 affordable housing units.

October 3 -

The Toronto-based bank announced enterprise-wide and business-specific revenue and expense targets, almost exactly one year after it was hit with more than $3 billion in fines and an asset cap for money-laundering-related blunders.

September 29 -

Lendistry, one of the nation's fastest-growing SBA 7(a) lenders, is getting a $25 million infusion from TD's community development arm.

September 18 -

Taylan Turan, who was previously HSBC Holdings' global CEO of retail banking, will join the Canadian bank later this month as chief operating officer.

September 10 -

The Canadian bank said it will take at least a year to hit an inflection point in U.S. loan growth. It has been shedding assets in an effort to free up space for growth in more promising business lines.

August 28 -

Growth in TD's home market has become even more important for the bank after its U.S. anti-money-laundering settlements imposed a cap on its American retail operations.

August 28 -

Industry veteran Chris Ward has been tapped to lead the Canadian bank's new U.S. small-business banking department. "It's absolutely a growth opportunity," he said.

August 6 -

The Florida man admitted to opening over 100 fake TD Bank accounts in exchange for bribes, leading to $72,000 in fraud losses at the bank.

June 27 -

The co-heads of TD Securities Automated Trading estimate that more than 90% of transactions will eventually be automated.

June 16 -

Upgrading its anti-money-laundering controls is the Canadian bank's top priority following historic failures that led to a $3.1 billion penalty and a U.S. asset cap.

May 22 -

Toronto-Dominion Bank set aside less money than expected for souring loans in the second quarter, despite concerns that U.S. tariffs would hamper economic growth.

May 22